403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

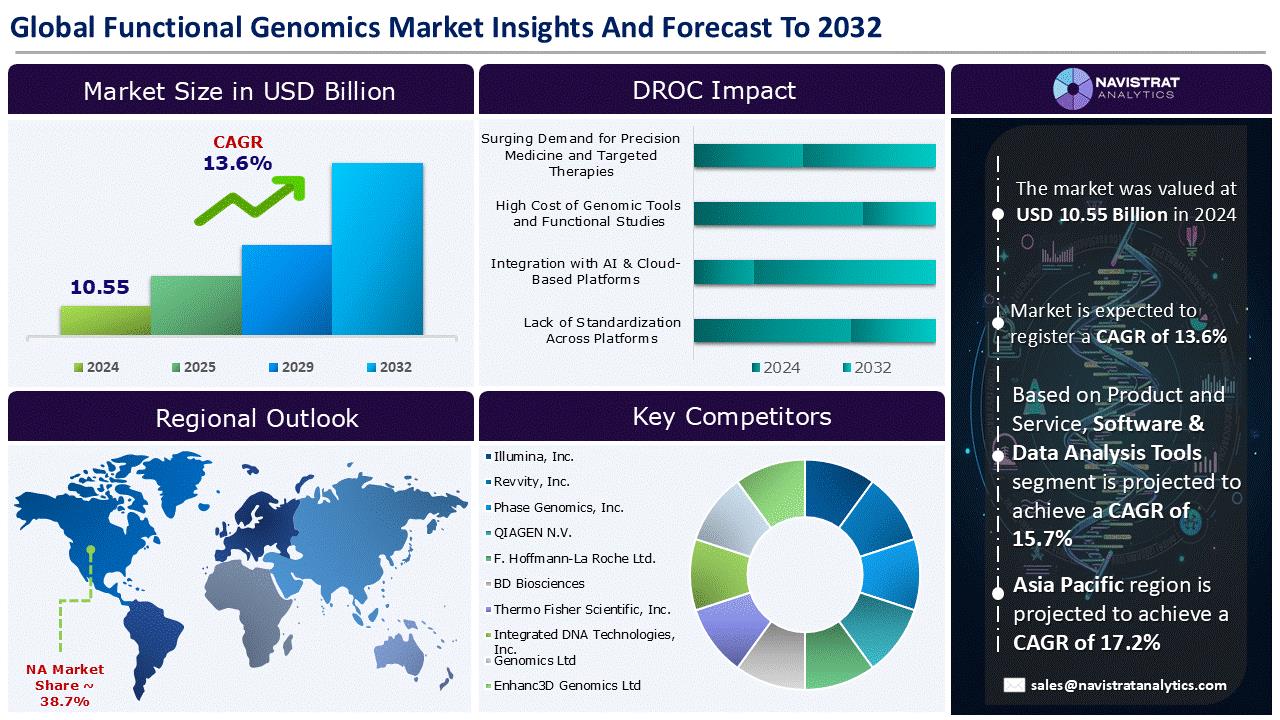

Functional Genomics Market Size to Reach USD 29.40 Billion in 2032

(MENAFN- Navistrat Analytics) July 29, 2025 - Rising demand for precision medicine and targeted treatments is a major factor fueling revenue growth in the functional genomics market. Breakthroughs in sequencing technologies have enabled detailed analysis of the human cancer genome and transcriptome. Numerous cancer models have been developed and thoroughly validated. Functional genomics screening and preclinical drug testing platforms have identified genetic vulnerabilities that can be exploited with therapeutic drugs. These genetic factors also hold promise as biomarkers for forecasting treatment responses.

Biotechnological progress is enhancing the accessibility of functional genomics platforms, enabling researchers to perform high-throughput genomic studies across a broader array of species. As agricultural scientists adopt these innovative approaches, the scope and applicability of functional genomics research within diverse agricultural systems will expand significantly.

In May 2024, Function Oncology—a company redefining the precision medicine landscape through its CRISPR-based platform—announced a cutting-edge R&D collaboration with Volastra Therapeutics, which is focused on targeting chromosomal instability (CIN), a key cancer vulnerability. This partnership merges Function's customized CRISPR-enabled functional genomics technology with Volastra's CIN expertise to expand patient eligibility for Volastra’s KIF18A inhibitors across various solid tumor types.

A major challenge in functional genomics and systems biology lies in creating bioinformatics tools capable of integrating and interpreting data from multiple 'omics' platforms to achieve a holistic view of cellular systems and networks. This involves the complex task of merging various relational databases, conducting in-depth statistical analyses, and translating the findings into formats that are easily understandable. Enhancing single-cell screening and selection methods, along with the use of advanced reporter systems, is expected to significantly accelerate progress in functional genomics and genetics research soon.

Segments market overview and growth Insights

Based on the technology, the functional genomics market is segmented into CRISPR/Cas9 Technology, RNA Interference (RNAi), Next-Generation Sequencing (NGS), Microarray Technology, and Polymerase Chain Reaction (PCR). The Next-Generation Sequencing (NGS) segment held the largest market share in 2024. Next-generation sequencing (NGS) has revolutionized genomics research by offering unprecedented high-throughput and cost-efficient methods for analysing DNA and RNA. This technology allows for the simultaneous sequencing of millions of DNA fragments, delivering comprehensive insights into genome architecture, genetic variations, gene expression patterns, and epigenetic modifications.

In February 2025, Roche launched its proprietary and groundbreaking Sequencing by Expansion (SBX) technology, marking a new era in next-generation sequencing. SBX combines a novel sensor module with innovative chemistry to deliver ultra-fast, high-throughput sequencing that is both flexible and scalable across diverse applications. This cutting-edge method uses a sophisticated biochemical process to convert the sequence of a target DNA or RNA molecule into a measurable surrogate polymer called an Xpandomer.

Regional market overview and growth insights

North America held the largest market share in the functional genomics market in 2024, driven by surging demand for precision medicine and targeted therapies and technological advancements in genomic tools. In January 2025, several leading U.S. health systems—including Advocate Health, CommonSpirit Health, Henry Ford Health, Northwell Health, Providence, and Trinity Health—announced the launch of the Truveta Genome Project, a groundbreaking initiative aimed at generating genetic data from tens of millions of consented, de-identified individuals. This effort is set to create the most extensive and diverse collection of genotypic and phenotypic data to date. In partnership with the Regeneron Genetics Center (RGC), Truveta and its member organizations will sequence the exomes of the first ten million participants. Microsoft Azure has been selected as the exclusive cloud platform for the project.

Competitive Landscape and Key Competitors

The functional genomics market is characterized by a fragmented structure, with many competitors holding a significant share of the market. List of major players included in the functional genomics market report are:

o Illumina, Inc.

o Genomics Ltd

o Enhanc3D Genomics Ltd

o Samplix ApS

o ALS Limited

o Arima Genomics

o MEDiC Life Sciences

o Revvity, Inc.

o Phase Genomics, Inc.

o QIAGEN N.V.

o F. Hoffmann-La Roche Ltd.

o BD Biosciences

o Thermo Fisher Scientific, Inc.

o Integrated DNA Technologies, Inc.

Major strategic developments by leading competitors

Inocras Inc.: In November 2024, Inocras Inc. and Summit Pharmaceuticals International Corporation entered a memorandum of understanding (MOU) to jointly explore the commercialization of whole genome sequencing (WGS) analysis services. This partnership aims to transform healthcare in Japan by leveraging genomic data and bioinformatics to enhance the understanding and treatment of cancer and other genetic disorders.

Ginkgo Bioworks: In September 2024, Ginkgo Bioworks — a leader in cell programming and biosecurity — announced the launch of Ginkgo Datapoints, a new initiative designed to accelerate the next phase of biotechnology by simplifying and optimizing AI model training. Ginkgo Datapoints focuses on delivering large-scale, high-quality biological datasets quickly and cost-effectively through an efficient agreement framework. This fall, the initiative will roll out a variety of data generation services, including protein characterization and functional genomics.

Navistrat Analytics has segmented functional genomics market based on product and service, technology, application, and end-use:

• Product and Service Outlook (Revenue, USD Billion; 2022-2032)

o Instruments

o Consumables & Reagents

o Software & Data Analysis Tools

o Services

• Technology Outlook (Revenue, USD Billion; 2022-2032)

o CRISPR/Cas9 Technology

o RNA Interference (RNAi)

o Next-Generation Sequencing (NGS)

o Microarray Technology

o Polymerase Chain Reaction (PCR)

• Application Outlook (Revenue, USD Billion; 2022-2032)

o Drug Discovery & Development

o Clinical Diagnostics

o Agricultural Genomics

o Toxicogenomics

o Biomarker Discovery & Validation

• End-Use Outlook (Revenue, USD Billion; 2022-2032)

o Academic & Research Institutes

o Pharmaceutical & Biotechnology Companies

o CRO and CDMO

o Hospitals & Diagnostic Laboratories

• Regional Outlook (Revenue, USD Billion; 2022-2032)

o North America

a. U.S.

b. Canada

c. Mexico

o Europe

a. Germany

b. France

c. U.K.

d. Italy

e. Spain

f. Benelux

g. Nordic Countries

h. Rest of Europe

o Asia Pacific

a. China

b. India

c. Japan

d. South Korea

e. Oceania

f. ASEAN Countries

g. Rest of APAC

o Latin America

a. Brazil

b. Rest of LATAM

o Middle East & Africa

a. GCC Countries

b. South Africa

c. Israel

d. Turkey

e. Rest of MEA

Biotechnological progress is enhancing the accessibility of functional genomics platforms, enabling researchers to perform high-throughput genomic studies across a broader array of species. As agricultural scientists adopt these innovative approaches, the scope and applicability of functional genomics research within diverse agricultural systems will expand significantly.

In May 2024, Function Oncology—a company redefining the precision medicine landscape through its CRISPR-based platform—announced a cutting-edge R&D collaboration with Volastra Therapeutics, which is focused on targeting chromosomal instability (CIN), a key cancer vulnerability. This partnership merges Function's customized CRISPR-enabled functional genomics technology with Volastra's CIN expertise to expand patient eligibility for Volastra’s KIF18A inhibitors across various solid tumor types.

A major challenge in functional genomics and systems biology lies in creating bioinformatics tools capable of integrating and interpreting data from multiple 'omics' platforms to achieve a holistic view of cellular systems and networks. This involves the complex task of merging various relational databases, conducting in-depth statistical analyses, and translating the findings into formats that are easily understandable. Enhancing single-cell screening and selection methods, along with the use of advanced reporter systems, is expected to significantly accelerate progress in functional genomics and genetics research soon.

Segments market overview and growth Insights

Based on the technology, the functional genomics market is segmented into CRISPR/Cas9 Technology, RNA Interference (RNAi), Next-Generation Sequencing (NGS), Microarray Technology, and Polymerase Chain Reaction (PCR). The Next-Generation Sequencing (NGS) segment held the largest market share in 2024. Next-generation sequencing (NGS) has revolutionized genomics research by offering unprecedented high-throughput and cost-efficient methods for analysing DNA and RNA. This technology allows for the simultaneous sequencing of millions of DNA fragments, delivering comprehensive insights into genome architecture, genetic variations, gene expression patterns, and epigenetic modifications.

In February 2025, Roche launched its proprietary and groundbreaking Sequencing by Expansion (SBX) technology, marking a new era in next-generation sequencing. SBX combines a novel sensor module with innovative chemistry to deliver ultra-fast, high-throughput sequencing that is both flexible and scalable across diverse applications. This cutting-edge method uses a sophisticated biochemical process to convert the sequence of a target DNA or RNA molecule into a measurable surrogate polymer called an Xpandomer.

Regional market overview and growth insights

North America held the largest market share in the functional genomics market in 2024, driven by surging demand for precision medicine and targeted therapies and technological advancements in genomic tools. In January 2025, several leading U.S. health systems—including Advocate Health, CommonSpirit Health, Henry Ford Health, Northwell Health, Providence, and Trinity Health—announced the launch of the Truveta Genome Project, a groundbreaking initiative aimed at generating genetic data from tens of millions of consented, de-identified individuals. This effort is set to create the most extensive and diverse collection of genotypic and phenotypic data to date. In partnership with the Regeneron Genetics Center (RGC), Truveta and its member organizations will sequence the exomes of the first ten million participants. Microsoft Azure has been selected as the exclusive cloud platform for the project.

Competitive Landscape and Key Competitors

The functional genomics market is characterized by a fragmented structure, with many competitors holding a significant share of the market. List of major players included in the functional genomics market report are:

o Illumina, Inc.

o Genomics Ltd

o Enhanc3D Genomics Ltd

o Samplix ApS

o ALS Limited

o Arima Genomics

o MEDiC Life Sciences

o Revvity, Inc.

o Phase Genomics, Inc.

o QIAGEN N.V.

o F. Hoffmann-La Roche Ltd.

o BD Biosciences

o Thermo Fisher Scientific, Inc.

o Integrated DNA Technologies, Inc.

Major strategic developments by leading competitors

Inocras Inc.: In November 2024, Inocras Inc. and Summit Pharmaceuticals International Corporation entered a memorandum of understanding (MOU) to jointly explore the commercialization of whole genome sequencing (WGS) analysis services. This partnership aims to transform healthcare in Japan by leveraging genomic data and bioinformatics to enhance the understanding and treatment of cancer and other genetic disorders.

Ginkgo Bioworks: In September 2024, Ginkgo Bioworks — a leader in cell programming and biosecurity — announced the launch of Ginkgo Datapoints, a new initiative designed to accelerate the next phase of biotechnology by simplifying and optimizing AI model training. Ginkgo Datapoints focuses on delivering large-scale, high-quality biological datasets quickly and cost-effectively through an efficient agreement framework. This fall, the initiative will roll out a variety of data generation services, including protein characterization and functional genomics.

Navistrat Analytics has segmented functional genomics market based on product and service, technology, application, and end-use:

• Product and Service Outlook (Revenue, USD Billion; 2022-2032)

o Instruments

o Consumables & Reagents

o Software & Data Analysis Tools

o Services

• Technology Outlook (Revenue, USD Billion; 2022-2032)

o CRISPR/Cas9 Technology

o RNA Interference (RNAi)

o Next-Generation Sequencing (NGS)

o Microarray Technology

o Polymerase Chain Reaction (PCR)

• Application Outlook (Revenue, USD Billion; 2022-2032)

o Drug Discovery & Development

o Clinical Diagnostics

o Agricultural Genomics

o Toxicogenomics

o Biomarker Discovery & Validation

• End-Use Outlook (Revenue, USD Billion; 2022-2032)

o Academic & Research Institutes

o Pharmaceutical & Biotechnology Companies

o CRO and CDMO

o Hospitals & Diagnostic Laboratories

• Regional Outlook (Revenue, USD Billion; 2022-2032)

o North America

a. U.S.

b. Canada

c. Mexico

o Europe

a. Germany

b. France

c. U.K.

d. Italy

e. Spain

f. Benelux

g. Nordic Countries

h. Rest of Europe

o Asia Pacific

a. China

b. India

c. Japan

d. South Korea

e. Oceania

f. ASEAN Countries

g. Rest of APAC

o Latin America

a. Brazil

b. Rest of LATAM

o Middle East & Africa

a. GCC Countries

b. South Africa

c. Israel

d. Turkey

e. Rest of MEA

Navistrat Analytics

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment