Economic Growth In Hungary Hinges On Consumer Spending

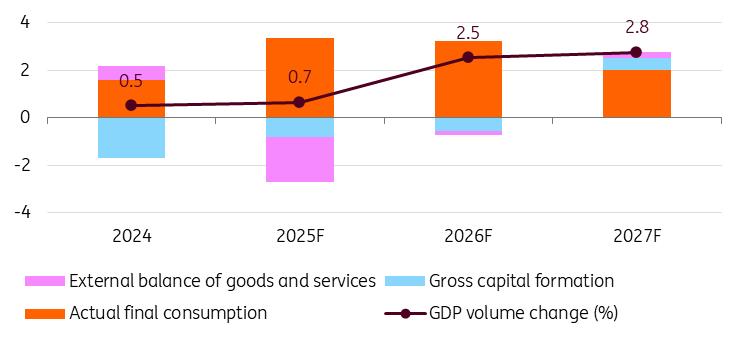

The detailed GDP report for the second quarter from the Hungarian Central Statistical Office (HCSO) did not reveal any significant revisions to recent GDP data. Therefore, we are keeping our baseline forecast unchanged, which predicts GDP growth of 0.7% in 2025, followed by economic activity of 2.5% and 2.8% in 2026 and 2027, respectively. This growth will be driven by continued increases in consumption and gradual improvements in investment, ensuring an improving balance in the growth structure over time. However, three years of sluggish (or perhaps even non-existent) capital stock growth, coupled with a deteriorating demographic situation, will make it increasingly challenging for the Hungarian economy to maintain a growth rate of over 3% without incurring significant imbalances in the longer term, in our view.

Real GDP (% YoY) and contributions (ppt)

Source: HCSO, ING

Looking ahead, weak business and consumer confidence are still the main constraints on the Hungarian economy. This confidence reached historic highs in the years leading up to the polycrisis (2018–2019). Unpredictable external factors such as geopolitics and tariffs, as well as uncertain global and local growth prospects, are holding back investment activity. Contrary to what would be expected in a macroeconomic textbook, high inflation and elevated inflation expectations are encouraging Hungarian households to save rather than consume. Although government interventions are directly boosting economic growth via government consumption and social transfers, they have yet to lead to a lasting turnaround in business and consumer confidence.

The biggest surprise in the detailed GDP data was the stronger-than-expected growth in actual final consumption, which now makes a bigger contribution to economic activity. However, the side effect is a stronger increase in import demand. Consequently, we have shifted to a less balanced growth outlook. While we have kept the 0.7% GDP growth forecast for 2025 unchanged, this comes with a significant negative contribution from net exports. The Hungarian economy still lacks external demand, with no quick change in sight. Rising consumption is putting pressure on the import channel. Furthermore, the one-off rise in exports due to tariff threats has now been reversed, resulting in a significant increase in imports, and consequently in inventories.

The volatility of the German economy and the uncertainty surrounding French domestic politics suggest that a rapid recovery is unlikely, and an upturn in external demand is not expected in the near future. Furthermore, the positive impact of the German investment programme and the increase in EU defence spending is not expected until 2026–2027. Against this backdrop, we anticipate a positive shift in the Hungarian economic outlook in the years ahead. As next year is an election year, we anticipate a significant increase in consumption, a gradual improvement in investment activity, and a negative statistical impact from shrinking inventories as the economic cycle turns. Exports will slowly pick up, but we do not expect a positive contribution from net exports until 2027.

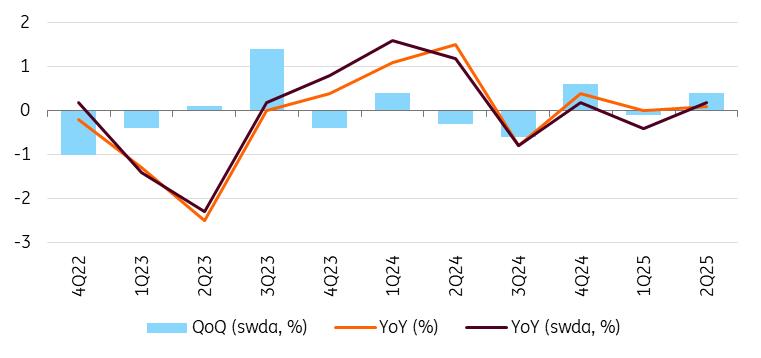

A deep dive into the second quarter of 2025The Hungarian Central Statistical Office did not make any significant changes to the second quarter's GDP data. The Hungarian economy grew by 0.4% on a quarterly basis in the April–June period. The seasonally and calendar-adjusted year-on-year index remained unchanged too, showing growth of only 0.2%. Therefore, the Hungarian economy has still been unable to show growth momentum, as GDP volume has fluctuated around the same level since mid-2022.

Hungarian GDP growth

Source: HCSO, ING

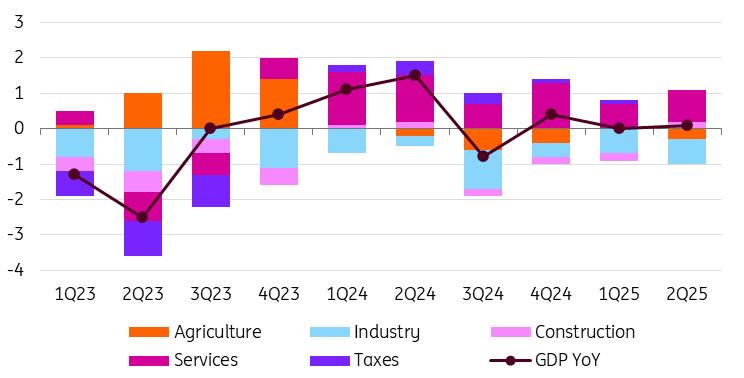

On the production side, agriculture saw a significant quarterly decline, while the industry and service sectors grew slightly. Construction, however, exhibited striking quarterly growth of 6%. Despite its small size, this sector largely prevented the Hungarian economy from entering another technical recession. The preliminary data release came as a positive surprise, and we can now attribute this to quarterly growth in industry and a stronger-than-expected performance in construction.

Year-on-year, agriculture experienced a double-digit decline in the second quarter due to adverse weather conditions. Manufacturing shrank by 4.4%, while the construction sector saw an increase of just over 5%. The services sector continues to support growth, but at a slower pace. The previous growth rate of around 2% has slowed to 1% this year. In short, no sector of the Hungarian economy is currently capable of sustaining significant growth, which suggests structural problems.

Contributions to GDP growth - production side (% YoY)

Source: HCSO, ING

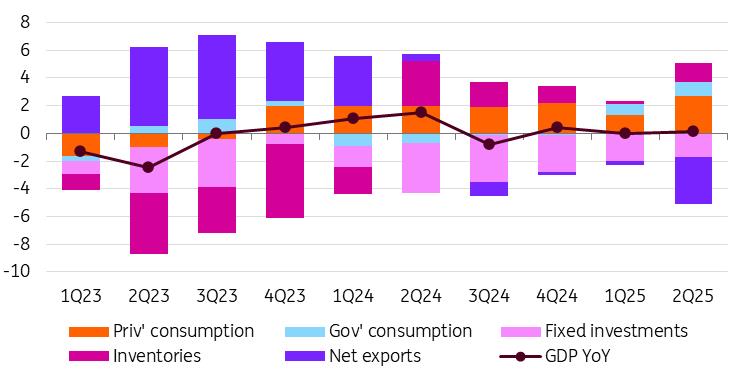

In terms of the expenditure approach, the most significant development is that actual final consumption of households grew considerably again after slowing down in the first quarter. This is good news, as the slowdown in growth did not continue and has led us to reconsider our previous view of a slower rise in consumption. The increase in household consumption was largely driven by a significant rise in social transfers in kind. The notion of strict fiscal control is contradicted by the fact that actual final consumption of government has grown significantly once again.

The story of investment activity is more than disappointing; it has contracted on the previous quarter 11 times in the last 12 quarters. Meanwhile, gross capital formation (investments plus inventories) has grown at an extraordinary rate. The increase of more than 10% on a quarterly basis may indicate two things. Firstly, following an export surge in the first quarter due to tariff threats, restocking took place in the second quarter. This resulted in better-than-expected industrial performance and high import growth. Secondly, a number of flagship investments may soon be activated; for now, they are only booked in inventories, but they may be reclassified as activated investments in the coming quarters.

Given the expansion in industry in terms of added value, it is surprising that exports fell by roughly 2% compared to the first quarter. Presumably, the tariff and inventory stories are behind this development. After exports were brought forward to the first quarter, export activity slowed down when the tariffs came into effect.

Based on yearly indices, it can be said that domestic demand grew exceptionally strongly in the second quarter. This was primarily due to base effects resulting from a surge in households and government consumption, and inventory changes may also have contributed significantly to the upside surprise. Investment activity showed a 7% year-on-year decline. This latter trend is consistent with the fiscal situation, the low confidence caused by declining order books and uncertain growth prospects. Net exports have held back the overall performance of the economy for four consecutive quarters. However, the negative impact of more than 3ppt seen in the second quarter was last observed in the pre-Covid period.

Contributions to GDP growth – expenditure side (% YoY)

Source: HCSO, ING The bottom line

Hungary is currently facing an unprecedented dual challenge. The country has experienced challenging periods due to labour market and/or inflation-related issues, which have impacted domestic demand. However, external demand has played a crucial role in stimulating growth during this period. While some crises have led to a decline in external demand, policymakers have had ample opportunity to bolster domestic demand. Over the past three years, we have observed a combination of domestic and external shocks, which have culminated in a confidence crisis and provided some kind of glass ceiling to the growth of the Hungarian economy.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment