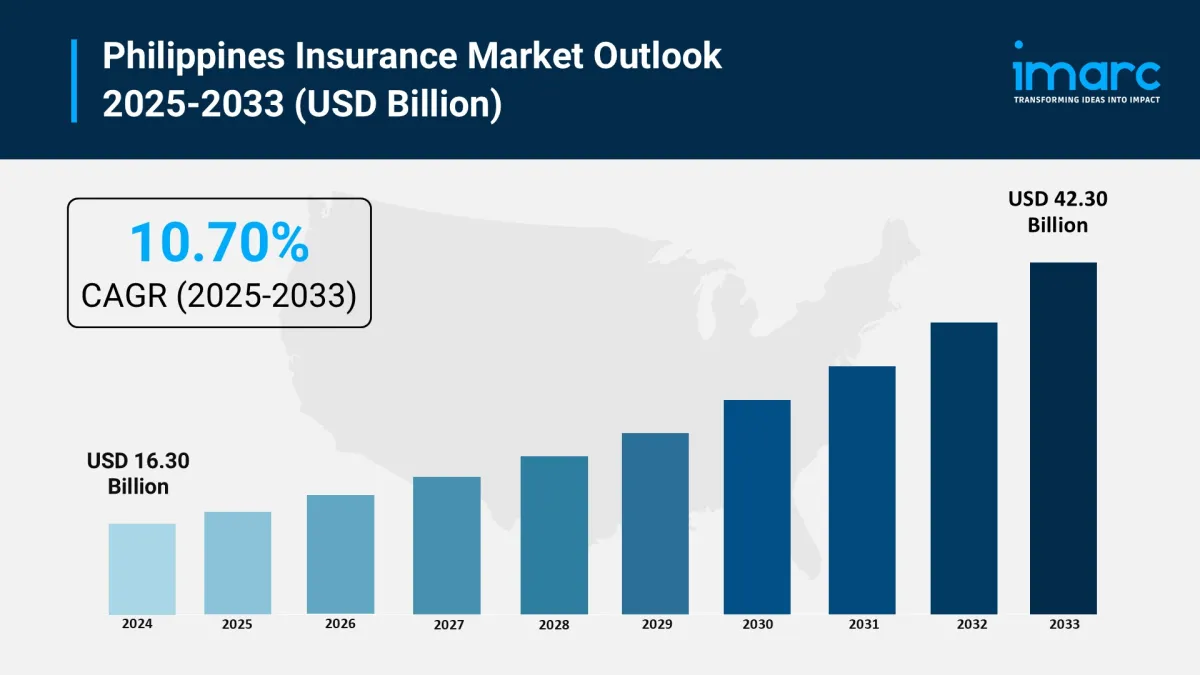

Philippines Insurance Market 2025 Worth USD 42.30 Billion By 2033 Exhibit A 10.70% CAGR

| Report Attribute | Key Statistics |

| Base Year | 2024 |

| Forecast Years | 2025-2033 |

| Historical Years | 2019-2024 |

| Market Size in 2024 | USD 16.30 Billion |

| Market Forecast in 2033 | USD 42.30 Billion |

| Market Growth Rate | 10.70% CAGR (2025-2033) |

Philippines Insurance Market Overview:

The Philippines insurance market is experiencing rapid growth, driven by strong economic development, rising disposable incomes, and modernization of financial services. Insurance providers are leveraging technology such as mobile platforms and AI to improve access and personalize offerings. Government regulations are fostering market expansion, while increasing financial literacy and awareness of health and life protection are motivating more Filipinos to secure insurance coverage. This leads to greater market penetration and improved service quality.

Request For Sample Report: https://www.imarcgroup.com/philippines-insurance-market/requestsample

Philippines Insurance Market Trends:

The market is evolving with digital transformation and insurtech innovations enhancing insurance accessibility and customer engagement. Partnerships between insurers and fintech or e-commerce platforms are expanding reach. The government is enforcing regulatory reforms to support microinsurance and digital onboarding. Additionally, ESG-aligned insurance products and growing interest in cyber and health coverage are shaping consumer demand.

Philippines Insurance Market Drivers:

The expanding middle class with rising disposable income is fueling demand, alongside increasing health awareness after the pandemic. Digital adoption and AI-driven personalized insurance solutions are improving customer experience. Government support and favorable regulatory environment are encouraging innovation and financial inclusion initiatives. Furthermore, bancassurance and financial literacy programs are boosting insurance penetration, particularly in underserved rural regions.

Market Challenges:

The market faces challenges including low insurance awareness and penetration in rural areas due to limited infrastructure and financial literacy. Affordability and perceived value gaps affect adoption among low-income segments. Frequent natural disasters complicate risk assessment and claims forecasting. Data limitations hinder accurate underwriting, especially among informal sectors. Additionally, operational costs and health inflation increase product pricing, challenging profitability.

Market Opportunities:

There are vast opportunities in expanding insurance coverage to MSMEs, informal workers, and rural populations through microinsurance and tailored products. Digital channels and mobile-first solutions provide convenient access. Climate and disaster risk insurance are growing due to the country's vulnerability to natural calamities. Youth and millennial engagement via tech-enabled offerings, along with public-private partnerships, provide avenues for market expansion and innovation.

Philippines Insurance Market Key Growth Drivers:

-

Strong economic growth and rising disposable incomes

Rapid digital transformation and AI adoption

Increasing health and life insurance awareness

Regulatory reforms fostering inclusive market growth

Expanding bancassurance and financial inclusion initiatives

Growth of climate and disaster risk insurance

Engagement of youth and tech-savvy consumers

Targeted microinsurance products for MSMEs and informal sector

Browse Full Report with TOC & List of Figures: https://www.imarcgroup.com/philippines-insurance-market

Philippines Insurance Market Segmentation:

By Type:

-

Life Insurance

Non-Life Insurance

By Region:

-

Luzon

Visayas

Mindanao

Competitive Landscape:

-

Sun Life Assurance

AIA Group

Pru Life UK

Allianz PNB Life Insurance

AXA Group

BDO Unibank

FWD Life Insurance

Insular Life Assurance

Manulife Philippines

Philippines Insurance Market News (2025):

-

May 2025: Insurance penetration increased to 1.89% in Q1 2025, showing growing market acceptance and outreach.

July 2025: Digital initiatives from Manulife Philippines advanced customer engagement through mobile platforms and AI, reflecting the push for tech-driven insurance services.

Key Highlights of the Report:

-

Market size reached USD 16.30 Billion in 2024

Forecast to grow to USD 42.30 Billion by 2033 at a CAGR of 10.70%

Strong economic and disposable income growth driving insurance demand

Increasing adoption of digital platforms and insurtech solutions

Government support through regulatory reforms and financial inclusion programs

Rising health and life insurance awareness post-pandemic

Growing focus on climate, disaster risk insurance, and youth market engagement

Note: If you require specific information not currently within the scope of the report, we can provide it as part of the customization.

Ask an analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=28745&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email:

Tel. No.: (D) +91 120 433 0800

Americas: +1 201-971-6302

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment