(MENAFN- Iraq Business News) By Ahmed Tabaqchali, Chief Strategist of AFC Iraq Fund .

Any opinions expressed are those of the author, and do not necessarily reflect the views of iraq business news .

Market Rallies as it Begins to Discount the Budget's Passage

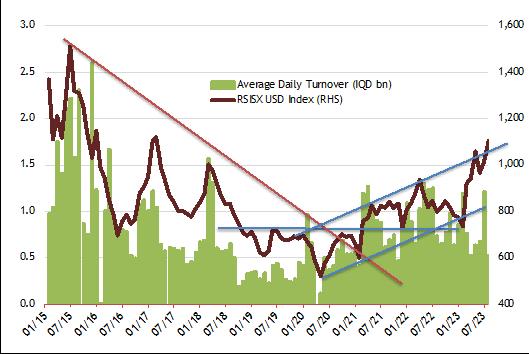

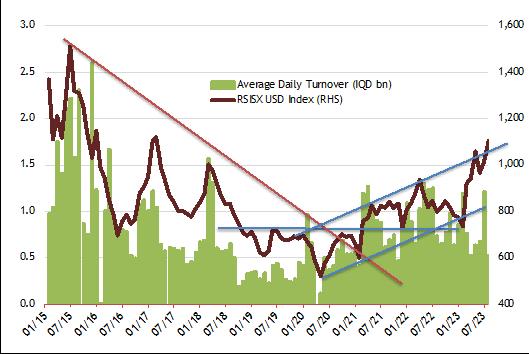

The market, as measured by the Rabee Securities RSISX USD Index, was up 9.2% in June and up 42.3% for the year, and its technical picture continues to be positive. The macroeconomic fundamentals discussed here last year continue to argue that the market's uptrend will likely remain in force, its upward slope will most likely moderate or go sideways given the summer holiday season with its lower volumes made worse by the start in late July of the Arbaeen pilgrimage.

The pilgrimage ends with a climax marking the end of the 40-day mourning period (Arbaeen in Arabic) of the death of Prophet Muhammad's grandson, Imam Hussein, which this year will be on 6th September 2023. Normal economic activities generally slow down considerably during the Arbaeen -among the world's largest annual pilgrimages, with a reported 21 million pilgrims taking part in 2022, with some walking to Karbala from across Iraq. Normally, about two-thirds of pilgrims come from Iraq and a third from Iran, Lebanon, the Gulf states, Pakistan, India, the U.K., and the U.S.

RSISX USD Index versus Average Daily Turnover

(Source: Iraq Stock Exchange, Rabee Securities, AFC Research, data as of July 31st)

As argued here in the last few months, the fundamental drivers for the market's next move would come from the government's implementation of the three-year 2023-25 budget following its passage into law by mid-June. The government will be increasing federal current expenditures by 21.5% in 2023 over 2022, representing a liquidity injection of 13.7% to 2022's estimated federal non-oil GDP.

While its planned non-oil investment spending for 2023 is equally meaningful and potentially far-reaching, which could add a further 13.2% liquidity injection to the non-oil economy, enhancing the liquidity injections of its current expenditures. However, given the government's historically low execution rate in investment spending and its capacity constraints, it is unlikely that most of this planned investment spending will actually materialize. Note: federal excludes the Kurdistan Region of Iraq 'KRI', details in the table below and notes below (*).

Federal Planned Expenditures for 2023 versus 2022's Actual Spending

(Source **: Ministry of Finance (MoF), IMF, AFC Research, data as of June 30th)

As such, it will be the government's current expenditures, in the form of the public sector payroll, social security, and spending on goods and services, that will kickstart the country's economic rebound following an uncertain year marked by political conflict following the surprising 2021 parliamentary elections as discussed here in the last few months . Moreover, the budget proposal passage into law in late June, and the slow machinery of government execution, the positive effects of the liquidity injection will likely take place in the second half of the year, which could magnify its effects.

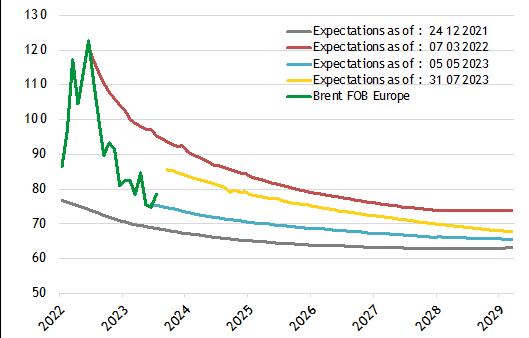

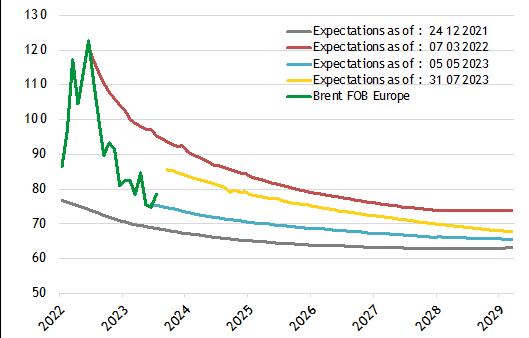

Meanwhile, global central banks' rate hiking cycle is nearing its end, and the IMF, in late july , modestly increased its global economic growth estimates to 3.0% for both 2023 and 2024 from its prior estimates of 2.8% and 3.0 respectively. Both developments are positive for global oil demand, and thus supportive for oil prices, as reflected market expectations for future Brent crude prices as seen in in long-term futures contracts.

By end of July, near-term expectations moved meaningfully higher from the lows in May that then reflected fears over the health of the global economy; and currently are near the upper end of a range marked by expectations at the end 2021 reflecting post-pandemic resumption of growth, and those at the height of the Ukraine war reflecting fears over oil supplies (yellow, blue, red, and red lines respectively in the chart below). This is ultimately positive for the government's oil revenues, given Iraq's extreme leverage to oil prices, for funding its ambiouse expenditures over the course of the expansionary three-year 2023-25 budget.

Market Expectations for Future Oil Prices

As Measured by Brent Futures Contacts (USD per barrel)

(Source: Futures contracts prices from the wall street journal as of July 31st, Brent FOB prices from the us energy information administration data as July 24th)

The positive global macro developments, and the budget's sizable liquidity injections eventually feeding into meaningful growth in corporate profits, should support the market's rally; which while being up 42.3% year to date, is still about 46.7% below its 2014 peak -reflecting the early stages of its recovery from a brutal multi-year bear market in which at the end of 2020 was down by 68.0% from its 2014 all-time high.

Notes and Sources.

(*) The 2023 budget includes a meaningful allocation in 2023 for the share of the Kurdistan Region of Iraq (KRI) in the federal budget. These payments were not made for most of 2022 due to the disputes between the Federal Government of Iraq (GoI) and the Kurdistan Regional Government (KRG), and thus the analysis here focuses only on the federal (i.e., ex KRI) allocations to allow for meaningful comparisons between planned federal spending in 2023 versus actual federal spending for 2022. The analysis assumes that the KRI's non-oil economy accounts for 15% of the country GDP. The allocation for the KRI will have a significant impact on the KRI's non-oil economy, with positive spill overs over the country's economy overall, however, it's not possible, as of now, to make an assessment as the KRG has not released a budget since 2013.

(**) Sources: (1) 2023 figures : The Council of Minister's 2023 budget proposal ; (2) 2022 figures: Ministry of Finance open budget documents ; (3) Non-oil GDP figure for Iraq-ex KRI, assumes that the KRI economy accounts for 15% of Iraq's 2022 non-oil GDP estimates as provide by IMF's Country Report No. 23/75 .

Please click here to download ahmed tabaqchali's full report in pdf format .

Mr Tabaqchali (@amtabaqchali ) is the Chief Strategist of the AFC Iraq Fund, and is an experienced capital markets professional with over 25 years' experience in US and MENA markets. He is a Visiting Fellow at the LSE Middle East Centre, Senior Fellow at the Institute of Regional and International Studies (IRIS), and a Senior Non-resident Fellow at the Atlantic Council. He is also a board member of Capital Investments, the investment banking arm of Capital Bank in Jordan.

His comments, opinions and analyses are personal views and are intended to be for informational purposes and general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any fund or security or to adopt any investment strategy. It does not constitute legal or tax or investment advice. The information provided in this material is compiled from sources that are believed to be reliable, but no guarantee is made of its correctness, is rendered as at publication date and may change without notice and it is not intended as a complete analysis of every material fact regarding Iraq, the region, market or investment.

The post iraqi market rallies as it begins to discount budget's passage first appeared on iraq business news .

Comments

No comment