(MENAFN- ValueWalk)

Investor asks Delaware court to block adoption of Masimo's new bylaws

, an activist fund run by Elliott Management veteran Quentin Koffey,

filed a with the SEC disclosing a Delaware lawsuit to block changes to Masimo Corp.'s bylaws.

Politan reported an unchanged 8.8% Masimo ( ) stake.

This Odey Fund Is Long On Commodities Stocks And Short On Logistics Properties [Exclusive]The LF Book Absolute Return Fund, overseen by Brook Asset Management under the Odey umbrella, returned -5.6% for the third quarter, bringing its year-to-date return to -9%. In what turned out to be a wild quarter for the financial markets, the MSCI TR Net World Index was up 2% in sterling and down 6.19% in

Politan's Complaint Against Masimo

In the Oct. 21 filing, Politan said,“filed a Verified Complaint in the Delaware Court of Chancery against Masimo and its board seeking relief to (i) declare certain bylaw amendments unenforceable, (ii) find that the Director Defendants breached their fiduciary duties, (iii) invalidate certain change of control provisions in the Chief Executive Officer Kiani's employment agreement.

And (iv) permanently enjoin the company and board and its board from taking any actions to prevent Politan from exercising its rights in accordance with the company's prior corporate bylaws to nominate directors, as more fully described in the complaint.”

What are other large shareholders doing?

holds 5,775,228 shares representing 10.99% ownership of the company. In its prior filing, the firm reported owning 6,875,547 shares, representing a decrease of 19.05%. The firm decreased its portfolio allocation in MASI by 10.20% over the last quarter.

holds 4,918,892 shares representing 9.36% ownership of the company. The firm reported owning 4,775,660 shares in its prior filing, representing an increase of 2.91%. The firm decreased its portfolio allocation in MASI by 77.02% over the last quarter.

holds 2,104,939 shares representing 4.01% ownership of the company. In its prior filing, the firm reported owning 2,069,501 shares, representing an increase of 1.68%. The firm decreased its portfolio allocation in MASI by 77.46% over the last quarter.

holds 1,786,307 shares representing 3.40% ownership of the company. In its prior filing, the firm reported owning 0 shares, representing an increase of 100.00%.

holds 1,690,514 shares representing 3.22% ownership of the company. In its prior filing, the firm reported owning 1,730,991 shares, representing a decrease of 2.39%. The firm increased its portfolio allocation in MASI by 6.25% over the last quarter.

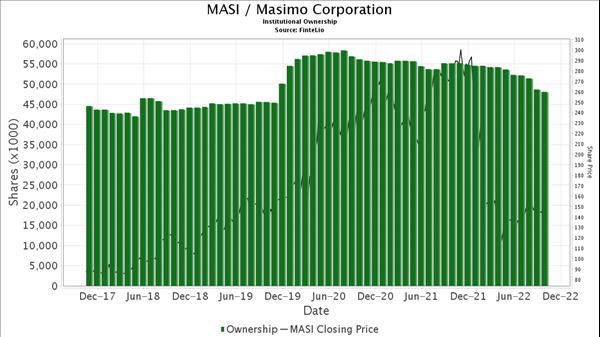

What is the overall institutional sentiment?

There are in Masimo Corporation. This is a decrease of 87 owner(s) or 8.70%.

The average portfolio weight of all funds dedicated to Masimo Corporation is 0.1770%, a decrease of 21.4499%. Total shares owned by institutions decreased in the last three months by 7.64% to 48,048,593 shares.

Based on this information, institutional sentiment is bearish.

Article by

Comments

No comment