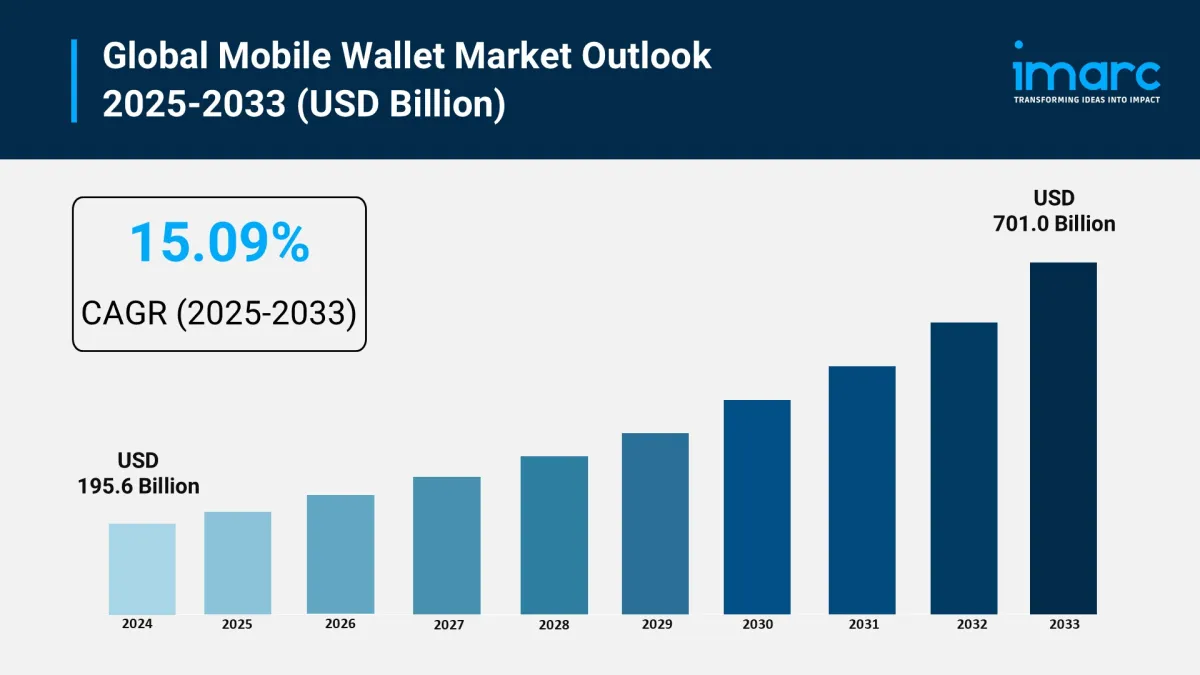

Global Mobile Wallet Market Size Projected To Reach USD 701.0 Billion By 2033 CAGR Of 15.09%.

The global mobile wallet market was valued at USD 195.6 Billion in 2024 and is projected to reach USD 701.0 Billion by 2033 , registering a CAGR of 15.09% during 2025–2033 , according to IMARC Group. The market growth is being driven by the rising penetration of smartphones, the expansion of e-commerce, and the increasing demand for secure, convenient, and contactless payment solutions. Mobile wallets are rapidly becoming an essential part of digital financial ecosystems, enabling seamless transactions and promoting financial inclusion across both developed and emerging economies.

Request Free Sample Report: https://www.imarcgroup.com/mobile-wallet-market/requestsample

Key Stats

-

Market Value (2024): USD 195.6 Billion

Projected Value (2033): USD 701.0 Billion

CAGR (2025–2033): 15.09%

Leading Segment (2025): Proximity mobile wallets expected to lead due to widespread NFC adoption

Key Regions: North America (largest), Asia Pacific (fastest-growing)

Top Companies: Alipay (Alibaba Group), Apple Inc., Google LLC (Alphabet Inc.), Amazon Web Services, PayPal Holdings, Samsung Electronics, Mastercard, Visa, American Express, Square.

Growth Drivers

Several key factors are propelling the mobile wallet market:

-

Smartphone Penetration & E-Commerce Growth: With smartphones now ubiquitous, consumers are increasingly relying on mobile wallets for online and offline payments, streamlining transactions without the need for physical cards.

Financial Inclusion: Mobile wallets provide affordable financial services to unbanked and underbanked populations, enabling payments, fund transfers, and access to microloans.

Technological Advancements: Near-field communication (NFC), biometric authentication, and AI-driven fraud detection are enhancing convenience, security, and trust in mobile wallets.

Contactless Payments: Rising health and hygiene awareness post-COVID-19 is accelerating the adoption of touchless transactions globally.

Contact Out Analysts for Brochure Requests, Customization, and Inquiries Before Purchase: https://www.imarcgroup.com/request?type=report&id=3885&flag=C

AI and Technology Impact

Advanced technologies are transforming the mobile wallet landscape:

-

Artificial Intelligence (AI): AI enables personalized recommendations, predictive spending insights, and real-time fraud detection, improving user experience and operational efficiency.

Biometric Authentication: Fingerprint, facial recognition, and other biometric methods add an extra layer of security, fostering consumer confidence.

NFC & Contactless Payments: NFC technology supports seamless tap-to-pay transactions, accelerating adoption across retail, transportation, and hospitality sectors.

Machine Learning & Analytics: Predictive analytics optimize transaction processing, customer engagement, and targeted promotional campaigns, enhancing business intelligence.

Segmental Analysis

By Type:

-

Proximity Mobile Wallets: Leading the market due to NFC-enabled payments and in-store usage.

Remote Mobile Wallets: Gaining traction for online payments, peer-to-peer transfers, and bill settlements.

By Application:

-

Retail: Major contributor, driven by online and in-store purchases.

Hospitality & Transportation: Facilitates seamless ticketing, bookings, and payments.

Telecommunication: Used for prepaid recharge, bill payments, and service subscriptions.

Healthcare: Supports digital payments for services, consultations, and medicine purchases.

Others: Includes education, government services, and utility bill payments.

Regional Insights

North America:

The largest market due to high smartphone penetration, mature financial infrastructure, and early adoption of digital payments.

Asia Pacific:

Projected to be the fastest-growing region, led by China, India, and Southeast Asia, driven by rising e-commerce, government initiatives for digital payments, and financial inclusion programs.

Europe:

Growth supported by technological adoption, strong regulatory frameworks, and integration with contactless payments.

Latin America:

Increasing smartphone adoption and expanding e-commerce platforms are fueling mobile wallet usage in Brazil and Mexico.

Middle East & Africa:

Adoption is accelerating due to fintech innovations, government-backed digital payment initiatives, and growing demand for secure, mobile-based financial services.

Market Dynamics

Drivers:

-

Rising digital adoption and smartphone penetration

Growth of e-commerce and contactless payment demand

Financial inclusion and unbanked population coverage

Restraints:

-

Security and privacy concerns

Dependence on internet connectivity and digital literacy

Key Trends:

-

Integration of mobile wallets with loyalty programs and rewards

Adoption of AI-driven fraud detection and personalized services

Expansion of QR-code and NFC-based payment systems

Leading Companies

Alipay (Alibaba Group): Leading provider of mobile wallet solutions with integrated financial services in Asia. Apple Inc.: Apple Pay enables secure NFC-based payments and in-app transactions. Google LLC (Alphabet Inc.): Google Wallet and Google Pay offer seamless payment solutions and peer-to-peer transfers. Amazon Web Services: Supports payment infrastructure and digital wallets for online marketplaces. PayPal Holdings: Global leader in digital payments, supporting cross-border transactions and e-commerce. Samsung Electronics: Samsung Pay integrates mobile wallets with NFC and MST technologies. Mastercard Incorporated: Provides payment processing and mobile wallet solutions worldwide. Visa Inc.: Offers mobile payment services integrated with banking and retail platforms. American Express Company: Focuses on mobile transactions and rewards-based payment systems. Square (Block, Inc.): Enables mobile point-of-sale and peer-to-peer payments for businesses and consumers.Recent Developments

-

2024: Alipay launched AI-driven personalized financial recommendations for mobile wallet users.

2024: Apple Pay expanded support for transit systems in major U.S. cities.

2023: Google Wallet integrated loyalty programs and crypto payment options.

2023: PayPal introduced QR-code-based payments in emerging markets to increase accessibility.

2023: Samsung Pay rolled out biometric authentication features to enhance security.

2023: Mastercard partnered with fintech startups to expand digital wallet adoption in Asia Pacific.

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email:

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- UK Cosmetics And Personal Care Market To Reach USD 23.2 Billion By 2033

- Global Mobile Wallet Market Size Projected To Reach USD 701.0 Billion By 2033 CAGR Of 15.09%.

- $MBG Token Supply Reduced By 4.86M In First Buyback And Burn By Multibank Group

- From Zero To Crypto Hero In 25 Minutes: Changelly Introduces A Free Gamified Crash Course

- Japan Halal Food Market Size To Surpass USD 323.6 Billion By 2033 With A CAGR Of 8.1%

- Pluscapital Advisor Empowers Traders To Master Global Markets Around The Clock

Comments

No comment