India Life Insurance Market Size, Share, Top Companies Outlook And Analysis Report 20252033

-

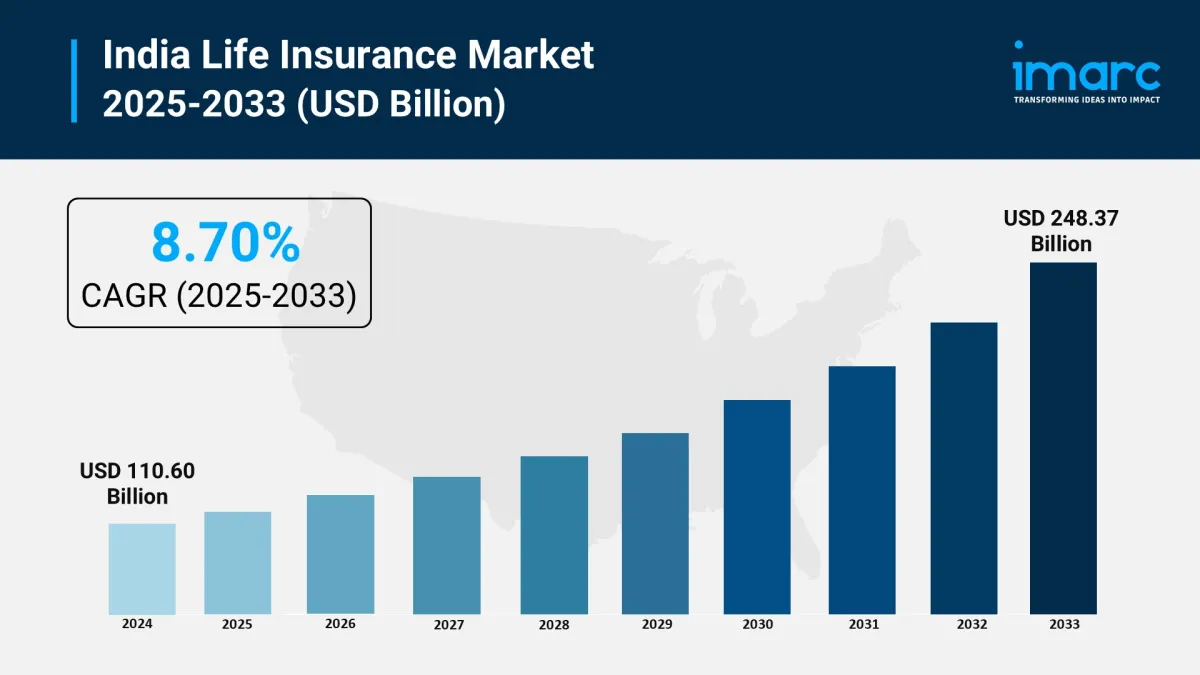

Market Size (2024): USD 110.60 Billion

Forecast (2033): USD 248.37 Billion

CAGR (2025–2033): 8.70%

Growing middle-class income levels and rising risk awareness

Increasing shift toward online and app-based life insurance policy purchases

Launch of flexible pension and retirement plans with tax benefits

Regulatory reforms improving insurance access and transparency

Get Free Sample Report: https://www.imarcgroup.com/india-life-insurance-market/requestsample

How Is AI Transforming the India Life Insurance Market?AI is reshaping life insurance distribution, underwriting, and servicing in India by:

-

Automating claims processing through AI-driven document recognition and fraud detection

Enhancing underwriting accuracy using predictive analytics based on health, demographics, and behavioral data

Personalizing policy recommendations via AI chatbots and robo-advisors on digital platforms

Optimizing customer support using NLP-based virtual agents and real-time query resolution

Detecting risks proactively through AI-powered health tracking apps and integration with wearables

-

Digital-First Ecosystem: Emergence of online marketplaces like Policybazaar and Bima Sugam

Youth-Centric Insurance Plans: Custom plans targeting young earners with ULIP and term policies

Retirement Planning Surge: Rising demand for annuity and pension-focused life insurance plans

Flexible Premium Options: Growth in both single and regular premium offerings across economic segments

Regulatory Boost: IRDAI reforms simplifying procedures and promoting digital adoption

By Type:

-

Term Life Insurance

Unit-Linked Insurance Plans (ULIP)

Endowment Insurance Plans

Retirement/Pension Plans

Others

By Premium Type:

-

Regular

Single

By Premium Range:

-

Low

Medium

High

By Provider:

-

Insurance Companies

Insurance Agents/Brokers

Others

By Mode of Purchase:

-

Online

Offline

-

North India

South India

East India

West India

North India continues to lead the market in 2024 due to higher insurance awareness, income levels, and agent networks. However, digital adoption in South and West India is accelerating online policy sales.

Latest Developments:-

January 2025: Bandhan Life Insurance launched the iInvest Pension Plan via Policybazaar - a market-linked retirement solution offering tax benefits, flexible investments, and no medical screening.

October 2023: IRDAI introduced Bima Sugam , a centralized digital platform enabling easier purchase, claims, and renewal of insurance policies, boosting transparency and user experience.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Permissionless Data Hub Baselight Taps Walrus To Activate Data Value Onchain

- Japan Shrimp Market Predicted To Hit USD 7.8 Billion By 2033 CAGR: 2.62%

- FBS Analysis Shows Ethereum Positioning As Wall Street's Base Layer

- BTCC Announces Participation In Token2049 Singapore 2025, Showcasing NBA Collaboration With Jaren Jackson Jr.

- Chipper Cash Powers 50% Of Bitcoin Transactions With Bitcoin Lightning Network Via Voltage

- Japan Green Hydrogen Market Size To Reach USD 734 Million By 2033 CAGR Of 27.00%

Comments

No comment