(MENAFN- ING)

Dutch housing associations can potentially afford to build around 14,000 new mid-market rental properties per year. However, more than half of the social housing corporations report that a lack of building land and long permit procedures considerably slow down new construction. Corporations can accelerate this in two ways: by acting as project developers in a split-off development company and by simplifying construction processes in cooperation with other parties.

So, just how big a problem is scarcity in the Dutch mid-market rental segment and what role can housing corporations play in alleviating that lack of stock?

1 How scarcity in the mid-market rental housing segment is developing

More households rely on mid-market rental housing

Demand for mid-market rental housing has been increasing in recent years. In 2018 (the most recent year available), 8% of households considering a move were mainly looking for a mid-market rental property, while this proportion never exceeded 5% before 2009. An important reason for the increasing demand is the more limited access to the owner-occupied segment for middle-income households because of:

- Tightened financing standards for buying a residence. In particular, the lowering of the maximum mortgage ('loan-to-value') from 2013 onwards has had an impact.

- Rising house prices. This was partially driven by tax exemptions, such as the immunity from property transfer tax for first-time buyers and the extended gift tax exemption for owner-occupied homes (known as the 'jubelton' or joyous tax-free gift lump sum), which the Rutte IV government wants to abolish

Housing corporations have started to offer fewer mid-market rental housing

After the introduction of the Dutch Housing Act 2015, housing corporations started to offer fewer mid-market rental housing because, according to the Act, their primary focus should be on their core task: providing affordable housing for people on low incomes. As a result of rent increases, the number of sold mid-market rental housing subsequently shifted to 'expensive rental housing' (above €1,000 per month).

Scarcity is relatively large

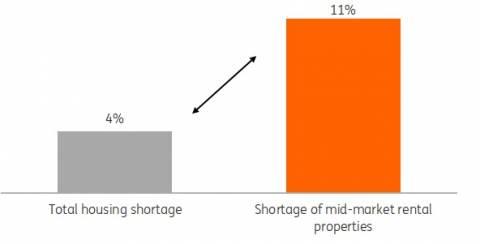

In 2019, the most recent available year, the demand for mid-market rental housing was more than 45,000 residences higher than the supply. This amounts to a 'shortage' of almost 11% of the total stock of mid-market rental housing, almost three times as high as the average scarcity for the entire housing market of about 4%.

Scarcity in mid-market rental properties is relatively large

Estimated national 'shortage' of residences in % of total housing stock; total vs mid-market rental segment, 2019

ABF Research, edited by ING Research, latest year available

2 The role housing corporations play in the mid-market rental segment

Housing associations own a quarter of mid-market rental properties

Approximately 10% of the total Dutch housing stock (7,856.000 in 2020) is deregulated rental housing. Of these, 500,000 fall in the mid-market rental property segment: a quarter (126,000) was owned by housing corporations and the rest (374,000) by private or institutional investors. The mid-market rental segment is not well defined. A common demarcation used by the Dutch Ministry of the Interior is that of deregulated rental housing with a rent between the regulation threshold (€752.33 in 2021) and €1,000, whereby the upper limit is based on consensus and can therefore vary over time and also depends on the purpose of the demarcation.

Since the new Housing Act, housing corporations are less active in the mid-market rental segment

Corporations were very active in the mid-market rental segment until 2015. Between 2012 and 2015, corporate ownership of the mid-market rental segment housing stock increased from 43% to 48%. Because of the focus on the core task that followed the Dutch Housing Act 2015, corporations were only in the picture for the construction of mid-market rental housing when the market failed to deliver. With the 'market test', municipalities first had to investigate whether there were any interested market parties. For corporations, this meant uncertainty about development possibilities and additional delays in the realisation of construction plans in a segment that was not part of their core business in the first place. Consequently, the construction of mid-market rental housing declined, and the mid-market rental property portfolio was phased out. In 2018 37% of these properties were still owned by housing corporations. In 2020 the share dropped to 25%.

Housing corporations' ownership of mid-market rental properties down in absolute and relative terms

Number of households renting in the mid-market rental properties segment*, by type of landlord

WoON 2018, edited by ING Research; *here, this means houses rented at €710–€1,000 per month **based on Capital Value (2021)

3 The role investors play in the mid-market rental segment

New regulations could make investors less interested in mid-market rental housing

An overview by Capital Value from 2021 shows that, from 2021 to 2023 inclusive, investors want to invest more than €33.5 billion in Dutch rental residences. The vast majority of domestic and international residential property investors indicate that they are interested in mid-market rental housing. In addition, a large majority of investors indicate that they are interested in new-build developments. The share of new construction in investors' total housing investment stood at 34% in 2020, down slightly from 36% in 2019. Due to the shortages and minimal chance of vacancy, mid-market rental housing is attractive to investors.

This is particularly the case in the Randstad conurbation, but demand is considerable in many larger cities beyond it. For investors, the low vacancy risk often outweighs the relatively low return (compared with high rent). The Dutch government wants to introduce a form of rent protection for mid-market rental housing that will make living more affordable for middle-income households and, at the same time, ensure investments in this segment are profitable for investors. Although the impact of the – as of 2021 – implemented maximum rent increase in the deregulated sector on the expected return of investors in the mid-market rental segment is probably limited, additional regulation of private rental sector rents can significantly reduce the expected return on investment. This could reduce investors' willingness to invest in the construction of mid-market rental housing.

4 The government's view on the role of corporations in mid-market rental

Rutte government facilitates the development of mid-market rental properties for housing corporations

The introduction of the Housing Act 2015 required corporations to focus more keenly on social rental housing. The government has made it less difficult for housing corporations to build mid-market rental properties in recent years. Until recently, the market test, in particular, was a major obstacle. The Rutte government is suspending this for its entire governmental term (2022-2025). This had already been implemented for the period from 2021 to 2023 inclusive. This eliminates the uncertainty surrounding the approval process for the construction of mid-market rental housing.

1 in 3 housing corporations want to invest in mid-market rental housing

The suspension of the market test has proven to be a crucial measure for many corporations to raise their ambitions in the mid-market rental housing sector. A majority of about 2 out of 3 housing corporations want to remain active in mid-market rental housing, i.e. keep their property portfolios stable or increase them. More than half of the above majority, meaning more than 1 in 3 housing corporations, indicated at the beginning of 2021 that they would like to expand their mid-market rental housing portfolios. In 2018, this was only 1 in 10. Slightly less than 1 in 4 wants to reduce their mid-market rental housing portfolios. This is probably made up of those corporations which are mainly active outside the larger cities, in regions where the scarcity of mid-market rental housing is limited.

5 Corporations' ambitions in this segment

1 in 3 housing corporations want to invest in mid-market rental housing

The suspension of the market test has proven to be a crucial measure for many corporations to raise their ambitions in the mid-market rental housing sector. A majority of about 2 out of 3 housing corporations want to remain active in mid-market rental housing, i.e. keep their property portfolios stable or increase them. More than half of the above majority, meaning more than 1 in 3 housing corporations, indicated at the beginning of 2021 that they would like to expand their mid-market rental housing portfolios. In 2018, this was only 1 in 10. Slightly less than 1 in 4 wants to reduce their mid-market rental housing portfolios. These are probably those corporations which are mainly active outside the larger cities, in regions where the scarcity of mid-market rental housing is limited.

More than 1 in 3 housing corporations want to expand their portfolios of mid-market rental properties

'How would you describe your corporation's mid-market rental property or non-DAEB strategy?'

Share of respondents per answer category to the question above:

Platform 31, 'From inaction to not-DAEB?', February 2021, *n=56, **n=125Platform 31, 'From inaction to not-DAEB?', February 2021, *n=56, **n=125

6 Obstacles holing back housing corporations' expansion plans

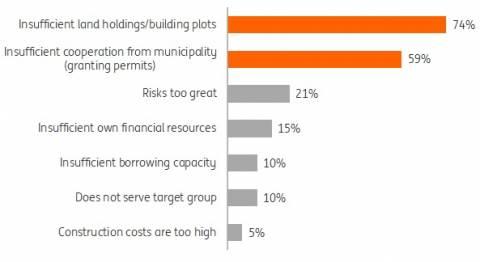

Although the regulatory barriers to the realisation of mid-market rental housing have been greatly reduced, housing corporations think that there are still obstacles which generally hinder the realisation of new construction. A lack of land along with insufficient cooperation from the municipality are the two obstacles corporations mention by far the most often in a 2021 survey by Capital Value. Nearly 75% say that a lack of building land is holding them back. In addition, almost 60% indicate that municipalities do not cooperate enough in granting permits.

New construction projects usually take one to two years, and the preceding planning phase often lasts considerably longer. First, a location must be designated, and then years may pass before construction finally begins. Moreover, the many requirements that municipalities set in various areas – such as quality, sustainability, and parking – often complicate inner-city projects. Furthermore, many delays result from zoning or environmental plan procedures, environmental and nature regulations and objections by local residents.

Lack of land holdings and cooperation from municipality are by far the biggest obstacles according to housing corporations

Main reasons for the inability of housing corporations to realise new building plans, in 1% of total number of respondents*, 2020

Capital Value, De woning(beleggings)markt in beeld 2021' (Focus on the residential [investment] market 2021) *n=50

7 Speedier ways housing corporations can expand their mid-market stock

We see two ways in which corporations can accelerate processes:

1) Accelerated accumulation of expertise: the corporation-owned development company

Many corporations have reduced or completely dismantled their development branch, but the faster realisation of mid-market rental housing requires their own development expertise, where possible, in a separate company. Larger corporations are constantly faced with extensive development tasks, consisting of large, mostly inner-city projects. A corporation with its own development company is less dependent on external project developers and can exercise control over its development of mixed neighbourhoods (with housing in all segments). This requires a market network and expertise in development processes that can be quickly built up through specialisation in a development company. A separate development company that carries out assignments for the corporation (as an authorised public housing institution) can concentrate fully on development assignments. This helps to get projects off the ground faster.

2) Working together for less complex construction projects

Acceleration requires procurement and development at scale. Intensified cooperation with other corporations, the municipality (and province) and market parties can provide more purchasing power and make larger-scale and shorter construction projects possible. Scale also helps develop conceptual or factory-built residences that can be constructed faster than traditional residences. Recently, for example, several housing corporations in the North Holland province and four municipalities announced a pilot scheme to make the issuing of permits more efficient to facilitate the construction of prefabricated modular residences.

8 Will this solve the scarcity of mid-market rental housing?

56% increase in planned housing association investments for mid-market rental housing in 1 year

Social housing corporations have planned (2021 to 2025) €2.5 billion in new mid-market rental housing investments for the next five years. That's 56% more than they had planned one year earlier, for the previous five-year period (2020-2024). Assuming €187,000 in average construction costs (land, building costs and other costs) per dwelling and an average realisation rate of 78% of the investment plans, this amounts to the construction of over 2,000 mid-market rental properties per year.

However, much more is potentially possible when investment space is used

With 2,000 new-build residences, housing corporations make a limited contribution to the ambition of 10,000 new mid-market rental properties per year that they have formulated together with investors and developers. But 2020 was probably not the last year that investment plans for mid-market rental housing were scaled up. If we take the estimated maximum borrowing capacity for new mid-market rental properties by housing corporations – the indicative spending capacity of 14.4 billion – as a starting point, then, in financial terms, even a number of some 14,000 new mid-market rental properties per year is feasible for housing corporations. This means that they can potentially make a substantial contribution to reducing the scarcity of mid-market rental housing, but this will require considerably greater investments.

Long-term perseverance is needed because of obstacles resulting in delays

In the short term, at least, housing corporations still have to deal with limited available building land and lengthy permit procedures. In short, housing corporations can make an important contribution to reducing the scarcity of mid-market rental housing, but long-term perseverance is needed.

MENAFN16052022000222011065ID1104223011

Author:

Edse Dantuma