Brazil Legal Services Market Key Segments, Challenges & Opportunities

Key Highlights:

-

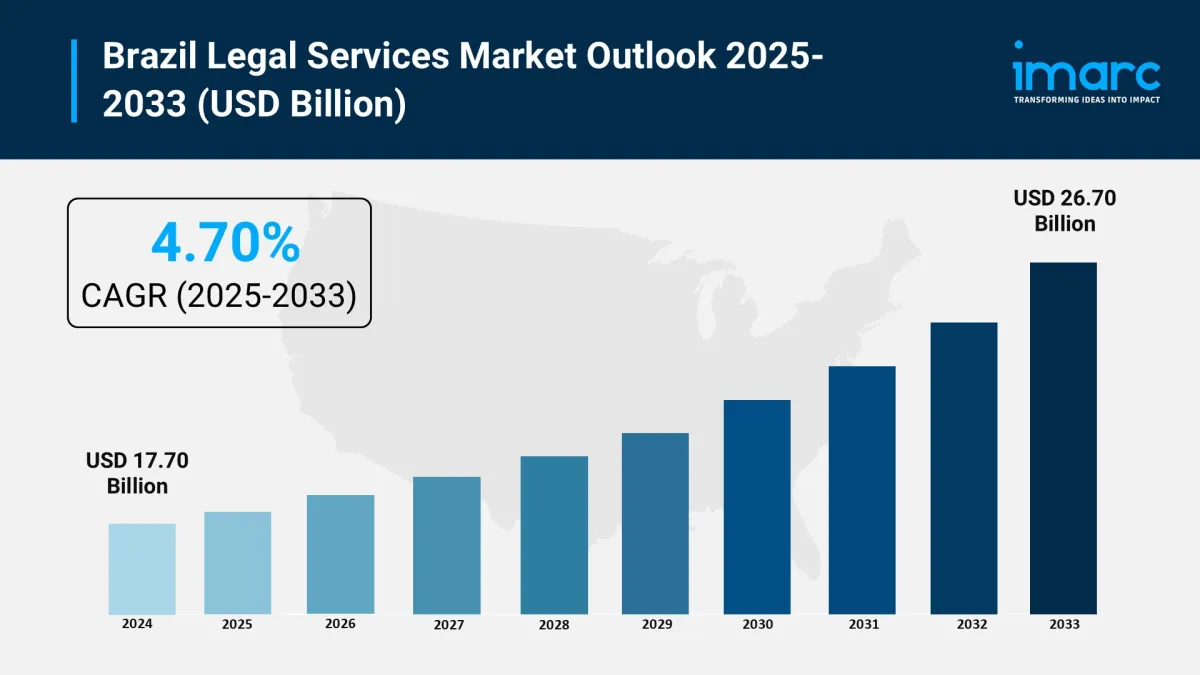

Market Size (2024): USD 17.70 billion

Market Forecast (2033): USD 26.70 billion

Market Growth Rate (2025-2033): 4.70%

Brazil has the highest lawyer density in the world, with one lawyer for every 164 people. This shows a competitive and diverse legal scene.

Economic Influence: Brazil has a GDP of USD 1.92 trillion. It also sees strong FDI inflows. These factors boost demand for legal services in M&A, finance, and capital markets.

Key Legal Hubs: São Paulo and Rio de Janeiro are the leaders. Fortaleza and Campinas are growing as regional markets for specialized services.

Digital Transformation: AI and legal tech tools like LawSauce boost efficiency in case management and client services. Also, Latin America's legal tech market is expected to hit USD 1,584.1 million by 2030.

Regulatory Complexity: Tax and regulatory systems can be very complicated. High tariffs create challenges for foreign firms trying to enter the market.

Specialized Practice Areas: Many people need skills in areas like dispute resolution, intellectual property, labor law, and environmental law. Boutiques like Dannemann Siemsen are doing well in these areas.

Foreign Investment Opportunities: President Lula's policy changes aim to strengthen multilateral ties. This is likely to increase foreign investment and the demand for legal advice.

AI is changing Brazil legal services market . It makes processes faster and boosts efficiency. Also, it helps tackle the problems of a system with over 82 million pending cases. Brazil's legal sector is part of the global market, expected to hit USD 1,362.8 billion by 2030. This growth will occur at a 4.5% CAGR.

Law firms in Brazil use AI for:

-

Document automation

Legal research

Predictive analytics

This helps cut costs and saves time for both firms and clients. WideLabs' Justice Intelligence platform uses natural language processing. It speeds up case analysis and helps millions access justice records. This impact is evident in Rio Grande do Sul. Legaltech startups have grown by 300% in just two years. AI use is rising fast. However, there are challenges. Regulatory gaps exist, like those under Brazil's General Data Protection Law (LGPD). Ethical issues, such as algorithmic bias, also need attention. Bill 2338/2023 guides responsible AI use. It promotes transparency and accountability. This helps create a more efficient legal system.

Key Highlights of AI Transformation-

Document Automation: AI tools, such as aDoc, simplify contract drafting and management. They cut down on manual tasks and increase productivity for legal teams.

Legal Research Efficiency: Generative AI, such as Tikal Tech's Eli, rapidly finds case law and precedents. This saves hours for over 1 million lawyers in Brazil.

AI platforms analyze large datasets to predict case outcomes. This helps in making strategic decisions in a market with 82 million pending cases.

Access to Justice: WideLabs' AI tools improve public access to legal records. This helps more than 8 million people in Rio Grande do Sul.

Compliance and Risk Management: AI helps follow LGPD and new AI rules. It needs algorithmic impact assessments for high-risk systems.

Legaltech Growth: The Brazilian Association of Lawtechs (AB2L) says legaltech startups grew by 300%. This surge is pushing innovation in a complex judicial system.

Ethical Challenges: We must have clear rules to tackle bias in algorithms and safeguard data privacy. This helps keep trust in AI legal services.

Brazil's proposed AI Act (Bill 2338/2023) requires transparency and risk assessments. This will shape how AI is used ethically in legal services.

The Brazil legal services market is booming. This growth comes from economic expansion, complex regulations, and more digitalization. Brazil, Latin America's largest economy, had a GDP of USD 1.92 trillion in 2022. It has a lively legal sector. There's one lawyer for every 164 people, which is the highest in the world. The global legal services market is expected to hit USD 1,362.8 billion by 2030. It will grow at a rate of 4.5% each year. This growth comes from the need for corporate law, compliance, and dispute resolution. In 2023, there are over 84 million pending court cases. Cities like São Paulo and Rio de Janeiro lead the way. However, places like Fortaleza and Campinas are growing fast. Digital transformation, like AI and legaltech, improves efficiency. Also, foreign investment and policy changes under President Lula create new opportunities. Challenges like complicated tax rules and ad limits continue. Still, market growth shows skill and flexibility, which build trust with stakeholders.

Download a sample copy of the report: https://www.imarcgroup.com/brazil-legal-services-market/requestsample

Key Market Trends-

Legaltech Adoption: AI tools like Justice Intelligence simplify legal research and document review. This boosts efficiency in a market with 84 million pending cases.

Rise of ALSPs: Alternative legal service providers are growing at a 6.12% rate. They offer affordable solutions for small and medium-sized enterprises (SMEs) and startups.

Regional Market Growth: Cities like Fortaleza and Campinas are becoming legal hubs. This is due to their growing local economies, along with São Paulo and Rio.

ESG Compliance Demand: More companies are focusing on environmental, social, and governance (ESG) services. This shift helps them meet sustainability regulations.

Litigation Surge: Many cases mean a greater need for dispute resolution skills. Firms like Sergio Bermudes are doing great work here.

-

Economic Growth : Brazil's USD 1.92 trillion GDP and FDI inflows fuel demand for corporate, M&A, and intellectual property legal services.

Globalization : Lula's multilateral policies increase cross-border transactions, requiring specialized legal expertise.

Regulatory Complexity: Navigating LGPD and tax rules increases the need for compliance and advisory services.

Digital Transformation: AI and legaltech adoption boost operational efficiency. Latin America's legaltech market is growing at a 9.8% CAGR.

Challenges: Smaller firms face complex tax systems, skill shortages, and advertising restrictions. These issues limit their growth. So, they need to form strategic partnerships.

Brazil Legal Services Market Report Segmentation:

Service Insights:

-

Taxation

Real Estate

Litigation

Bankruptcy

Labor/Employment

Corporate

Others

The report has provided a detailed breakup and analysis of the market based on the service. This includes taxation, real estate, litigation, bankruptcy, labor/employment, corporate, and others.

Mode Insights:

-

Online Legal Services

Offline Legal Services

The report has provided a detailed breakup and analysis of the market based on the mode. This includes online legal services and offline legal services.

End User Insights:

-

Legal Aid Consumers

Private Consumers

SMEs

Charities

Large Businesses

Government

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes legal aid consumers, private consumers, SMEs, charities, large businesses, and government.

Regional Insights:

-

Southeast

South

Northeast

North

Central-West

-

In May 2024, DLA Piper opened a foreign legal advisory in Sao Paulo. This office assists Brazilian and international businesses with US legal matters in cross-border deals. The company announced it will keep its partnership with Campos Mello. This Brazilian law firm has 170 attorneys across three locations in Brazil.

In September 2023, CMS, a group for law firms, made a deal with Focaccia, Amaral e Lamonica Advogados (FAS). This law firm in Brazil will help CMS grow its presence and skills in South America. FAS has over 120 experts and 11 partners. It provides many services, like tax, M&A, corporate law, and banking.

About Us:

IMARC Group is a global consulting firm. We help ambitious changemakers make a lasting impact. The company provides a comprehensive suite of market entry and expansion services.

IMARC offers:

-

Market assessment

Feasibility studies

Company incorporation help

Factory setup support

Regulatory approval guidance

Licensing navigation

Branding and marketing strategies

Sales strategies

Competitive analysis and benchmarking

Pricing and cost research

Procurement research

These services cover every step of your business journey.

Contact Us:

IMARC Group

134 N 4th St., Brooklyn, NY 11249, USA

Email: sales[@]imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Permissionless Data Hub Baselight Taps Walrus To Activate Data Value Onchain

- Japan Shrimp Market Predicted To Hit USD 7.8 Billion By 2033 CAGR: 2.62%

- FBS Analysis Shows Ethereum Positioning As Wall Street's Base Layer

- BTCC Announces Participation In Token2049 Singapore 2025, Showcasing NBA Collaboration With Jaren Jackson Jr.

- Chipper Cash Powers 50% Of Bitcoin Transactions With Bitcoin Lightning Network Via Voltage

- Japan Green Hydrogen Market Size To Reach USD 734 Million By 2033 CAGR Of 27.00%

Comments

No comment