From Belém To The Boardroom What COP30 Means For Climate Leadership

This year's COP30 meeting, held in Belém, Brazil, marks a milestone for us as the fifth COP we have jointly covered. Each year, as we approach the event, it's difficult not to feel overwhelmed by the sobering updates on the state of the climate – and this year is no exception.

This year's COP focuses on updating the five-year climate action plans from participating countries, known as Nationally Determined Contributions (NDCs). The United Nations was only able to analyse 64 updated NDCs, representing just 30% of global emissions, as many major emitters have yet to submit their new plans. If these countries fully implement their updated NDCs, their collective emissions would be approximately 17% lower in 2035 compared to 2019 levels. While this represents progress over previous commitments, it still falls far short of the 60% reduction needed by 2035 to keep the 1.5°C goal within reach.

Compounding the concern, the World Meteorological Organisation has highlighted that the ability of our oceans and forests to absorb CO2 is diminishing. This underscores the critical importance of adaptation, especially for developing nations. However, funding for adaptation efforts remains woefully inadequate, as noted in the latest UN Adaptation Finance Gap Report.

While COP30 centres on updated climate action plans, the process has been anything but smooth

A key focus at this year's COP is the submission of updated Nationally Determined Contributions (NDCs) by countries, as required every five years under the Paris Agreement, marking the second official update cycle since 2015. However, this process has been anything but smooth.

-

China, the world's largest emitter, recently announced its first-ever absolute emissions reduction target, pledging to cut net greenhouse gas emissions by 7-10% from peak levels by 2035. While this move marks a step forward and demonstrates some progress, experts cited in CarbonBrief and Nature contend that the target remains overly cautious. They argue that, given China's commitment to reach net-zero by 2060 and its outsized influence on global emissions trends, its pace of progress will be a decisive factor in the world's ability to achieve the Paris Agreement's goal of limiting global warming to well below 2°C.

Meanwhile, the US federal delegation – representing the world's second-largest emitter – will be absent after withdrawing from the Paris Agreement.

Finally, the European Union, the third-largest emitter, is also facing significant internal disputes over climate targets. Major member states such as France, Germany, Poland, and Italy have formed a blocking minority against the European Commission's proposal for a 90% emissions cut by 2040. As a result, the EU missed the deadline to deliver an updated NDC, arriving at the UN General Assembly with only a statement of intent. At present, only about one-fifth of the 195 participating countries have submitted updated versions of their NDCs.

What's more, developed nations are still $100bn short of the $300bn annual climate finance commitment to developing countries. The outlook for increasing these funds remains bleak; in 2025, for example, the United States withdrew $18bn of previously pledged support.

Despite many challenges, corporate leaders remain committed to sustainabilityOverall, the outlook for COP30 appears very challenging on both the climate and policy fronts, offering little cause for optimism at this stage. So, what kind of sentiment lingers among corporate leaders?

Here, the picture is mixed. While recent global surveys among C-suite executives indicate a continued strong commitment to sustainability, the path ahead is far from straightforward. Sustainability initiatives do not exist in isolation – business leaders must also contend with challenges such as geopolitical tensions, trade disputes, domestic unrest, and political instability. These factors complicate the ability to make long-term investments in sustainability.

Additionally, the transition to a net-zero economy inevitably results in both winners and losers, impacting certain industries, regions, and workers more negatively than others. In Europe, for example, strong corporate lobbying efforts have emerged against pivotal transitions and policy measures, including the 2035 ban on combustion engines and the implementation of carbon pricing for buildings and road transport (ETS2).

Three major sustainability trends in the corporate worldAmid this complex and evolving landscape, three major sustainability trends are emerging within the corporate sector.

1. Corporate climate action remains resilient, but more discreet

Many corporate leaders are not backing away from sustainability, despite widespread headlines about the so-called“ESG collapse” and increasing political pushback. Major surveys show that sustainability continues to be a high priority for businesses. For example, both Deloitte's and Capgemini's global surveys reported that four out of five CEOs have increased their sustainability investments over the past year, with almost two out of ten noting a substantial jump of more than 20%. Similarly, a Harvard Business Review analysis found that only 13% of firms have scaled back their climate commitments.

However, there is a notable shift in how corporate leaders present their sustainability efforts; they are now much less vocal about their initiatives. According to Harvard Business Review, more than half of companies have opted to understate or completely stop publicising their sustainability achievements, even as they continue to make progress internally. This practice, referred to as“greenhushing,” involves leaders deliberately keeping quiet or making only symbolic gestures in public about their environmental strategies. By doing so, companies aim to shield themselves from political, public, or legal scrutiny.

For instance, the Grantham Research Institute on Climate Change and the Environment reports that at least 226 new climate-related legal cases were filed in 2024 alone, raising the total number of cases to 2,967. This highlights the growing legal risks that may motivate companies to keep their sustainability actions more discreet.

2. Corporate leaders focus on areas where sustainability aligns with business value

The surveys mentioned reveal that CEOs increasingly view sustainability investments as a direct contributor to financial performance. Notably, revenue generation has now surpassed compliance, brand reputation, and cost savings as the most frequently cited benefit of sustainability efforts. CEOs are increasingly focusing on areas where sustainability aligns directly with business value, such as enhancing supply chain resilience, advancing the circular economy, and developing innovative sustainable products.

3. Managing climate risks enters the corporate agenda

The emphasis of sustainability is shifting beyond emission reduction, with managing climate risks gaining importance. Recent findings from Deloitte indicate that climate-related extreme weather events are already impacting one in three corporate leaders' operations. In light of these challenges, leaders are actively restructuring their supply chains and business operations to enhance resilience and adapt to a changing climate.

Rising physical climate risks are now a major and growing concern for corporate leaders. Over the past year, natural disasters have triggered global losses estimated between $320bn and $417bn – approximately double the inflation-adjusted average of the past 30 years. Insurers such as Munich Re, Gallagher Re, and Swiss Re report that only about one-third of these losses were actually covered by insurance.

Consequently, some regions are becoming increasingly uninsurable, and the protection gap continues to widen: while corporate insurance policies are typically renewed on an annual basis, business leaders must make long-term investment decisions that extend well beyond the scope of yearly coverage.

Our take on recent sustainability trends

While corporate leaders have become less vocal about their sustainability efforts, we believe sustainability remains a crucial driver of long-term value. The energy transition is expected to progress, not only due to emissions reduction targets, but also because renewables often represent the most cost-effective power solution. In today's fragmented world, many regions are seeking greater energy independence, and renewables offer a compelling option, especially in areas with limited fossil fuel resources, like Europe.

However, it is uncertain whether this momentum alone will set businesses firmly on a net-zero trajectory. Achieving net-zero goes beyond expanding renewable electricity; it also requires substantial progress in decarbonising heating, producing low-carbon feedstock for materials such as steel and plastics, and developing sustainable fuels for sectors like aviation, shipping, and trucking. These areas demand transformative changes that, even with supportive policies, are often not yet economically viable or may conflict with existing business models – particularly when considering strategies that involve degrowth. These challenges make it significantly more difficult for corporate leaders to implement the comprehensive sustainability transitions that COP meetings call for.

This is reflected in the reality that, according to CapGemini, only one in five leaders has developed thorough and actionable transition plans. It is also increasingly clear that business leaders cannot achieve sustainability in isolation due to the many interdependencies involved. For instance, progress in electrification depends on expanding grid capacity, decarbonising heavy industry relies on advancements in carbon capture and storage (CCS) and hydrogen technologies, and supporting unviable business cases often requires robust policy support.

We therefore anticipate that leading CEOs will increasingly champion systemic change – whether publicly or through strategic, behind-the-scenes efforts – and actively promote cross-sector collaborations designed to accelerate the sustainability transition.

Three things corporate leaders should follow during COP30What opportunities and challenges does COP30 present for corporate leaders? In our view, COP30 brings three critical topics to the forefront of the corporate agenda that every boardroom should be watching closely.

1. Article 6 and carbon markets

Corporate leaders can use carbon markets, both mandatory and voluntary markets, in their pursuit to compensate for or lower emissions. Last year at COP29 in Baku, negotiators achieved the long-awaited full operationalisation of Article 6 of the Paris Agreement, unlocking international carbon markets after nearly a decade of complex negotiations. This milestone provides the legal and technical clarity needed for countries and companies to engage in cross-border carbon activities and trade.

This year's COP marks a pivotal moment. With the rulebook now complete, attention shifts to implementation. The Article 6 Supervisory Body is expected to report on its progress, including the approval of methodologies and registry operations. This will shape how companies can participate in high-integrity carbon markets, either through compliance or voluntary offsetting. The decisions made at COP30 will influence the credibility, cost, and availability of carbon credits and determine how companies can use them to meet net-zero targets or regulatory obligations, for example, by a clear distinction between credits for carbon reductions and carbon removals.

2. Climate finance

The progress realised at COP summits holds the ability to move climate finance from a specialised area to mainstream acceptance.

Climate finance returns to the spotlight, and we expect a strong emphasis on mobilising capital, especially for developing countries. Therefore, corporate leaders should closely monitor the outcomes of COP30 and be ready to adjust their strategies to capitalise on new developments, in particular regarding blended finance and sustainable finance.

-

Blended finance – the strategic use of concessional public funds to de-risk private investment – is helping corporates scale clean technologies and expand into emerging markets. It's particularly relevant for firms with global supply chains or infrastructure exposure, offering a way to crowd in capital while managing risk. With COP acting as a catalyst and private sector interest growing, blended finance could become more standardised, scalable, and innovative.

Sustainable finance instruments, such as green and sustainability-linked debt, continue to be effective tools to raise capital to achieve climate goals. Corporates can leverage resources like the Corporate Climate Finance Playbook from COP28 to broaden the use of sustainable finance across diverse business models and sectors. In addition, transition debt can also play a bigger role over time in allowing companies to finance decarbonisation without needing to be“green” from day one. It is also crucial for hard-to-abate industries like steel, cement, and aviation to attract more capital to overcome complex decarbonisation challenges.

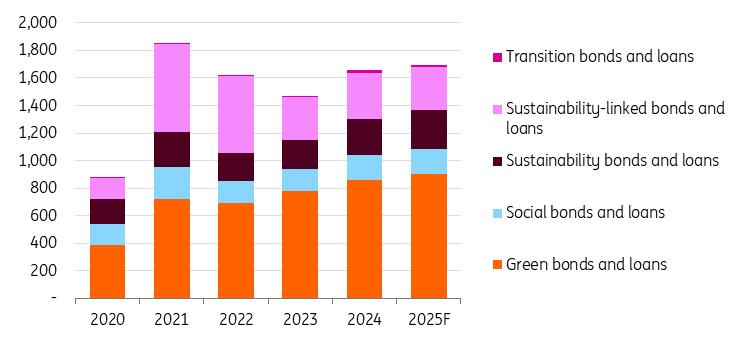

In the past, important sustainable finance architecture, such as the Glasgow Financial Alliance for Net Zero (GFANZ) at COP 26 in 2021, was instrumental in driving subsequent issuance and facilitating decarbonisation. For instance, in 2021, sustainable finance issuance by large corporates experienced a remarkable surge – more than doubling from 2020 levels – as anticipation built ahead of COP26. Any meaningful decision at COP30 can further contribute to broadening the global sustainable finance market.

Global sustainable finance issuance doubled in the runup to COP26 in 2021 and can be boosted by another meaningful COPGlobal sustainable finance issuance in $bn

Source: Bloomberg New Energy Finance, ING Research. Note: the issuance numbers exclude asset-backed securities, though we acknowledge the positive sustainable development in the space.

3. Renewables and nature

In sustainability, corporate leaders are navigating a dual imperative: rapidly increasing renewable energy capacity and use to reduce emissions while actively restoring nature to combat biodiversity loss. COP meetings set the global ambition for both areas. At past COP events, agreements were reached to transition away from fossil fuels, triple global renewable energy capacity by 2030, and halt and reverse biodiversity loss by 2030.

Despite these international commitments, many corporate leaders struggle to integrate energy and nature goals, often treating them as separate pillars within their sustainability strategies. Yet, some projects offer a unique opportunity to address both challenges simultaneously. For instance, solar and wind farms can be designed to deliver measurable biodiversity benefits, such as incorporating pollinator-friendly plantings or animal-friendly fencing, at minimal additional cost. Responsibly planned offshore wind farms can create new marine habitats.

Integrating biodiversity considerations into core energy projects not only bridges these critical sustainability objectives but also elevates nature restoration to a boardroom priority.

Outlook: navigating a challenging COP, but corporate opportunities abound

Over the past five years of covering COP events, we have learned that international efforts, while important, often fall short and leave significant room for progress. Much like parenting, where one must decide whether to emphasise successes or address shortcomings, we have focused on the latter.

As we look ahead to COP30, it is evident that corporate leaders will face a complex landscape – one filled with both challenges and exciting new opportunities to drive meaningful change in sustainability and innovation.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment