Vitalik Addresses Galaxy Digital FUD: Defends Ethereum Exit Queue

Deleted post from Galaxy Digital's DeFi head. Source: Etc.

While critics focus on the queue's length, Buterin emphasized the importance of staking as a“solemn duty” rather than merely a liquidity event. He likened unstaking to“a soldier deciding to quit the army,” adding that the friction involved is essential for maintaining network security. Despite the delays, Ethereum remains among the most secure blockchains, with over 1 million active validators and roughly 35.6 million ETH staked-around 30% of the total supply.

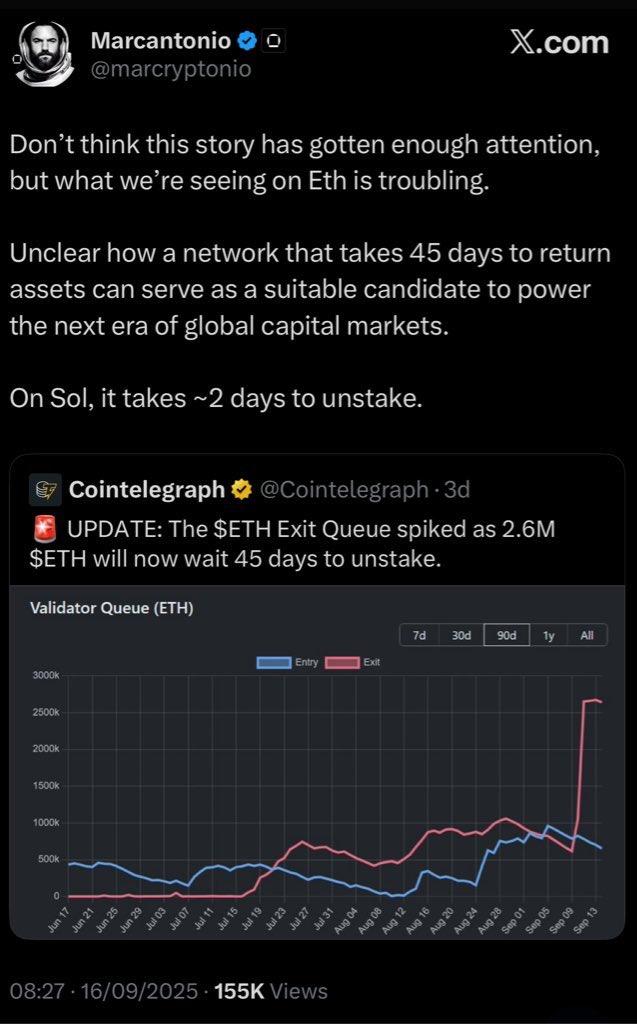

Buterin also acknowledged that the current queue design could be improved, warning that reducing delays might compromise the network's security and trustworthiness-particularly for validators who do not operate nodes continuously. The recent surge in Ethereum 's exit queue hit an all-time high last week, signaling increased withdrawal activity during periods of volatile markets.

Meanwhile, Galaxy Digital made notable moves in the broader crypto market, recently acquiring $1.5 billion worth of Solana (SOL ) and partnering with Alameda Research-backed firms like Multicoin Capital and Jump Crypto . The firm also became the first Nasdaq -listed entity to tokenize its shares on Solana , further connecting traditional finance with DeFi assets.

title="Validator Queue Data" width="600" height="40

Criticism erupted on social media when Galaxy's head of DeFi attempted to downplay Ethereum 's staking challenges, which led to accusations of“FUD” (fear, uncertainty, doubt) against the ecosystem. Industry figures like Jimmy Ragosa and Anthony Sassano voiced concerns over the company's apparent disinformation tactics, prompting calls to reconsider the firm's involvement with Ethereum projects. Conversely, Solana proponents like Mike Dudas noted Galaxy's proven track record in delivering value within their blockchain network.

Despite rising concerns about queue delays, Ethereum 's ecosystem remains robust. The current total ETH in the exit queue is around 2.5 million, with recent spikes driven largely by exploits targeting projects like Kiln Finance. Only about 512,000 ETH are in the entry queue, reaching a two-year high amid ongoing institutional accumulation and growing interest from investors seeking to capitalize on the network's long-term potential.

Crypto Investing Risk Warning

Crypto assets are highly volatile. Your capital is at risk. Don't invest unless you're prepared to lose all the money you invest.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment