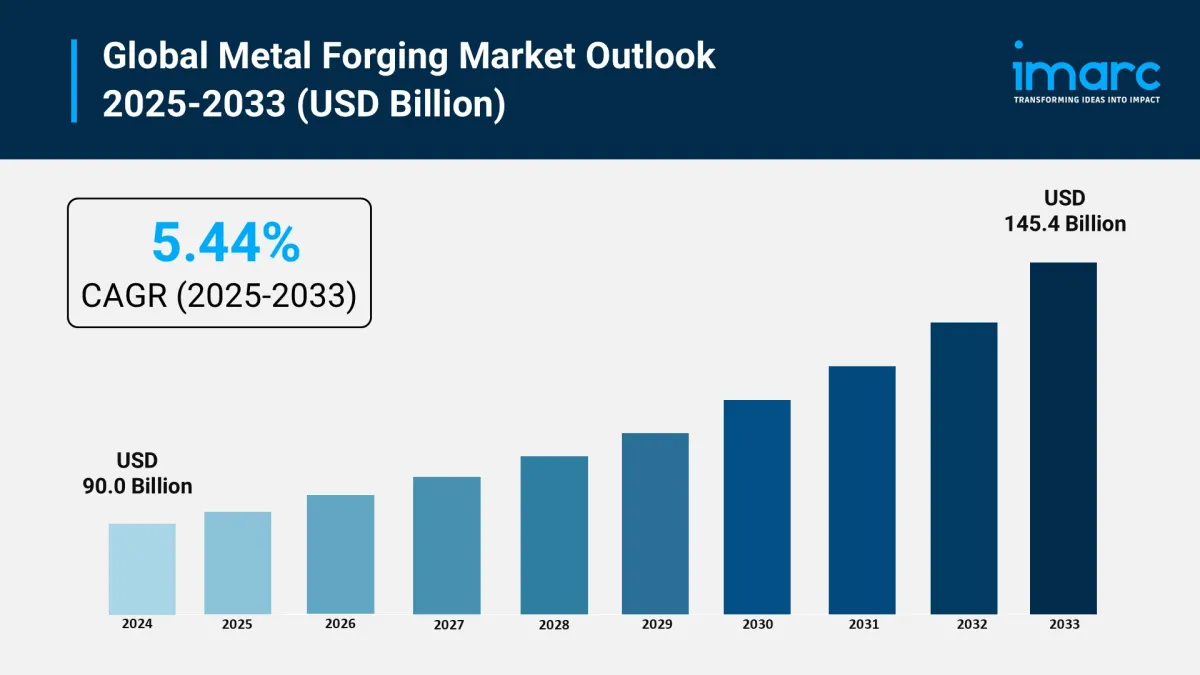

Global Metal Forging Market Size Projected To Reach USD 145.4 Billion By 2033 CAGR Of 5.44%.

The global metal forging market reached USD 90.0 Billion in 2024 and is projected to grow to USD 145.4 Billion by 2033 , at a CAGR of 5.44% during 2025–2033 , according to IMARC Group. This growth is driven by the rising adoption of forged components across automotive, aerospace, oil and gas, construction, and agriculture industries. Demand is fueled by the exceptional strength, durability, and wear resistance of forged parts, which are essential for high-stress applications. Advancements in precision forging, closed-die techniques, and the use of lightweight alloys such as titanium and aluminum are further enhancing efficiency and product performance, supporting the market's steady expansion worldwide.

Request Free Sample Report: https://www.imarcgroup.com/metal-forging-market/requestsample

Key Stats

-

Market Value (2024): USD 90.0 Billion

Projected Value (2033): USD 145.4 Billion

CAGR (2025–2033): 5.44%

Leading Segment (2025): Automotive

Dominant Raw Material: Carbon Steel

Key Regions: North America (largest), Asia Pacific (fastest-growing)

Major Companies: Arconic Corp., Bharat Forge Ltd., Nippon Steel Corp., Thyssenkrupp AG, Precision Castparts Corp., ATI

Growth Drivers

Expanding Industrial Applications: Widespread use of forged parts in industries requiring high structural integrity, including automotive, aerospace, and heavy machinery manufacturing. Automotive Innovation: Electric and hybrid vehicles increasingly use lightweight forged components to improve efficiency and performance. Aerospace Demand: Precision forging enables production of high-strength components capable of withstanding extreme conditions. Infrastructure Development: Large-scale construction projects in emerging economies drive demand for forged steel and alloy products. Advanced Manufacturing Techniques: Closed-die forging, near-net shaping, and high-precision processes improve product consistency while minimizing material waste.Contact Out Analysts for Brochure Requests, Customization, and Inquiries Before Purchase: https://www.imarcgroup.com/request?type=report&id=3478&flag=C

AI and Technology Impact

The integration of automation, robotics, and AI is transforming metal forging operations:

-

AI-Powered Simulation: Predicts stress distribution, material flow, and defect prevention during the forging process.

Digital Twin Technology: Enables real-time monitoring, performance testing, and predictive maintenance of forging equipment.

Computer-Aided Manufacturing (CAM): Optimizes tooling and die design for faster production cycles.

Real-Time Process Control: Modern forging presses and hammers use sensors for precision and reduced material loss.

Lightweight Alloys: Advancements in metallurgy facilitate production of high-performance titanium and aluminum components for aerospace and EV sectors.

Segmental Analysis

By Raw Material:

-

Carbon Steel (largest share) – Favored for its strength and cost-effectiveness.

Alloy Steel

Aluminum – Growing demand in automotive and aerospace.

Magnesium

Stainless Steel

Titanium – High growth in aerospace and defense.

Others

By Application:

-

Automotive (dominant segment) – High-volume demand for engine, transmission, and chassis components.

Aerospace – Precision parts for aircraft structures and engines.

Oil and Gas – Forged parts for drilling, refining, and pipeline systems.

Construction – Structural supports and heavy machinery components.

Agriculture – Equipment and machinery parts.

Others

Regional Insights

-

North America: Largest market, supported by strong aerospace and automotive industries.

Asia Pacific: Fastest-growing region, with China, India, and Japan leading in manufacturing and infrastructure expansion.

Europe: Strong focus on lightweight alloys and sustainability in forging processes.

Latin America: Growth driven by oil and gas projects and agricultural machinery demand.

Middle East & Africa: Infrastructure and energy sector developments driving demand for forged products.

Market Dynamics

Drivers:

-

Increasing demand for high-performance, durable components.

Technological innovations in forging processes.

Expanding EV and aerospace industries.

Restraints:

-

High capital investment for advanced forging machinery.

Skilled labor shortages in some regions.

Key Trends:

-

Adoption of Industry 4.0 for smart manufacturing.

Increased recycling and sustainable forging practices.

Development of eco-friendly furnaces and heating systems.

Leading Companies

Arconic Corp. – Specializes in aerospace-grade forged components. ATI – Offers advanced alloy forging solutions for multiple industries. Bharat Forge Ltd. – A global leader in automotive and industrial forging. Bruck GmbH – Known for precision forging in energy and industrial applications. China First Heavy Industries – Major producer for heavy equipment and infrastructure. Ellwood Group Inc. – Offers high-quality open-die forging solutions. Jiangyin Hengrun Heavy Industries Co. Ltd. – Supplies forged products to global OEMs. Nippon Steel Corp. – Integrates advanced metallurgy with forging expertise. Precision Castparts Corp. (Berkshire Hathaway) – Leading aerospace and defense forging supplier. Kovárna Viva – Specializes in industrial and transport equipment forging. Larsen & Toubro Limited – Strong presence in oil, gas, and infrastructure sectors. Scot Forge – Employee-owned forging company serving multiple sectors. Thyssenkrupp AG – Offers innovative forging solutions with global reach.Recent Developments

-

2024: Bharat Forge expanded production capacity for EV components.

2024: ATI developed new titanium alloys for aerospace applications.

2023: Nippon Steel introduced low-carbon steel forging technologies.

2023: Thyssenkrupp partnered with Siemens for AI-driven forging process optimization.

2023: Arconic launched a new high-strength aluminum forging line for aerospace.

2023: Precision Castparts Corp. expanded its defense-sector forging operations in the U.S.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment