Indonesia plans to relax bank merger rule in efficiency push

(MENAFN- Gulf Times) Indonesia is planning further steps to make it easier for foreign banks to invest in local lenders as well as encourage domestic mergers, as it tries to strengthen the sector against growing competition from financial technology firms.

The Financial Services Authority, known as OJK, expects to amend the so-called single presence policy later this year, according to Heru Kristiyana, commissioner for banking supervision at the regulator.

The revised rule, which will make no distinction between foreign and local lenders, would relax the longstanding requirement that the acquiring banks have to merge all their local operations into one entity.

'The single presence policy will be flexible so that there's consolidation and our banks become more efficient, Kristiyana said in a recent interview in his Jakarta office. 'Foreign banks are still interested in coming to Indonesia because the net interest margin is still high at around 5%.

The single presence rule was introduced in 2006 as a way to push consolidation among the 2,000 or so local banks.

However it proved unpopular with some of the foreign lenders seeking to expand their operations in Indonesia.

A bigger deterrent came in 2012 when regulators set conditions for financial institutions to raise holdings in banks above 40%, prompting DBS Group Holdings Ltd to abandon an attempt to take over Bank Danamon Indonesia the following year.

Since then, Indonesia has relaxed the 40% rule, clearing the way for Japan's Mitsubishi UFJ Financial Group Inc to take control of Danamon earlier this year, and for Sumitomo Mitsui Financial Group Inc to buy Bank Tabungan Pensiunan Nasional.

Kristiyana said the entry of technology firms into the financial industry requires a more nimble banking sector in Indonesia. 'With the development of fintech and banking digitalisation, banks are required to be efficient so they can compete, he said. 'You must consolidate if you can't compete.

Removing the single presence rule could make it easier for Standard Chartered Plc to hang on to its 45% stake in PT Bank Permata Tbk, according to Suria Dharma, an analyst at Samuel Sekuritas.

The London-based bank said in 2016 it was considering merging its local branch network with Permata in order to move to a single presence, before indicating earlier this year it may sell out of Permata. PT Bank Mandiri has been in discussions to purchase the Permata stake, and has hired Morgan Stanley to advise on the potential deal, people familiar with the matter said earlier this year.

Kristiyana said the single presence rule may still apply if a large bank seeks to take a stake in another sizeable lender.

A large bank acquiring a smaller rival would be allowed to retain it as a separate entity, he added, without specifying the threshold for a merger requirement.

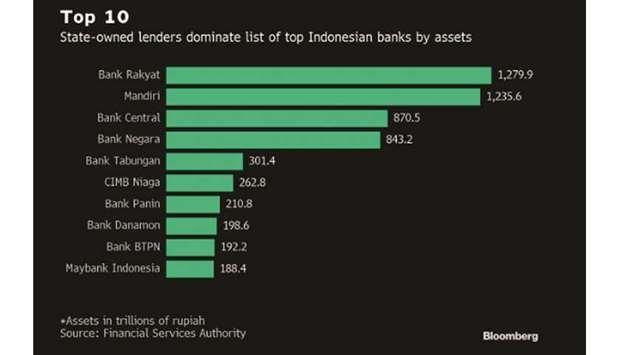

Indonesia has 115 conventional and Shariah banks and almost 1,800 rural lenders, catering to the archipelago's more than 260mn people, data from the Financial Services Authority show.

Banks are among the best performers in Indonesia this year with the Jakarta Stock Exchange Finance Index surging 12%, outperforming the 3% gain for the broader benchmark index.

Even as the single presence rule is relaxed, foreign banks looking to acquire Indonesian lenders should still demonstrate a commitment to lending to infrastructure and small and medium-sized enterprises, and appoint Indonesian residents as president director and president commissioner, the two most senior corporate roles, Kristiyana said.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment