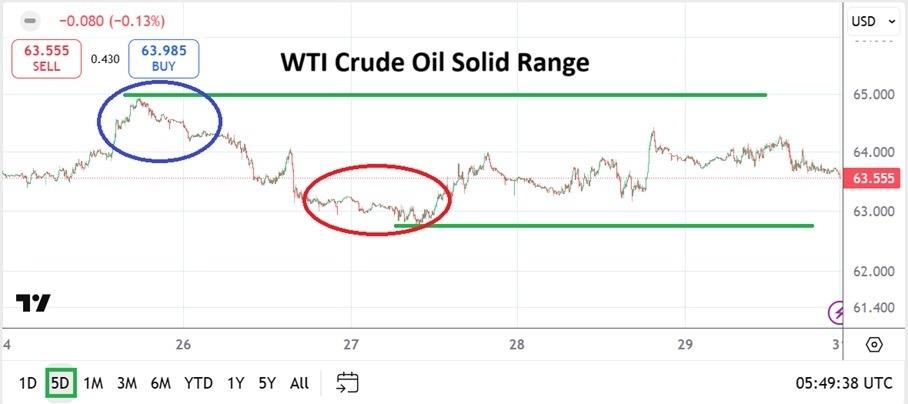

Crude Oil Weekly Forecast 31/08: Solid Prices (Chart)

(MENAFN- Daily Forex)

- As the Labor Day weekend approached WTI Crude Oil finished this past week of trading around the 63.555 mark. Typically seen as the last big driving weekend of the summer and sometimes playing into trading sentiment within the energy sector, WTI Crude Oil delivered a rather tranquil quiet air. Having seen a rather solid rise in value the week before, the past handful of days in the commodity turned out to be rather calm. WTI Crude Oil did find some stronger buying as last week began and a price of nearly 64.950 was attained on Monday, but after the week's high was created early selling started to be seen. A low for the week was touched this past Wednesday when WTI Crude Oil traded near the 62.770 ratio briefly. WTI Crude Oil did trade higher after that and hit 64.400 thereabouts on Thursday, but then the commodity began to traverse lower again.

- Lows from Tuesday until Thursday of last week saw a lot of trading below current levels. Perhaps conservative traders will want to wait on technical perceptions of resistance levels being tested while looking for lower values. Yes, the same can be said for those who believe that WTI Crude Oil is too low around the 63.000 level. But for the moment it feels unlikely that stronger sentiment in WTI Crude Oil going to create a massive burst higher. Meaning that moves higher that develop may be able to be wagered on speculatively with selling positions while looking for reversals lower.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Microgrid Market Growth, Key Trends & Future Forecast 2033

- Nickel Market Estimated To Exceed USD 55.5 Billion By 2033

- Primexbt Launches Empowering Traders To Succeed Campaign, Leading A New Era Of Trading

- Chaingpt Pad Unveils Buzz System: Turning Social Hype Into Token Allocation

- Ecosync & Carboncore Launch Full Stages Refi Infrastructure Linking Carbon Credits With Web3

- Japan Halal Food Market Size To Surpass USD 323.6 Billion By 2033 With A CAGR Of 8.1%

Comments

No comment