Crisis-hit Turkey survives as an extension of China

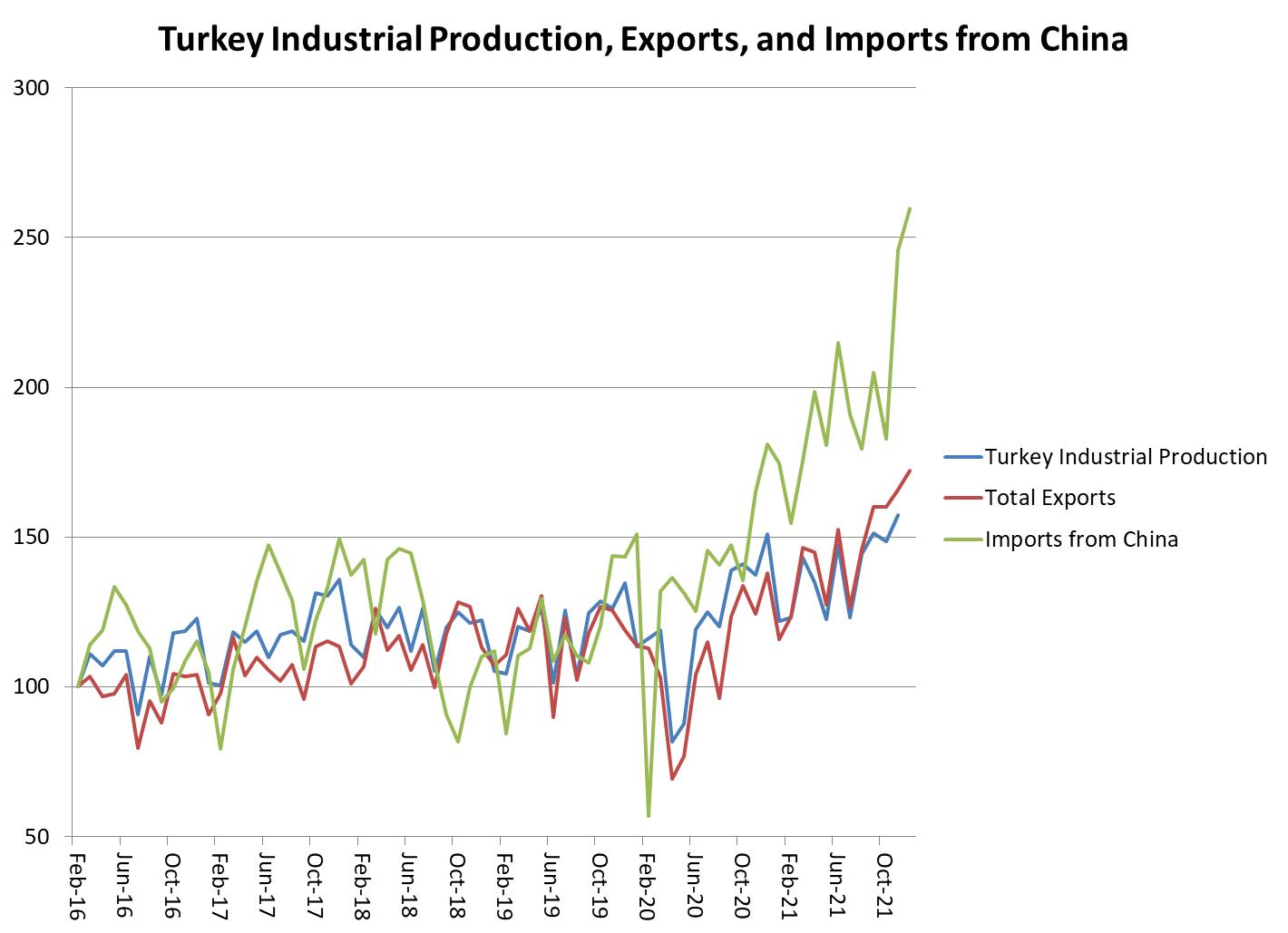

NEW YORK – Despite a catastrophic currency devaluation and 50% annual inflation as of December, Turkish manufacturing is booming and exports have risen by more than half from pre-pandemic levels.

A real economic boom in the midst of financial disaster is puzzling, but there's a simple explanation: Turkish manufacturing doesn't have much to do with Turkey. It buys Chinese capital equipment and semi-finished goods and sells the finished products to Europe.

Turkey has found a niche in the fast-growing trade relationship between Europe and China as a producer of steel products, chemicals, household appliances and other goods, concentrating on more labor-intensive and environmentally problematic industries.

Its economic dependence on China has increased significantly. This helps explain why Turkey eschewed American efforts for a diplomatic boycott of the Beijing Winter Olympics to protest against China's treatment of its Uighur minority, even though the Uighurs speak a Turkish dialect and have strong cultural and religious ties to Turkey.

Mao Zedong might have said that political power grows out of the barrel of a gun, but for Xi Jinping, it is more likely to grow out of the door of a shipping container.

China's imports from the rest of Asia have nearly tripled during the past five years, prompting 15 Asian countries including Australia to join the Regional Comprehensive Economic Partnership with China – but not the United States.

That was an important Chinese diplomatic victory. Now, a quantum jump in Sino-Turkish trade is likely to enhance China's political influence in Western Asia.

Turkey's surprising resilience is yet another expression of the Sino-forming of the world economy. China's robust supply chains support not only China's remarkable trade performance, but move the trade of its Asian neighbors into a tightly-integrated commercial nexus.

The Turkish lira has fallen by more than 50% against the US dollar since 2018, and the cost of production against default on its foreign-currency debt is more than 5 percentage points, compared to 2 percentage points for Brazil.

Nonetheless, Turkey has managed to more than double its imports from China in the past two years. Turkey runs a trade deficit, so it has to borrow in order to buy more foreign goods.

Turkey's official data show little increase in foreign debt, but the triangular trade among China, Turkey and Europe allows ways to keep trade credits off the official balance sheet.

Turkey imports in order to export. Consumption and other goods imports fell during 2021, while imports of intermediate and capital goods rose, supporting a 32% overall rise in exports.

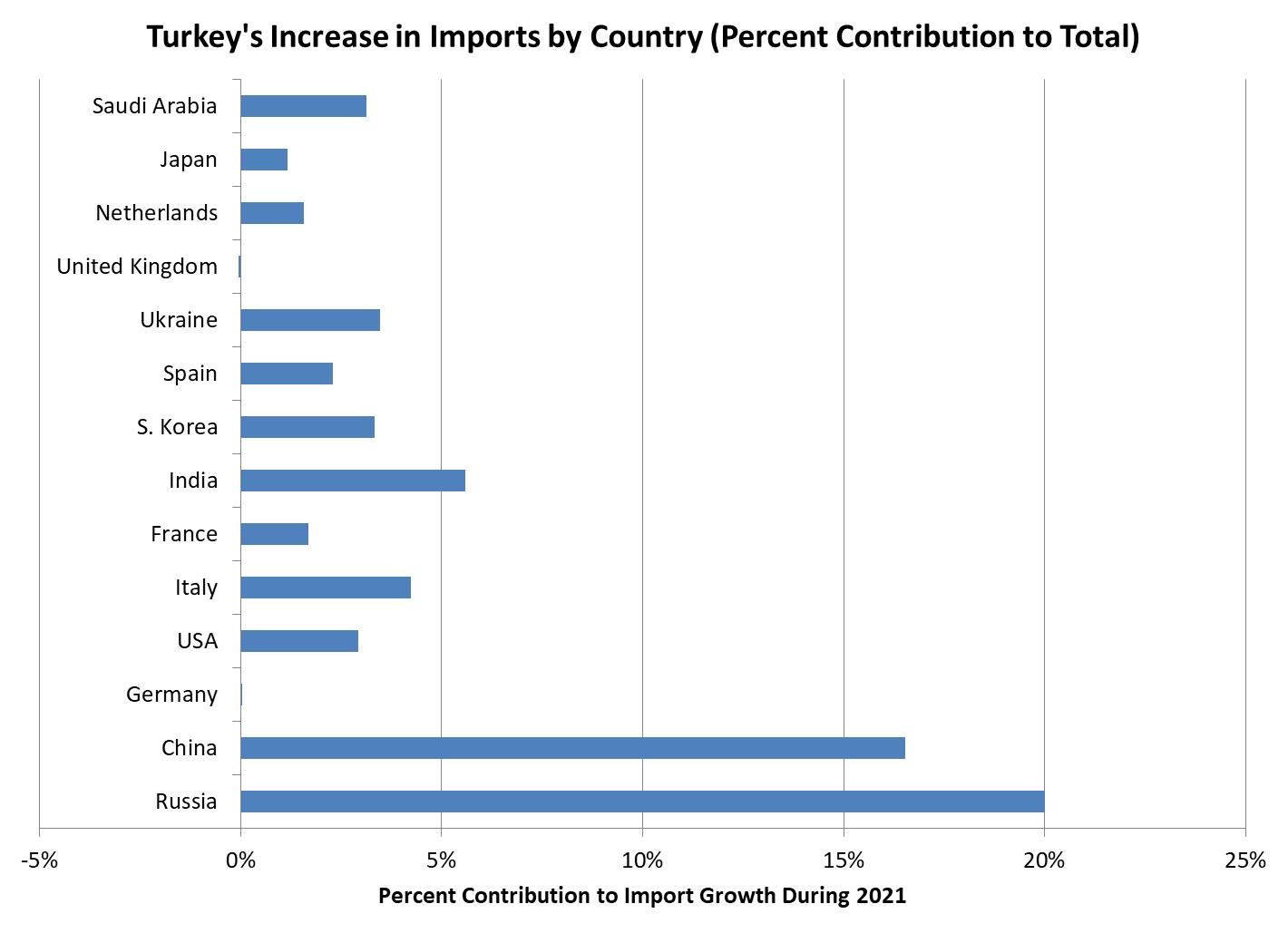

The Turkish Statistical Institute's breakdown of trade by country shows that the lion's share of the increase in imports came from Russia – mainly due to higher energy prices – and China.

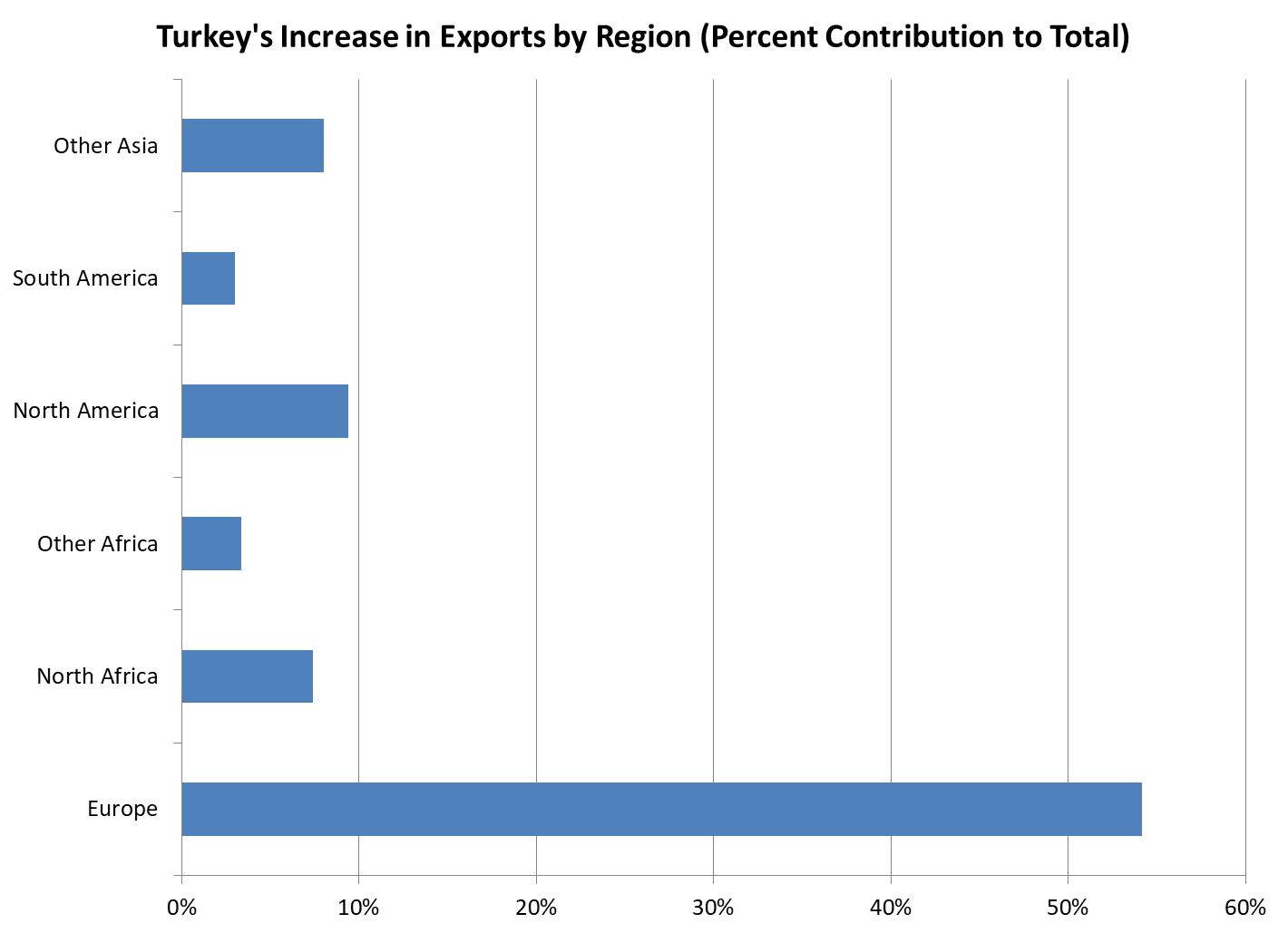

The export picture is markedly different. Europe accounted for more than half the 2021 increase in Turkish exports.

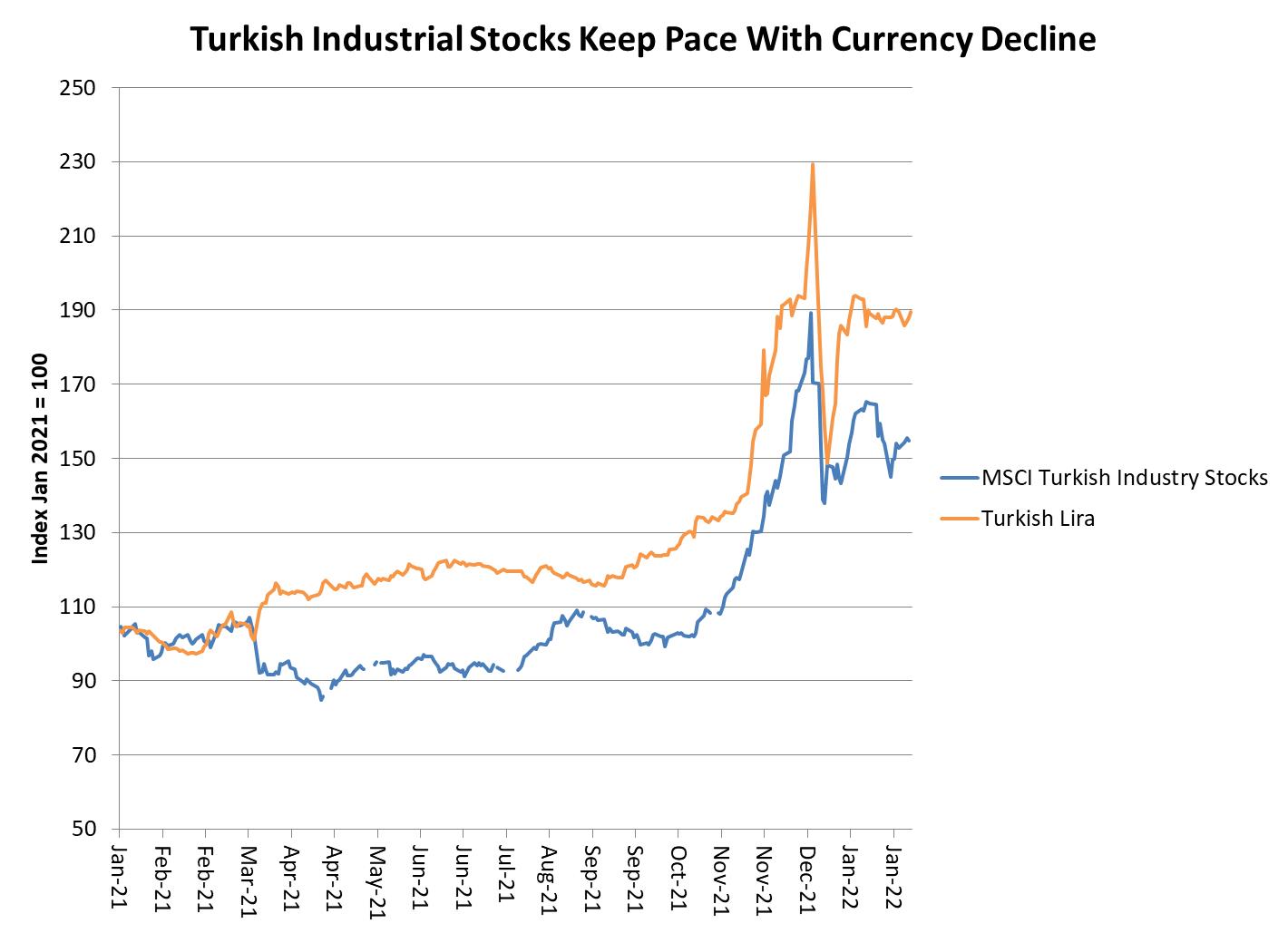

Turkish industrial companies who benefit from this trade boom earn foreign currency by exporting and paying for their imports with foreign currency.

The value of the Turkish currency is of secondary importance to them. That explains why the stock prices of Turkish industrial companies rose as the Turkish lira fell, that is, remained stable in terms of US dollars.

Turkish stock prices are a secondary concern for the Recep Tayyip Erdogan government. The market capitalization of the Istanbul 100 Index is less than US$40 billion.

The dollar value of Turkey's housing stock, the main repository of middle-class wealth, exceeds $700 billion, I calculated in a 2020 study .

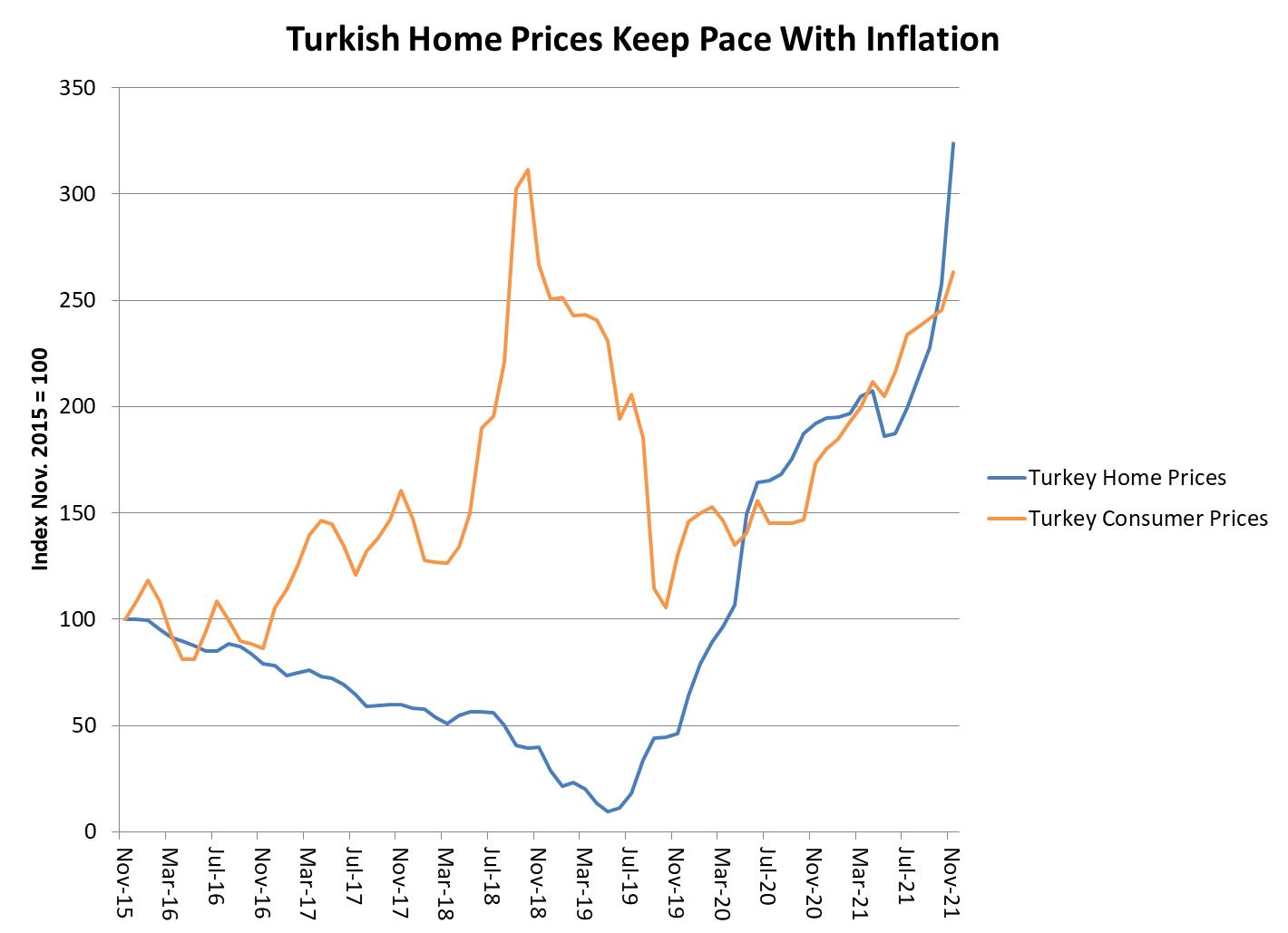

Erdogan's low interest-rate policy sunk the Turkish lira, but Turkish home prices have more than kept pace with inflation. That is key to President Erdogan's political staying power.

Unlike the Latin American and African devaluations of the past generation, the collapse of the lira did not take down with it the wealth of the middle class and industrial investors.

Tensions between China and Turkey flare up periodically over the Uighur problem. Religious conservatives in Erdogan's Justice and Freedom Party complain about China's forced assimilation of Muslims into secular Chinese culture, and the nationalist Gray Wolves movement occasionally breaks the window of a Chinese restaurant in Istanbul.

But President Erdogan wants to stay in power, and China controls the means by which Erdogan can do so, namely Turkish economic growth, jobs and asset prices.

American strategists who hope that Turkey will provide a counterweight to growing Chinese and Russian influence in Western Asia may be spinning their wheels. Without China, Turkey's economy would be a Venezuelan-style shambles, and that gives China enormous pull in Ankara.

Follow David P Goldman on Twitter at @davidpgoldman

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment