India Saree Market 2025: Size, Share, Growth, Latest Trends, Industry Statistics And Forecast Report By 2033

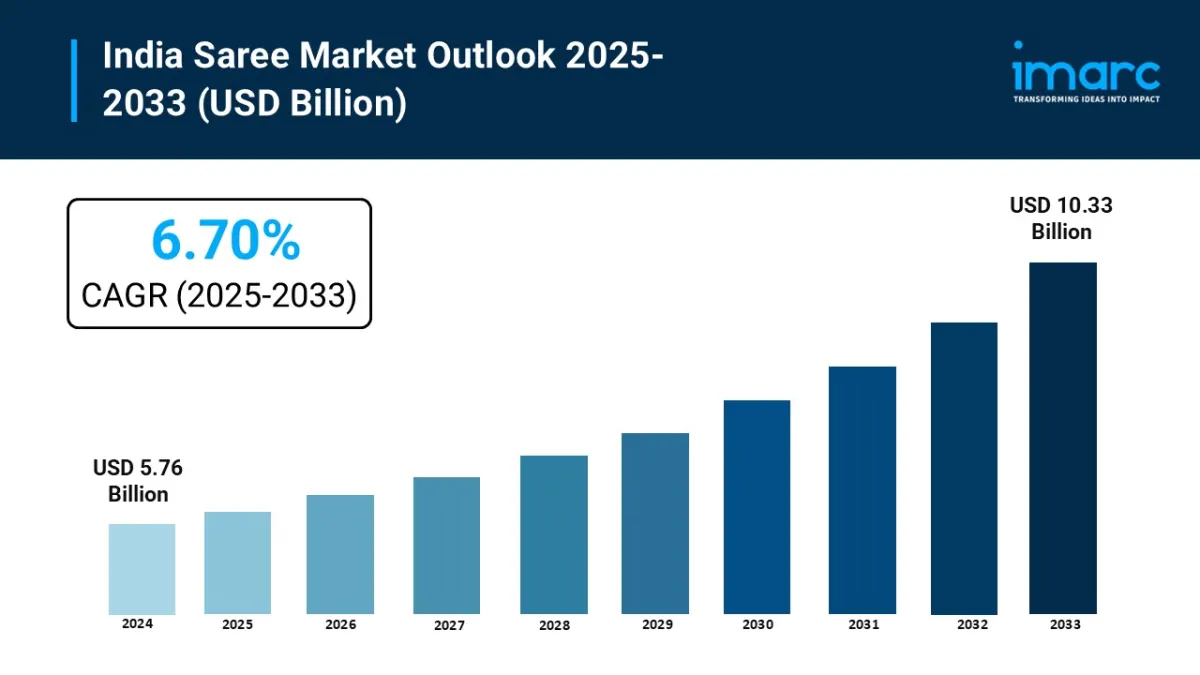

In 2024, the India saree market was valued at approximately USD 5.76 billion , and it is forecasted to reach USD 10.33 billion by 2033 , reflecting a steady CAGR of 6.70% between 2025 and 2033. Key growth drivers include rising demand for sustainable handloom sarees, bolstered by government initiatives like Geographical Indication (GI) tags and the Handloom Mark, rapid digital transformation via AI-powered customization and virtual try-ons, strong appeal among younger demographics through celebrity endorsements and eco-conscious branding, and increased accessibility through e-commerce platforms.

Key Highlights-

Market Size (2024): USD 5.76 billion

Forecast (2033): USD 10.33 billion

CAGR (2025–2033): 6.70%

Major Growth Contributors:

-

Surge in consumer preference for sustainable and authentic handwoven sarees (e.g., Banarasi, Kanjeevaram, Chanderi)

Expansion of AI-enabled e-commerce features like virtual try-ons and personalized recommendations

Strong youth engagement via social media influencers and eco-friendly messaging

Get instant access to a free sample copy and explore in-depth analysis: https://www.imarcgroup.com/india-saree-market/requestsample

How Is AI Transforming the Saree Market in India?-

AI-Powered Design Innovation: AI tools assist in generating fresh patterns and fusion styles that blend traditional motifs with current trends.

Personalization & Virtual Try-On: Online platforms use AI to offer virtual draping and style suggestions, improving consumer confidence in fit and aesthetics.

Smart Demand Forecasting: Retailers leverage AI analytics to predict regional and seasonal demand, optimizing inventory levels and reducing wastage.

Sustainability Monitoring: AI-driven satellite and analytical methods are enhancing the integrity of organic cotton sourcing-boosting trust and supply in sustainable saree manufacturing.

-

National Initiatives: Programs like the Handloom Mark, GI tags, National Handloom Development Programme, and support via NHDP and RMSS enhance authenticity and weaver livelihoods.

E-commerce & Digital Expansion: Growth of organized e-commerce platforms and social commerce (Flipkart, Amazon, ONDC) is democratizing access to regional saree styles.

Premiumization and Fusion Trends: A rise in demand for designer sarees, fusion drapes, and ready-to-wear styles is reshaping the product mix.

Sustainable & Ethical Demand: Buyers increasingly favor sarees made from eco-friendly fabrics, organic dyes, and ethically sourced materials.

Urban and Tier-II Market Growth: Organized retail and digital penetration are expanding into Tier-II and Tier-III cities, tapping deeper into culturally inspired demand.

Type of Saree Insights:

-

Cotton Sarees

Silk Sarees

Synthetic Sarees

Linen Sarees

Chiffon Sarees

Georgette Sarees

Designer Sarees

Handloom Sarees

Others

Price Range Insights:

-

Economy Sarees

Mid-Range Sarees

Premium/Luxury Sarees

By Distribution Channel:

-

Offline Retail (traditional stores, saree chains)

Online/E-commerce (Web platforms, social commerce, virtual stores)

Regional Insights:

-

North India

South India

East India

West India

Discuss Your Needs with Our Analyst – Inquire or Customize Now: https://www.imarcgroup.com/request?type=report&id=35333&flag=C

Latest Developments in the Industry-

Corporate Expansion & IPOs: Structured retail chains and ethnic brands (e.g., Avantra, Taneira) are scaling rapidly. Sai Silks Kalamandir has filed a DRHP to raise ₹1,200 crore.

Organized E-commerce Growth: Platforms like ONDC are enabling rural artisans to reach national and international buyers, aligning with“Make in India” and digital inclusion goals.

Sustainable Sourcing Initiatives: AI-backed satellite monitoring projects are improving organic cotton certification and supply chains-supporting India's green fashion ambitions.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment