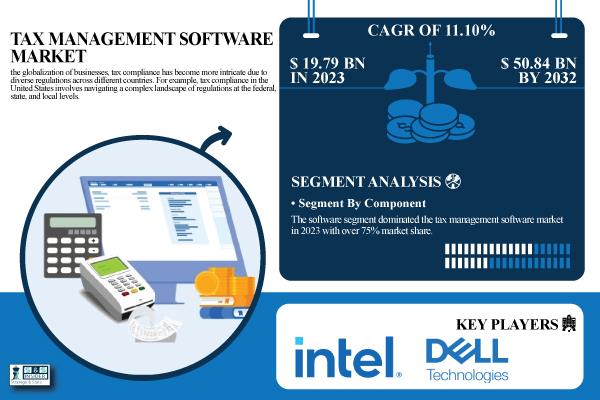

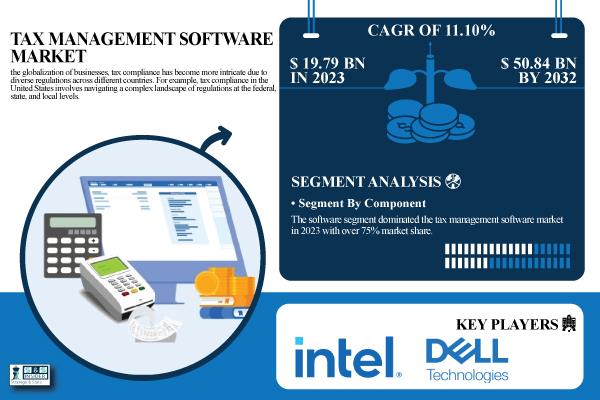

(MENAFN- GlobeNewsWire - Nasdaq) The tax management software market is expanding as businesses face increasingly complex global tax regulations, with high adoption in e-commerce where automated, location-based tax calculation is essential for managing cross-border compliance.Austin, Dec. 03, 2025 (GLOBE NEWSWIRE) -- The Tax Management Software Market size was valued at USD 19.79 Billion in 2023 and is expected to reach USD 50.84 Billion by 2032, growing at a CAGR of 11.10% over the forecast period 2024-2032.

Due to the various laws in various nations, tax compliance has grown increasingly complex as a result of company globalization. For instance, negotiating a complicated web of federal, state, and local requirements is necessary to ensure tax conformity in the U.S.

Download PDF Sample of Tax Management Software Market @

Growing Complexity of International Tax Compliance to Propel Market Growth Globally

Globally, governments are always updating their tax laws to account for changes in the economy, guarantee equity, and close gaps. For businesses of all sizes, this fast-paced environment presents significant challenges. Because of this, businesses have to deal with a complex regulatory framework that varies not only between nations but also within states or regions. As a result, businesses are increasingly depending on tax management software as an essential instrument to effectively manage compliance. These software applications provide crucial tools for businesses to manage filings, automate tax computations, and guarantee compliance with regional, federal, and international regulations. They help by instantly alerting businesses to changes in regulations, enabling them to promptly modify their tax strategies. Furthermore, failing to comply can result in significant financial consequences such as fines, penalties, and harm to reputation.

Segmentation Analysis:

By Component

The software segment dominated the tax management software market in 2023 with over 75% market share as it is highly beneficial for businesses as it streamlines intricate tax regulations and provides immediate updates on legal modifications. The professional services segment is anticipated to witness the fastest CAGR during 2024-2032 due to the evolving tax regulations, companies are turning to expert guidance more often to improve their tax management strategies and stay compliant.

By Tax Type

The direct tax sector held a market share of 55% in 2023 and dominated the market, due to the increasing challenges related to tax laws and compliance that businesses are dealing with. The indirect tax is projected to become the fastest-growing segment during 2024-2032, fueled by the rising popularity of Goods and Services Tax (GST) and Value Added Tax (VAT) systems on a global scale.

By Deployment

The on-premise segment dominated the tax management software market in 2023 with a 53% market share, and will continue with the segment becoming the fastest-growing during 2024-2023. This control is maintained by organizations wanting to keep a hold on their financial information and follow strict rules.

If You Need Any Customization on Tax Management Software Market Report, I nquire Now @

Regional Insights:

In 2023, North America held a 37% market share lead in tax management software, mostly due to well-established accounting and financial firms, sophisticated technological infrastructure, and strict laws. The increasing complexity of tax regulations and the need for compliance have led to significant investment in tax technology solutions in the U.S. and Canada.

The APAC region is anticipated to become the fastest-growing with a rapid CAGR during 2024-2032, due to rapid economic growth, higher tax compliance requirements, and a growing uptake of digital solutions by SMEs.

Key Players:

Thomson Reuters (ONESOURCE, UltraTax CS) Intuit Inc. (TurboTax, QuickBooks) Avalara (AvaTax, CertCapture) Wolters Kluwer N.V. (CCH Axcess, ATX) H&R Block (BlockWorks, Tax Pro Go) Sovos Compliance LLC (Taxify, Sovos Intelligent Compliance Cloud) Vertex Inc. (Vertex O Series, Vertex Cloud) Xero Limited (Xero Tax, Hubdoc) SAP SE (SAP Tax Compliance, SAP S/4HANA for advanced compliance reporting) ADP, Inc. (ADP SmartCompliance, ADP Tax Filing) Deloitte Touche Tohmatsu Limited (Tax@Hand, GlobalAdvantage) Ernst & Young (EY) (EY Global Tax Platform, EY EDGE) Oracle Corporation (Oracle Tax Reporting Cloud Service, Oracle ERP Cloud) TaxJar (TaxJar API, TaxJar SmartCalcs) Drake Software (Drake Tax, Drake Accounting) CCH Incorporated (ProSystem fx Tax, CCH iFirm) ClearTax (ClearTax GST, ClearTax e-Invoicing) Sage Group plc (Sage Intacct, Sage Business Cloud Accounting) TaxAct, Inc. (TaxAct Professional, TaxAct Business) Zoho Corporation Pvt. Ltd. (Zoho Books, Zoho Expense)

Tax Management Software Market Report Scope:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

CONTACT: Rohan Jadhav - Principal Consultant

Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)

Comments

No comment