AUD/USD: Australian Dollar Eyes Jobs Data, RBA Rate Cut Bets

Currency option traders are suggesting that Thursday'seconomic calendarevent risk for the Australian Dollar should not be taken lightly. This is indicated by the recent jump in AUDUSD overnight implied volatility to 8.66 percent and is roughly in line with the reading of 8.88 percent headed into last month's Aussie jobs data release.

The rise in implied volatility indicates that spot AUDUSD may experience a sizable response to the upcoming Aussie jobs data – particularly if the headline employment change and unemployment rate figures cross the wire materially above or below consensus. If the closely watch economic indicators miss to the downside, it could push the odds of another RBA rate cut higher and send the Australian Dollar lower in turn.

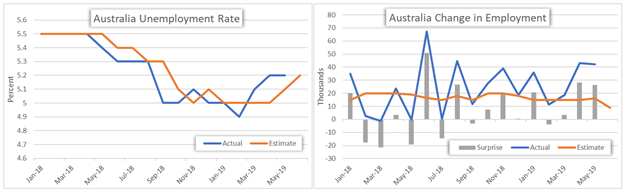

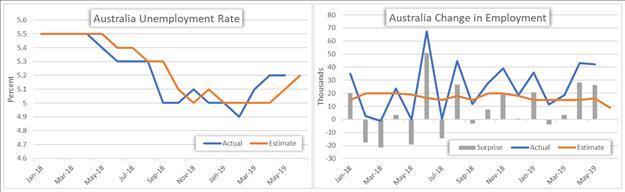

AUD – AUSTRALIA UNEMPLOYMENT RATE & CHANGE IN EMPLOYMENT CHART

According to Bloomberg's median consensus, markets are expecting Australia's unemployment rate and change in employment numbers for June to come in at 5.2 percent and 9.0K respectively.

RBA COULD CUT RATES AGAIN IF AUSTRALIA EMPLOYMENT DATA DISAPPOINTSSustained dovishness hinted at in the latestRBA minutescould keep the Australian Dollar under pressure – more so if the upcoming Australia employment data fails to inspire optimism forAUDbulls. The RBA has already cut rates twice this year and expressed willingness to ease monetary policy further to 'support sustainable growth in the economy' if needed.

Correspondingly, more RBA rate cuts could be on the table before the year ends if Australia's central bank does in fact decide to keep juicing the economy with more rate cuts in response to lackluster labor market data.

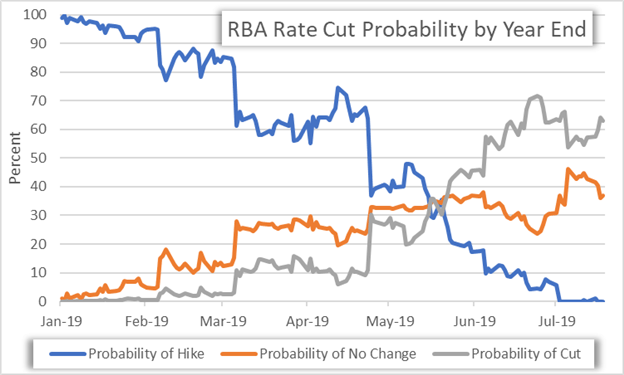

AUD – RESERVE BANK OF AUSTRALIA RATE CUT PROBABILITY CHART

The probability that the RBA lowers the overnight cash rate by another 25 basis points by its December 3 meeting stands at 63 percent currently. Yet, even if the Aussie jobs data inspires optimism for AUDUSD bulls, the latest trade tiff between the US and China withPresident Trump threatening additional tariffscould keep RBA rate cut bets bid and upside in spot AUDUSD at bay.

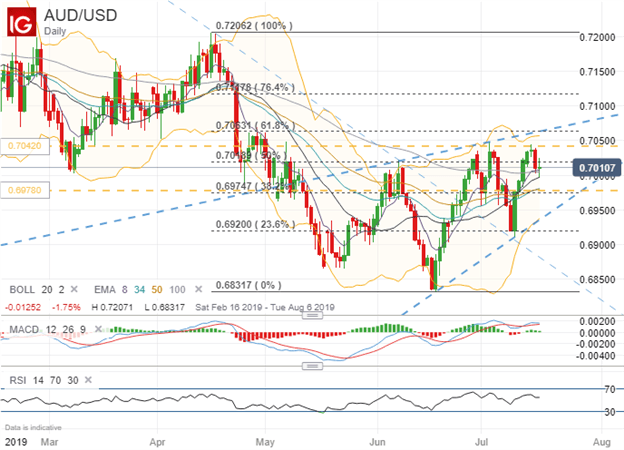

However, the uptrend starting to develop in spot AUDUSD could be reiterated if Thursday's Aussie jobs data noticeably tops market estimates. Looking to the technical, spot AUDUSD might find some buoyance from the rising exponential moving averages, but price action could struggle to eclipse resistance posed by the 50.0 percent retracement from April's high – a major area of confluence around the 0.7000 handle.

SPOT AUDUSD PRICE CHART: DAILY TIME FRAME (FEBRUARY 17, 2019 TO JULY 17, 2019)

That said,the path of least resistance could be a test of support near the 38.2 percent Fibonacci retracement level which closely aligns with the lower bound of the option implied trading range. Spot AUDUSD is calculated to range as high as 0.7042 or as low as 0.6978 during Thursday's trading session in response to the Australian jobs report with a 68 percent statistical probability. This 64-pip trading range is estimated from a 1-standard deviation move from spot AUDUSD using the overnight implied volatility reading of 8.66 percent.

-- Written byRich Dvorak , Junior Analyst forDailyFX.com

Connect with@RichDvorakFXon Twitter for real-time market insight

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment