Lesotho- A game-changer in property sector

(MENAFN- The Post) MASERU - RBS Construction, in collaboration with the Standard Lesotho Bank, has launched a programme aimed at providing housing to those who previously could not afford building their own house due to high building costs.

The project, which was launched last Thursday, aims to have 90 000 homes built over the next 15 to 20 years.

The houses will be built using weather and environmentally friendly and fire resistant technology at affordable prices.

According to Standard Lesotho Bank head of Home Loans Azaele Makara, the housing project is a game-changer in the property sector that is used to building houses using bricks and water.

'This project is offering the low on the ladder a chance to become home owners,' Makara said.

CEO of RBS Construction, Gustav Serfontein, said the project 'will see thousands who were unable to afford or access home loans owning homes through mortgages'.

'For example someone who earns M3 000 or less can afford to pay a monthly amount of M500 or more to own a one bedroom home with functional running water, sewage system and solar electricity,' Serfontein said.

Serfontein said another incredible feature is that the houses take less than a month to build.

'Because of the material we use, with everything being an easy fit, within seven days a family can move into the house,' Serfontein said.

On behalf of the Minister of Local Government, Kabelo Lethunya said the project will help alleviate accommodation challenges, noting that the country needs to construct 98 711 dwellings or 169 706 rooms to be constructed by 2025 to eradicate the problem.

'This translates into a need of 5 195 dwellings or 8 932 rooms to be constructed a year,' Lethunya said.

She indicated that the government intends to meet this need by facilitating new housing development through an enabling environment.

'Government intends to participate directly in the housing construction process through Lesotho Housing and Land Development Corporation, joint ventures and non-governmental sectors,' Lethunya said.

Lethunya said providing decent, affordable housing is a growing challenge in Lesotho, where 70 percent of households earn less than M1 000 a month.

As a result, their low incomes disqualify them from receiving loans from commercial banks.

'These households have mainly acquired their plots through savings, or loans from relatives and friends,' Lethunya said.

'The cost of building a formal dwelling and obtaining services is beyond most households in Lesotho,' she said.

The 2018 National Housing Policy contains strategies to make housing more accessible and affordable in the country.

The policy emphasises a more efficient use of land and it encourages densification within urban areas to ensure densities that will reduce the cost of providing housing and basic services and infrastructure.

'The policy further encourages adoption of appropriate construction methods and technologies as such improvements could cut housing construction costs by up to 30 percent and delivery time by 40-50 percent,' Lethunya said.

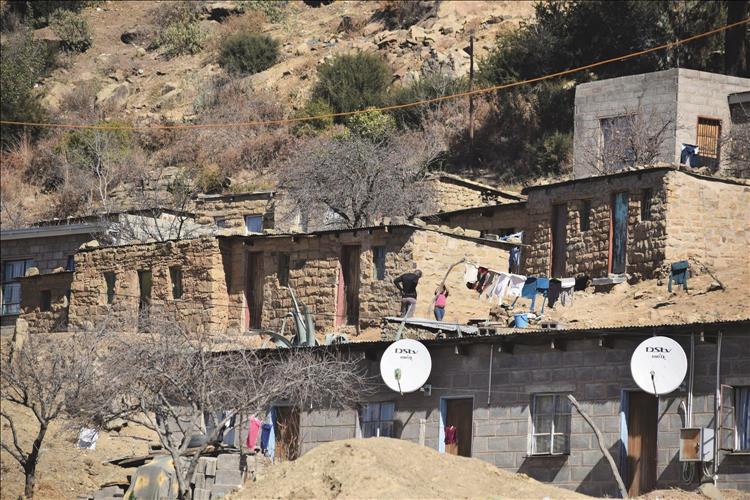

This project comes in the wake of rural populations constantly migrating to cities in search of job opportunities and often end up stranded after finding opportunities hard to come by.

With the national unemployment rate sitting at 28 percent, most end up being street vendors, maids or find work in the textile industry earning too little to afford decent accommodation.

Many end up living in mud houses, or rent shabby rooms with no electricity, running water or enough living space.

According to the Centre for Affordable Housing Finance in Africa Lesotho profile (CAHF), the price of the cheapest, newly built house by a formal developer or contractor in an urban area is M165 000.

The profile further states that the average rental price for the cheapest newly built house by a formal developer or contractor in an urban area is M2 500 a month.

The Lesotho Housing Policy of 2018 says about 70 percent of households earn less than M1 000 a month and can only afford a dwelling costing M48 000.

'Basotho still rely on social networks and inheritance to own property with a small percentage, 23 percent, living in houses they financed through bank loans,' according to CAHF.

'Some build their homes themselves while others live in homes they inherited.'

Financial institutions such as the Standard Lesotho Bank offer home loans from M100 000 up to M10 million at an interest rate of 12.5 percent payable over a 20-year period.

FNB Lesotho is present in only five districts and offers home loans at interest rates of 11.25 percent and 13.25 percent at the lower and upper bound, respectively.

Between the years 2004-2019, FNB Lesotho issued 191 housing construction loans, classified as follows: 19 building loans worth over M13 million, 63 purchase loans worth of over M63 million, 82 equity release loans worth of M29.2 million and 27 switch finance loans worth of over M21.2 million.

The number of mortgages classified as non-performing is recorded at 10 and the value of residential mortgages outstanding stands at M10 million.

Nedbank Lesotho offers home loans for buying readily available housing stock on freehold title and sectional title.

Between January 2018 and December 2018, Nedbank Lesotho issued 37 housing construction loans and the value of housing construction loans for the same period stands at M21.7 million.

The average mortgage term is 20 years with a 10 percent average down payment on a mortgage.

Even though STANLIB Lesotho is not offering mortgages, it is supporting housing-related loans by allowing its clients to use their investments as collateral for mortgages/housing loans with other banks.

Of the 16 registered microfinance institutions in Lesotho, only two – Lesana Lesotho (Pty) Limited and Letshego Financial Services – are providing housing-related loans in a specific housing portfolio.

The average loan size given by Lesana Financial Services is M33 359.

The loans are payable at the rate between 21.5 percent for housing-related loans and 45 percent for other loans a year over a period of 60 months.

Lemohang Rakotsoane

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment