Retailers In California Turn To Accounts Payable Services By IBN Technologies To Improve Accuracy Transparency And Long-Term Financial Control

"Accounts payable services [USA]"California retailers are showcasing measurable financial progress by adopting accounts payable services to streamline operations. The update highlights improved invoice cycle times, enhanced supplier confidence, and stronger internal controls. Readers will discover how structured service partnerships are enabling retail brands to manage payables with accuracy, transparency, and long-term financial stability.

Miami, Florida - 02 Sep, 2025 - As organizations expand and transaction volumes surge, the demand for dependable accounts payable services has become a defining priority for businesses striving for financial precision. Enterprises in retail, manufacturing, and service sectors are increasingly turning to specialized expertise to maintain transparent workflows, reduce invoice discrepancies, and enhance vendor satisfaction. What was once a back-office function is now a strategic pillar of operational excellence, shaping cash flow visibility and reinforcing compliance standards.

In response to mounting complexity, outsourcing financial workflows is no longer just a cost-saving measure-it is emerging as a competitive advantage. Accounts payable companies like IBN Technologies are helping organizations implement structured systems that handle large volumes while preserving accuracy. This approach delivers a clear value proposition: stronger financial control, consistent vendor relationships, and readiness for audit and regulatory requirements.

Minimize mistakes in transaction handling and account balancing Get a Free Consultation:

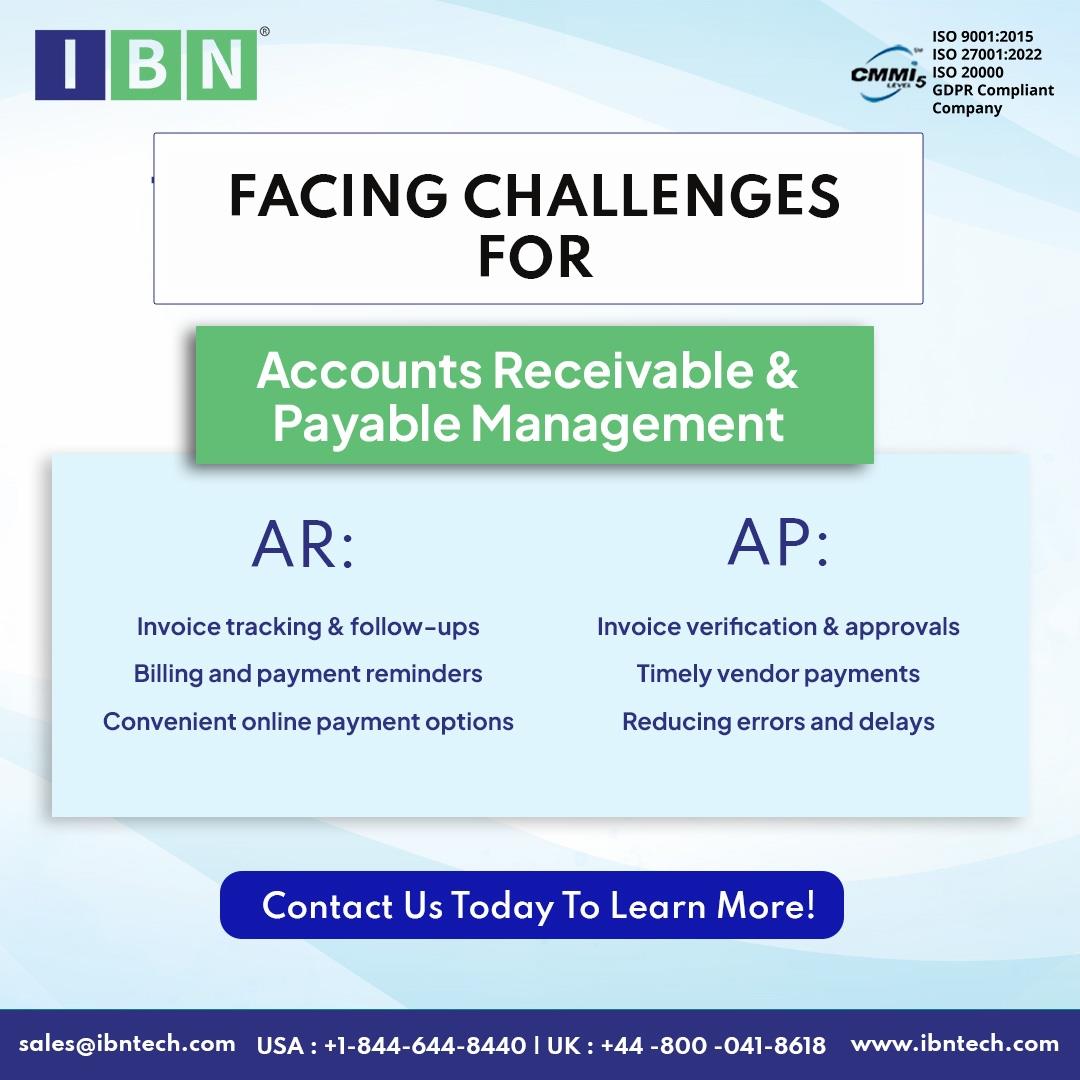

Industry Challenges in Accounts Payable Management

While demand for improved systems grows, several challenges continue to affect internal finance teams:

Delays caused by manual accounts payable procedures and document approvals.

High error rates in accounts payable processing leading to vendor disputes.

Limited visibility into invoice tracking and payment scheduling.

Compliance gaps that complicate audits and tax readiness.

Vendor dissatisfaction due to inconsistent settlement timelines.

IBN Technologies' Strategic Solutions

IBN Technologies has developed a structured suite of accounts payable services designed to address these pressing challenges. Acting as one of the trusted accounts payable outsource providers, the firm ensures that businesses gain access to streamlined, technology-enabled workflows supported by finance specialists.

Their services include invoice receipt management, three-way matching with purchase orders, real-time discrepancy resolution, and supplier contract alignment for payment scheduling. By using human oversight, IBN Technologies minimizes delays and improves accuracy in all stages of the accounts payable processing cycle.

This transparency supports both short-term operational improvements and long-term strategic planning. IBN Technologies also adapts to peak seasonal volumes for industries such as retail, ensuring consistent performance even when invoice loads surge dramatically.

By combining structured workflows, advanced reporting, and dedicated financial oversight, IBN Technologies continues to demonstrate why specialized accounts payable companies are indispensable partners for businesses seeking operational efficiency and financial resilience.

✅ Consistent invoice validations aligned with purchase order standards

✅ Clear oversight of daily accounts payable activity within all departments

✅ Issues identified and corrected before vendor escalation is needed

✅ Supplier conditions factored into payment scheduling automatically

✅ Financial records structured for audits and reporting accuracy

✅ High transaction volumes handled seamlessly during seasonal demand

✅ Continuous adherence to vendor-related tax submission obligations

✅ Location-level invoice tracking ensuring precise monthly accounts

✅ Real-time reconciliation tools enhancing internal financial visibility

✅ Specialized AP teams for retail managing complete documentation cycles

California Retailers Strengthen AP Performance

Retail companies in California are achieving higher accuracy and stronger supplier confidence by modernizing their financial processes. Collaborative models and outsourced accounts payable services have become essential, with providers such as IBN Technologies guiding the transition.

● Invoice cycle times reduced by 40%

● Manual checks replaced through layered review systems

● Supplier confidence strengthened by precise payment practices

IBN Technologies continues to assist California retailers through professional AP management. Businesses adopting outsourced accounts payable services are now gaining from structured payables oversight and a reliable framework for long-term financial stability.

Advantages of Outsourcing Accounts Payable

Organizations outsourcing accounts payable functions benefit in multiple ways:

Cost Control – Reduced overhead from in-house staffing and infrastructure.

Scalability – Ability to handle growing invoice volumes seamlessly.

Compliance Assurance – Systems aligned with tax regulations and audit requirements.

Vendor Satisfaction – Reliable and transparent payment cycles build stronger partnerships.

Strategic Focus – Finance leaders can focus on planning rather than manual tasks.

Partnering with experienced accounts payable outsource providers ensures that businesses can maintain growth without sacrificing financial accuracy.

Building the Future of Accounts Payable Excellence

The increasing adoption of accounts payable services reflects a shift in how businesses view financial operations. What was once considered a back-office necessity is now seen as a foundation for sustainable growth. Structured outsourcing solutions are enabling enterprises to standardize accounts payable procedures, reduce compliance risks, and ensure long-term vendor trust.

IBN Technologies has positioned itself as a strategic partner in this transformation, delivering measurable outcomes through precision, transparency, and scalability. Their expertise allows businesses in sectors such as retail, manufacturing, and distribution to replace fragmented manual workflows with well-coordinated systems that align with both regional and global compliance standards.

As companies prepare for continued economic shifts and increased competition, the importance of outsourced financial support will continue to rise. Businesses that adopt professional accounts payable services today will be better equipped to manage tomorrow's financial challenges.

Related Service:

Bookkeeping Services:

About IBN Technologies

IBN Technologies LLC, an outsourcing specialist with 26 years of experience, serves clients across the United States, United Kingdom, Middle East, and India. Renowned for its expertise in RPA, Intelligent process automation includes AP Automation services like P2P, Q2C, and Record-to-Report. IBN Technologies provides solutions compliant with ISO 9001:2015, 27001:2022. The company has established itself as a leading provider of IT, KPO, and BPO outsourcing services in finance and accounting, including CPAs, hedge funds, alternative investments, banking, travel, human resources, and retail industries. It offers customized solutions that drive AR efficiency and growth.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Microgrid Market Growth, Key Trends & Future Forecast 2033

- Nickel Market Estimated To Exceed USD 55.5 Billion By 2033

- Primexbt Launches Empowering Traders To Succeed Campaign, Leading A New Era Of Trading

- Chaingpt Pad Unveils Buzz System: Turning Social Hype Into Token Allocation

- Ecosync & Carboncore Launch Full Stages Refi Infrastructure Linking Carbon Credits With Web3

- Japan Halal Food Market Size To Surpass USD 323.6 Billion By 2033 With A CAGR Of 8.1%

Comments

No comment