403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

Mcdonald's Signal 06/11: Earnings Suggest Correction? -Chart

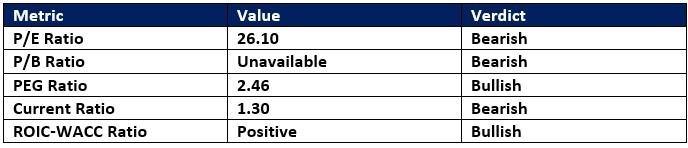

(MENAFN- Daily Forex) Short Trade IdeaEnter your short position between $305.02 (a minor horizontal support level) and $308.51 (the lower band of its bearish price channel).Market Index Analysis

- McDonald's (MCD) is a member of the Dow Jones Industrial Average, the S&P 100, and the S&P 500 indices. All three indices hover near record highs amid an expanding AI bubble, but lack market breadth, as bearish catalysts accumulate. The Bull Bear Power Indicator of the S&P 500 shows a negative divergence and does not support the uptrend.

- The MCD D1 chart shows price action below its horizontal resistance zone. It also shows price action breaking down below its ascending Fibonacci Retracement Fan. The Bull Bear Power Indicator turned bullish but remains below its descending trendline. The average trading volumes rose during the post-earnings advance, but overall trail average bearish volumes. MCD corrected as the S&P 500 pushed higher, a significant bearish trading signal.

- MCD Entry Level: Between $305.02 and $308.51 MCD Take Profit: Between $276.53 and $283.47 MCD Stop Loss: Between $318.04 and $326.32 Risk/Reward Ratio: 2.19

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment