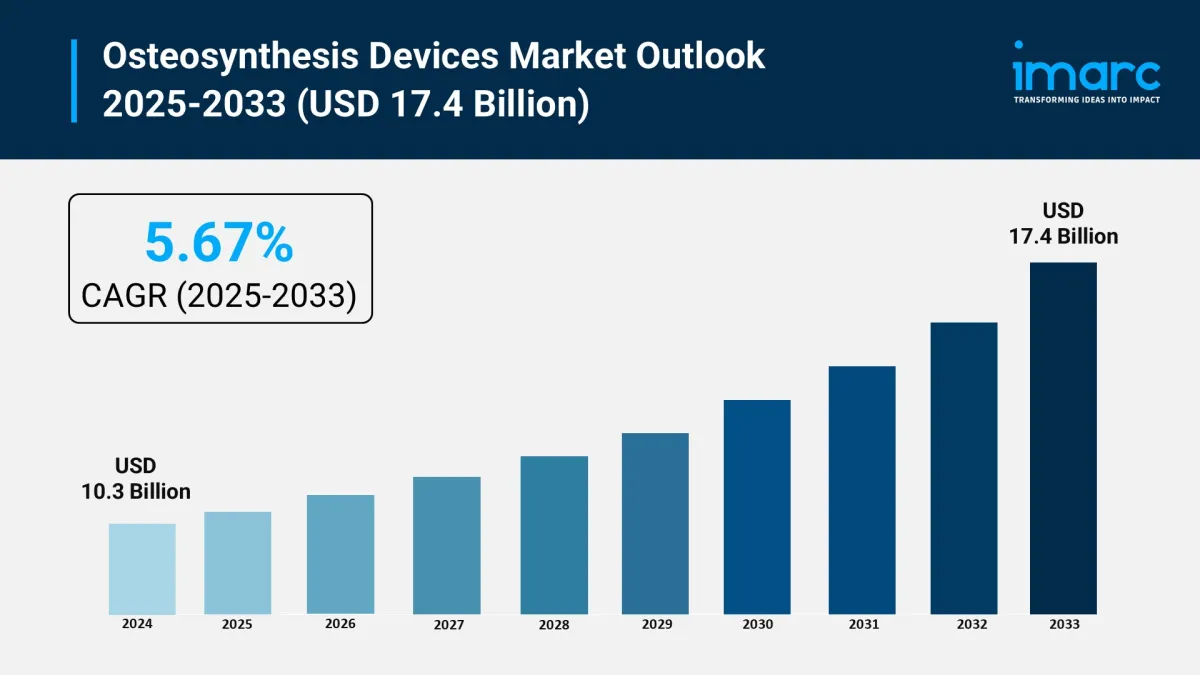

Osteosynthesis Devices Market Size To Hit USD 17.4 Billion In 2033 Grow CAGR By 5.67%

The osteosynthesis devices market is experiencing rapid growth, driven by rising prevalence of bone fractures and musculoskeletal disorders, technological advancements and minimally invasive surgeries, and government initiatives and healthcare infrastructure investment. According to IMARC Group's latest research publication, “Osteosynthesis Devices Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033”, the global osteosynthesis devices market size reached USD 10.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 17.4 Billion by 2033, exhibiting a growth rate (CAGR) of 5.67% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Receive Your“Osteosynthesis Devices Market” Sample PDF – Don't Miss Out!

Our report includes:

-

Market Dynamics

Market Trends And Market Outlook

Competitive Analysis

Industry Segmentation

Strategic Recommendations

Growth Factors in the Osteosynthesis Devices Market

-

Rising Prevalence of Bone Fractures and Musculoskeletal Disorders

One of the strongest drivers for the osteosynthesis devices market is the increasing incidence of bone fractures due to factors like osteoporosis, osteomalacia, sports injuries, and road accidents. For example, the International Osteoporosis Foundation survey reveals that 43% of women over 50 have reported bone fractures from minor falls. Additionally, sports injuries affect millions of children and teens worldwide, with over 3.5 million kids under 14 injured annually in the U.S. alone. The global rise in road accidents also contributes significantly, as accident victims often require osteosynthesis devices for bone repair and orthopedic recovery. This surge in fracture cases propels demand for advanced fixation devices, especially in regions with aging populations and active youth demographics, directly boosting market growth.

-

Technological Advancements and Minimally Invasive Surgeries

Advances in osteosynthesis technology significantly fuel market expansion. Innovations include the development of bio-resorbable implants that eliminate the need for removal surgeries, reducing patient morbidity and overall treatment costs. Minimally invasive surgical (MIS) techniques have also gained wide acceptance because they shorten recovery times and reduce hospital stays. Furthermore, the adoption of 3D printing for custom implants and smart implants with monitoring capabilities have started to shape the market. These technologies increase the effectiveness and appeal of osteosynthesis treatments, encouraging broader adoption by healthcare providers worldwide.

-

Government Initiatives and Healthcare Infrastructure Investment

Governments globally are actively supporting the medical devices industry, including osteosynthesis devices. For instance, India's government launched schemes like the Production Linked Incentive (PLI) to promote domestic manufacturing of medical devices. Investments in healthcare infrastructure in emerging economies like China, India, and Brazil improve access to osteosynthesis procedures. Developed regions such as North America benefit from sophisticated reimbursement systems and strong healthcare infrastructure, enabling faster adoption and innovation. These public and private initiatives contribute to increased availability and affordability of osteosynthesis devices, driving sustained market growth.

Key Trends in the Osteosynthesis Devices Market

-

Increasing Use of Bio-Resorbable and Smart Implants

The trend towards bio-resorbable fixation systems is gaining momentum because these implants degrade naturally in the body, avoiding the need for secondary removal surgeries. This development is a game changer for patient comfort and healthcare costs. Additionally, smart implants equipped with sensors to monitor healing progress and implant status in real-time are emerging. These implants allow doctors to track recovery remotely, improving postoperative care and outcomes. Companies are investing in R&D to bring such intelligent devices to market, reflecting a shift towards more personalized and tech-enabled orthopedic care.

-

Shift to Less Invasive Surgical Procedures

Minimally invasive osteosynthesis operations are becoming more popular due to their benefits like reduced trauma to tissues, less blood loss, minimized scars, and quicker patient recovery. This trend is partly driven by rising patient preference for faster return to normal life and economic pressures to reduce hospital stays and costs. Training programs, such as the University of Minnesota's Orthopedic Bootcamp, are also equipping future surgeons with cutting-edge MIS skills, cementing this trend's impact on the industry. Manufacturers are responding by designing implants and instruments optimized for these approaches.

-

Expansion of Customized Osteosynthesis Solutions

The use of technologies like 3D printing and advanced imaging is allowing manufacturers to create patient-specific, anatomically precise osteosynthesis implants. Customized devices better fit individual bone structures, enhance surgical outcomes, and reduce complications. This tailored approach is particularly beneficial for complex fracture cases and patients with unique anatomical challenges. The growth of personalized medicine, coupled with investments in manufacturing innovations, is pushing this trend forward, with more healthcare providers adopting customized osteosynthesis solutions as standard care.

Ask analyst of customized report: https://www.imarcgroup.com/request?type=report&id=6836&flag=E

Leading Companies Operating in the Global Osteosynthesis Devices Industry :

-

Arthrex Inc.

B. Braun Melsungen AG

Globus Medical Inc.

GS Medical USA

Johnson & Johnson

Life Spine Inc.

MicroPort Scientific Corporation

Neosteo SAS

Precision Spine Inc.

Smith & Nephew plc

Stryker Corporation

Zimmer Biomet

Osteosynthesis Devices Market Report Segmentation:

By Type:

-

Internal

-

Screw and Plates

Wires and Pins

Intramedullary Rods and Nails

Spinal Fixation Devices

-

Fracture Fixation

Bone Lengthening

Internal comprises screws and plates, wires and pins, intramedullary rods and nails, and spinal fixation devices, with internal devices representing the largest segment.

By Material:

-

Non-Degradable

Degradable

Non-Degradable includes both non-degradable and degradable materials, with non-degradable devices accounting for the largest market share.

By Fracture Type:

-

Patella, Tibia or Fibula or Ankle

Clavicle, Scapula or Humerus

Radius or Ulna

Hand, Wrist

Vertebral Column

Pelvis

Hip

Femur

Foot Bones

Others

Patella, Tibia or Fibula or Ankle covers various fracture types such as clavicle, scapula or humerus, radius or ulna, hand, wrist, vertebral column, pelvis, hip, femur, foot bones, and others, with patella, tibia or fibula or ankle being the largest segment.

By End User:

-

Hospitals

Orthopedic Specialist Clinics

Others

Hospitals encompasses hospitals, orthopedic specialist clinics, and others, with hospitals holding the largest market share.

Regional Insights:

-

North America (United States, Canada)

Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

Latin America (Brazil, Mexico, Others)

Middle East and Africa

North America represents the largest market for osteosynthesis devices, driven by factors like increasing road accidents, rising bone fracture incidences, and a growing geriatric population.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales[@]imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Wallpaper Market Size, Industry Overview, Latest Insights And Forecast 2025-2033

- GCL Subsidiary, 2Game Digital, Partners With Kucoin Pay To Accept Secure Crypto Payments In Real Time

- North America Perms And Relaxants Market Size, Share And Growth Report 2025-2033

- Chaingpt Pad Unveils Buzz System: Turning Social Hype Into Token Allocation

- Invromining Expands Multi-Asset Mining Platform, Launches New AI-Driven Infrastructure

- Global Mobile Wallet Market Size Projected To Reach USD 701.0 Billion By 2033 CAGR Of 15.09%.

Comments

No comment