Indonesia Steel Market 2025: Size, Share, Industry Outlook, Trends Analysis And Forecast Report By 2033

-

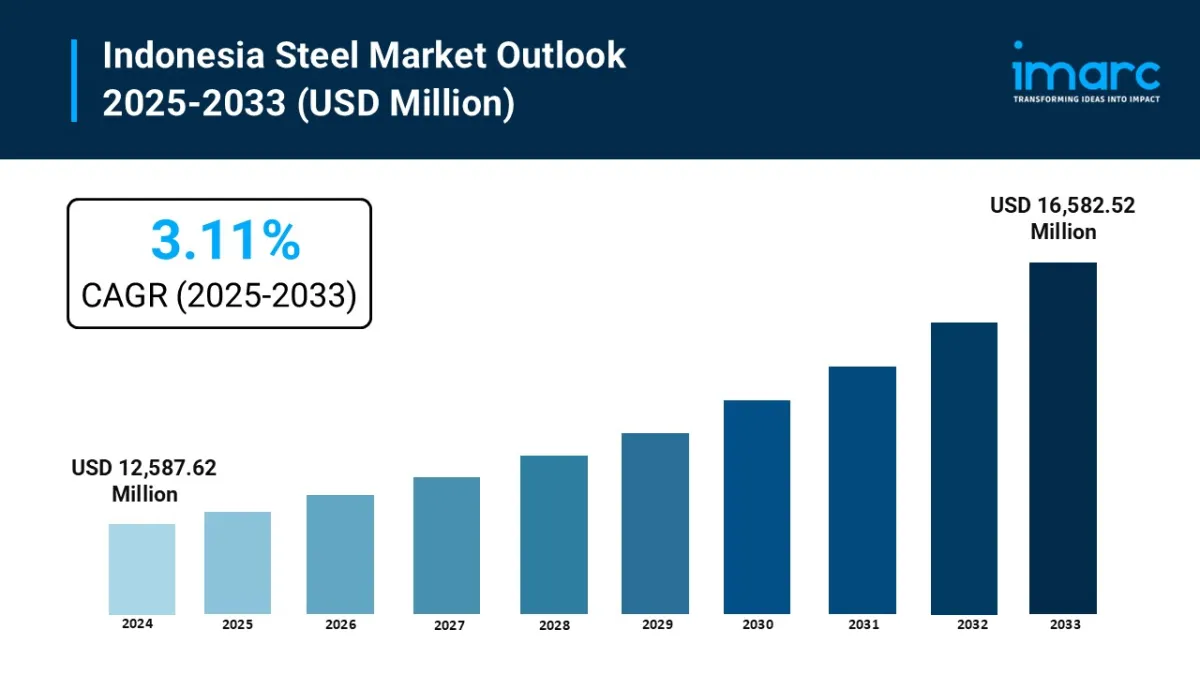

Market size (2024): USD 12,587.62 million .

Forecast (2033): USD 16,582.52 million .

CAGR (2025–2033): 3.11% .

Major growth contributors / industry activities:

-

Large-scale infrastructure & national strategic projects (Nusantara and other National Strategic Projects) driving long- and flat-steel consumption.

Rising automotive manufacturing and EV incentives raising demand for higher-grade flat products.

Government measures (import controls, local content rules, incentives) supporting domestic capacity expansion and import substitution.

Get instant access to a free sample copy and explore in-depth analysis: https://www.imarcgroup.com/indonesia-steel-market/requestsample

How Is AI Transforming the steel market in Indonesia?-

Predictive maintenance: AI models ingest sensor / vibration / temperature data to predict equipment failures and schedule maintenance, reducing unplanned downtime and spare-part lead risk.

Process optimisation & quality control: Machine-learning systems monitor casting/rolling parameters in real time to reduce defects and improve yield (finer control on cooling rates, chemistry, speed).

Energy & emission efficiency: AI-driven optimisation reduces energy consumption and carbon intensity through smarter process set points and waste-minimisation routines-supporting decarbonisation targets.

Supply-chain and production planning: AI improves demand forecasting and inventory optimisation (raw materials like nickel/iron concentrates), which is important where upstream mineral policy and price-control initiatives affect supply.

-

National infrastructure programmes & new capital build (Nusantara): Heavy, sustained demand for structural and long steel for bridges, roads, ports and high-rise buildings.

Government policy & import substitution: Anti-dumping, local content and investment incentives aimed at strengthening domestic production and reducing import dependence.

Automotive & EV manufacturing push: Incentives to grow vehicle assembly and EV supply chains increase demand for flat/high-strength steels and specialty grades.

Technology-driven modernisation: Industry 4.0 deployments (automation, digital twin, AI/ML) in mills to raise OEE and lower unit costs.

Sustainability & energy transition impacts: Moves to improve energy efficiency, recycling and low-emission steelmaking (driven by national climate commitments and global buyer expectations).

Retrofit & capacity modernisation: Re-rolling mills, finishing lines and upstream integration (smelters/NPI for stainless supply) to capture value and stabilise raw material availability.

Type Insights:

-

Flat Steel

Long Steel

Product Insights:

-

Structural Steel

Prestressing Steel

Bright Steel

Welding Wire and Rod

Iron Steel Wire

Ropes

Braids

Application Insights:

-

Building and Construction

Electrical Appliances

Metal Products

Automotive

Transportation

Mechanical Equipment

Domestic Appliances

Regional Insights:

-

Java

Sumatra

Kalimantan

Sulawesi

Others

Discuss Your Needs with Our Analyst – Inquire or Customize Now: https://www.imarcgroup.com/request?type=report&id=38095&flag=C

Latest Developments in the Industry-

Jindal Stainless commissioned an NPI smelter (Aug 2024) - Jindal Stainless brought an NPI smelter online in Halmahera (joint-venture/49% equity noted), securing nickel supply for stainless production and reducing exposure to volatile feedstock markets. This aligns with Indonesia's strategy of capturing more value domestically in the stainless / battery metals chain.

Plans to establish a domestic metal exchange for nickel trading (announced Aug 2024) - Industry groups and policymakers signalled plans for a metal exchange (nickel focus) to strengthen domestic price formation and support the broader downstream stainless & battery industries. This supports national efforts to move up the value chain and stabilise critical raw-material pricing.

SIMBARA tracking system expanded to nickel and tin (Jul–Aug 2024) - Government expanded an online mineral-tracking system (SIMBARA) to monitor movement of nickel and tin from mine to processing plant to improve transparency, curb illegal mining, and support domestic processing targets-measures that feed into secure steel/stainless raw material supply and sustainable resource governance.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment