403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

Asia 2026: 5 Questions For Japan's Year Of 'Sanaenomics'

(MENAFN- ING)

What are the main reasons for economic recovery in 2026?

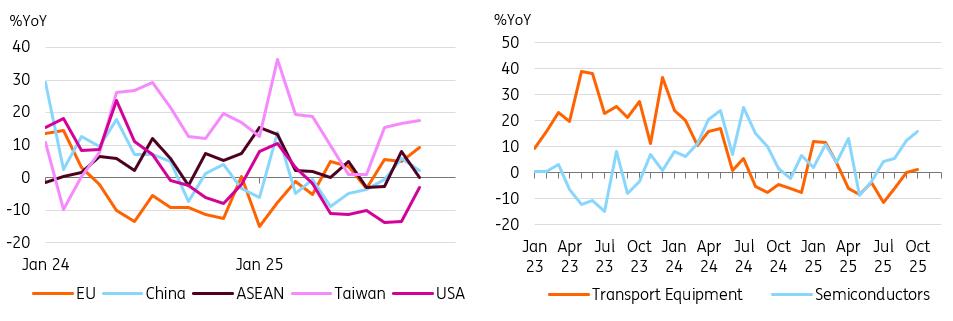

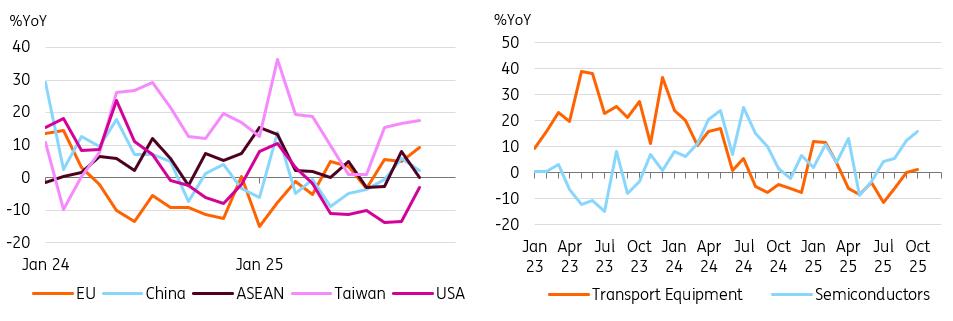

Semiconductors will boost exports, and US exports should rebound

Source: CEIC

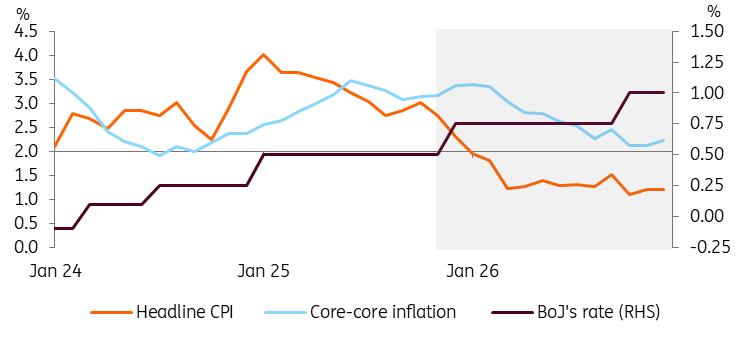

Will the BoJ continue to hike rates?

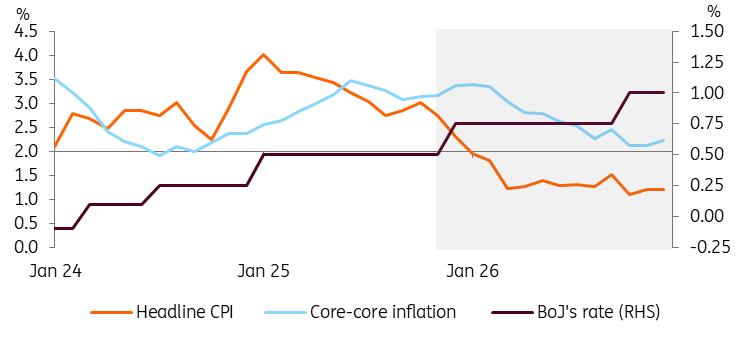

Core inflation excluding fresh food and energy will stay well above 2%, supporting the BoJ's rate hike

Source: CEIC, ING estimates

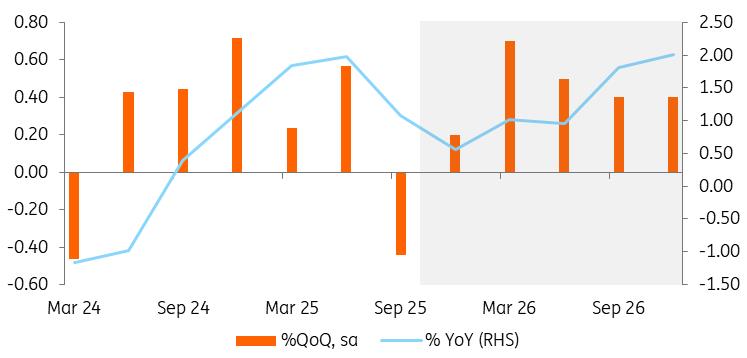

How might Sanaenomics affect the economy and monetary policy?

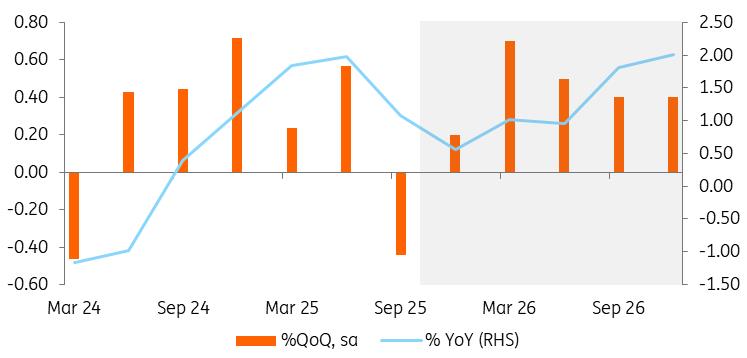

Sanaenomics might boost growth more than expected

Source: CEIC, ING estimates

What might Sanaenomics mean for financial markets?

We expect to see a decline of Chinese tourists to Japan

Source: CEIC

-

Japan's economy is expected to recover quite meaningfully in 2026 thanks to 'Sanaenomics' and reduced trade tensions. A lower cost of living and solid wage growth are expected to support private spending, while easing trade tensions should boost exports. Combined with structural labour shortages at home, robust global AI demand, reduced US tariff uncertainty, and solid corporate earnings, we expect significant investment growth in 2026. For wage growth, Rengo, one of the largest trade unions in Japan, is vying for pay raises of at least 5% during the upcoming spring wage negotiations. We expect another near-5% wage growth rise for 2026, which will eventually turn real wages positive.

Like other major Asian tech exporters, strong demand for semiconductors is expected to drive export growth. In addition, following the US-Japan trade agreement, auto exports have started to recover. We believe the weak yen has helped offset some of the effects of tariffs, which will continue to benefit Japanese exporters.

The Bank of Japan's slow and steady normalisation process will continue, but real interest rates will remain negative. Accommodative monetary conditions will therefore support growth.

Semiconductors will boost exports, and US exports should rebound

Source: CEIC

Will the BoJ continue to hike rates?

-

The BoJ continued its move toward policy normalisation in 2025, implementing a 25bp hike in the first quarter and pursuing quantitative tightening by reducing its holdings of Japanese government bonds (JGBs) and ETF/J-REITs. Given recent hawkish remarks from several BoJ officials, including Governor Kazuo Ueda, the likelihood of another rate hike in December appears high.

Growth conditions are projected to improve in 2026, with core inflation remaining above 2%. This may prompt the BoJ to consider a 25bp hike, with the policy rate reaching 1.0%. The BoJ will monitor whether wage growth remains above 3% in the spring negotiations and whether underlying inflation remains near 2%. Policy normalisation will likely proceed slowly due to policy coordination with the government. We expect the next hike to materialise much later, in October. With real interest rates still negative, a 25bp hike is justifiable in our view.

However, there is potential for the BoJ to raise rates to a total of 50bp, depending on wage growth and the strength of private consumption. This could be triggered, ironically, by Sanaenomics.

Core inflation excluding fresh food and energy will stay well above 2%, supporting the BoJ's rate hike

Source: CEIC, ING estimates

How might Sanaenomics affect the economy and monetary policy?

-

In early December, the Japanese cabinet approved the government's first economic stimulus package, valued at approximately ¥21.3tr. The initiatives are focused on stabilising inflation, enhancing defence and diplomacy, and promoting sustainable growth.

We agree with the need for a stimulus package to boost short-term growth and reduce inflation, but this may influence the BoJ's monetary policy.

Inflation is projected to drop below 2% when energy subsidies are introduced early next year, with an expected decrease to 1.4% year-on-year in 2026 from 3.1% in 2025. Lower energy and food costs, financial support for childcare, and a strong equity market should stimulate more consumer spending, which may result in stronger growth than anticipated. This may also push up core inflation above 2%. So far, BoJ policymakers have suggested that current inflation is mainly driven by cost-push factors, meaning the underlying rate of increase hasn't yet reached 2%. Should core inflation continue to exceed headline inflation, it would indicate demand-driven inflationary conditions. In turn, the BoJ may implement more rate hikes or introduce them earlier than anticipated.

Sanaenomics might boost growth more than expected

Source: CEIC, ING estimates

What might Sanaenomics mean for financial markets?

-

The recent sell-off in JGBs was influenced by multiple factors, including high odds for a BoJ rate hike in December, increased debt issuance thanks to stimulus packages, and the possible unwinding of carry trades. As is widely known, Sanaenomics is based on aggressive fiscal spending to revitalise the economy. However, combined with the ongoing BoJ's quantitative tightening, market concerns about fiscal sustainability could increase. This could boost JGB yields and weaken the JPY at the same time.

If yields on short-term JGBs increase rapidly, it could place a strain on households and businesses. Long-term JGBs are primarily traded by institutional investors and have a limited direct connection to the real economy. However, any sudden surge in short-term JGB yields might negatively impact the fragile economic recovery.

If the economy experiences a downturn, the BoJ may encounter difficulties. A sudden policy change could increase market volatility and damage overall conditions. As a result, this might prevent the BoJ from responding promptly to changes in macroeconomic conditions.

-

Other key aspects of Sanaenomics include strengthening defence and diplomatic capabilities. If not implemented carefully, this policy may lead to increased regional tensions, as observed between Japan and China. We don't think the tensions will escalate further for now. Since her conversation with US President Donald Trump, Takaichi has not commented further on China or Taiwan, suggesting the status quo will hold. With strong approval ratings, Takaichi has little incentive to provoke China.

Any deterioration in relations would affect Japan more than China. For example, after Japan purchased the disputed Senkaku Islands in 2012, tensions led to a 40% drop in Chinese tourism to Japan. This time, the Chinese government has cancelled flights and banned Japanese seafood in retaliation. While it's hard to gauge the full impact on Japan's economy, these actions pose clear short-term downside risks.

We expect to see a decline of Chinese tourists to Japan

Source: CEIC

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment