Dydx Offers $462K Compensation To Traders After October 10 Chain Halt

- dYdX plans to compensate traders affected by a blockchain outage, with a community vote to allocate up to $462,000 from its insurance fund. The October chain halt was caused by a misordered code process and delayed validator restart, which led to trade inaccuracies and liquidation losses. Binance faced significant technical issues during the crypto market crash, including pricing errors and stablecoin depegging, prompting a $728 million relief pledge. Despite losses, Binance clarified that it does not assume liability but is taking steps to support affected traders through token airdrops and a substantial fund. These incidents highlight the resilience and ongoing development needed in the crypto ecosystem as it grapples with market crashes and regulatory scrutiny.

Decentralized exchange dYdX has issued a detailed post-mortem explaining a significant system outage last month and outlining its plans for community-driven compensation. The platform revealed that its governance community would vote on reimbursing traders impacted by the eight-hour chain halt, potentially drawing up to $462,000 from the protocol's insurance fund.

The incident, which occurred on October 10, was traced back to a misordered code deployment, compounded by delays in validators restarting oracle services. This disruption caused the matching engine to process trades and liquidations at incorrect prices because of stale oracle data. No user funds were lost on-chain, according to dYdX, but some traders experienced liquidation-related losses during the downtime.

Wallets affected by the outage. Source: dYdXdYdX emphasized that the incident did not entail a breach of on-chain security but pointed out the need for improved process management. The governance will now vote on whether to allocate funds from the insurance reserve to support traders who suffered losses.

Binance's response to the Market CrashThe October sell-off, which erased approximately $19 billion from crypto positions-marking one of the largest liquidation events in history-also tested Binance's infrastructure. During the market turmoil, traders encountered technical malfunctions, including erroneous token prices below zero and the depeg of Ethena 's USDe stablecoin, raising concerns around platform stability and liquidity management.

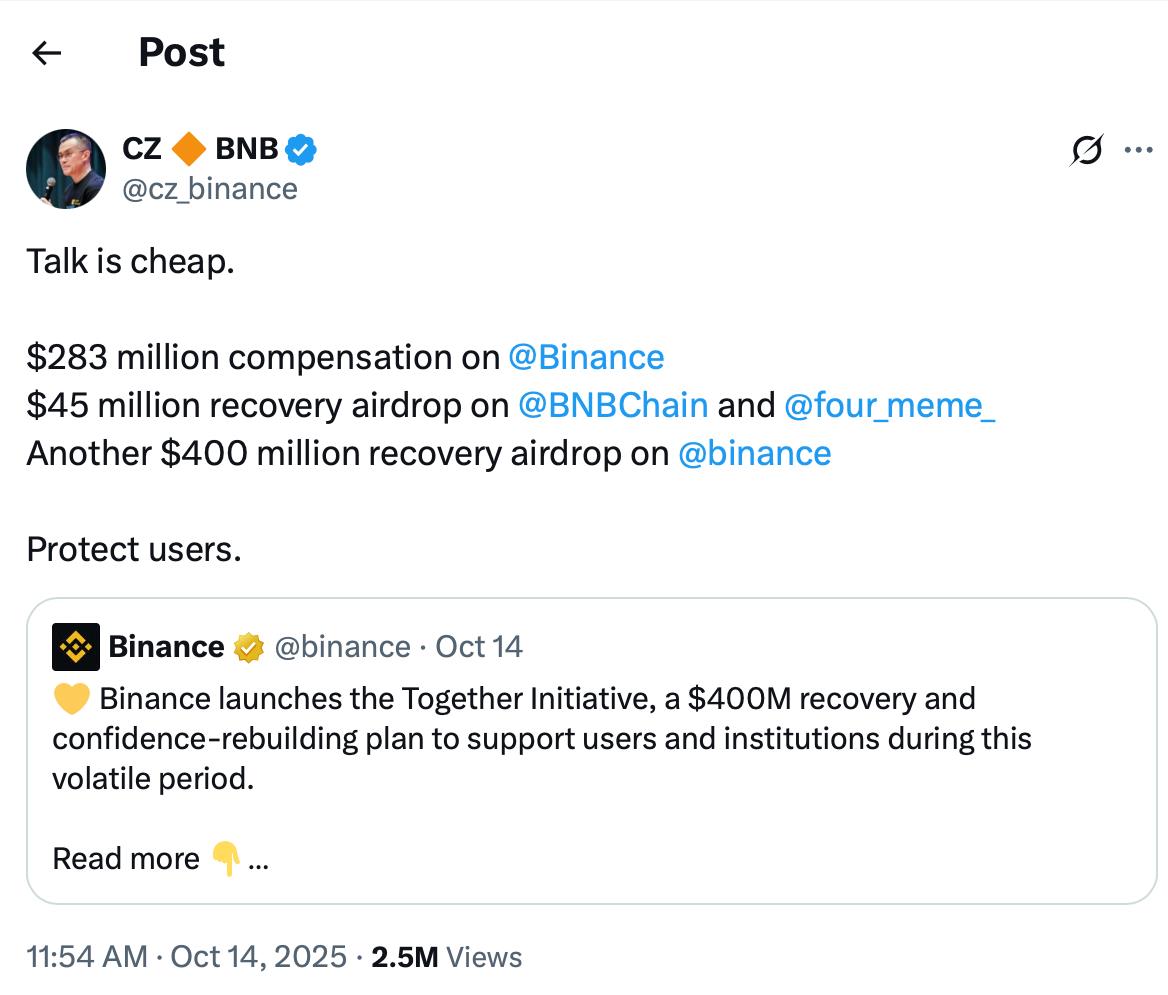

While Binance clarified that it does not accept liability for traders' losses, the exchange announced a relief package totaling $728 million. This includes a $400 million fund aimed at helping those affected, consisting of $300 million in token vouchers and $100 million allocated to ecosystem participants impacted by market chaos.

Source: CZ_binance

To bolster confidence, Binance also airdropped $45 million worth of BNB tokens to memecoin traders hit by the crash. These efforts illustrate the platform's approach to balancing risk management with maintaining user trust amid volatile market conditions.

As market turmoil continues to influence the crypto landscape, these incidents exemplify the importance of stronger infrastructure, clearer regulatory pathways, and resilient community measures to enhance stability and investor protection in the evolving blockchain ecosystem.

Crypto Investing Risk WarningCrypto assets are highly volatile. Your capital is at risk. Don't invest unless you're prepared to lose all the money you invest.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment