Why Bitcoin Will Dominate The Fourth Turning: Expert Analysis

During an interview with Anthony Pompliano, Visser highlighted that the average individual's confidence in legacy systems is waning. This decline, he argued, is likely to channel investment toward Bitcoin - a neutral, permissionless asset that operates independently of government control or traditional banking structures.

The“Fourth Turning” concept, borrowed from the book by William Strauss and Neil Howe, characterizes a recurring pattern of societal upheaval, reform, and rebuilding driven by generational shifts. Visser sees Bitcoin as a direct response to this cycle, positioning itself as a resilient store of value amid global instability.

Jordi Visser shares insights on“The Pomp Podcast”. Source: Anthony Pompliano

“Bitcoin is fundamentally trustless,” Visser explained.“It was created to address the distrust in banks- but now, we've moved past the banks entirely.” He emphasized that trust issues extend beyond financial institutions to governments, employers, currencies, and debt, making it difficult to see how trust can be restored in the current climate.

These comments come amid declining consumer confidence, geopolitical instability, and historic levels of government debt-factors that erode individual purchasing power and underscore the need for hard, incorruptible money. In such a landscape, Bitcoin 's appeal as a safe haven grows stronger, particularly as traditional systems falter.

Related: 'Bitcoin Standard' author: Argentina's bond 'Ponzi' near collapse, Bitcoin is the exit

Confidence in the economy hits new lows amid a K-shaped recoveryVisser pointed to the growing disparity across economic segments, characterized by a K-shaped recovery, where wealth consolidates at the top while more people at the bottom face economic decline. This divide reflects a systemic skew where asset holders see increasing prosperity, and others suffer from inflation and unemployment pressures.

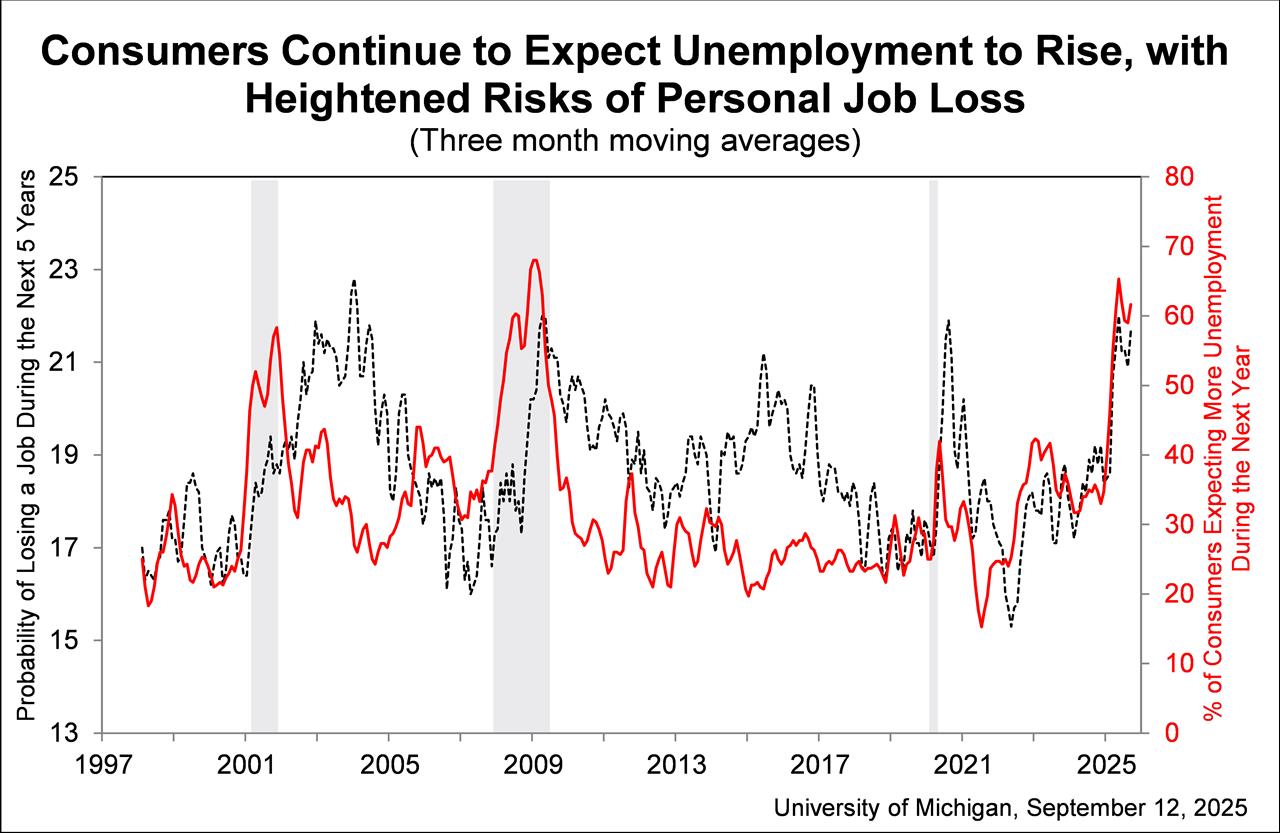

The percentage of individuals expecting higher unemployment in 2026. Source: University of Michigan

The latest consumer sentiment survey shows only 24% of respondents expect their spending to stay consistent by 2026, with rising inflation and trade tensions cited as primary concerns. Additionally, over 60% anticipate unemployment to increase within the same period, highlighting widespread economic uncertainty and a fragile outlook.

As these conditions deepen, Bitcoin 's role as a safeguard against inflation and a hedge in uncertain times becomes increasingly attractive for investors seeking stability amid the chaos of traditional markets.

Magazine: US risks being 'front run' on Bitcoin reserve by other nations: Samson Mow

Crypto Investing Risk WarningCrypto assets are highly volatile. Your capital is at risk. Don't invest unless you're prepared to lose all the money you invest.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment