Iraqi Stocks: What Next After Two Gangbuster Years?

Any opinions expressed are those of the author, and do not necessarily reflect the views of Iraq Business News .

What Next After Two Gangbuster Years?

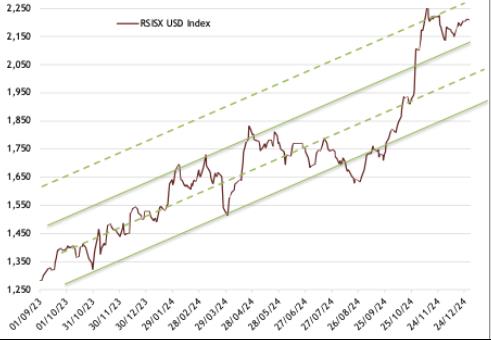

The market, as measured by the Rabee Securities U. S. Dollar Equity Index (RSISX USD Index), was up 44.8% and 97.2% in 2024 and 2023 respectively.

For December, the market was up 2.1% and spent most of the month consolidating its gains following a blistering 35.9% rally since late August 2024, which could continue over the next few weeks. However, the market's technical picture continues to be positive, and the likely consolidation or pullback should be within its multi-month uptrend as much as the prior consolidations and pull-backs have done over the prior months (chart below).

A promising aspect of the market action in 2024 is the 42.8% increase in average daily turnover (adjusted for block trades) versus that of 2023, itself up 9.9% over that of 2022.

Rabee Securities U.S. Dollar Equity Index

(Source: Iraq Stock Exchange, Rabee Securities, AFC Research, daily data as of December 30th)

Outlook for 2025

After two "gangbusters years", the obvious question is what is in store for the market in 2025? The answer made a year ago following a "gangbuster year 2023 ", and repeated here lies with the dynamics that powered the market's performance in 2023 and 2024 and their continuation going forward.

Foremost among the two key dynamics are the cumulative positive effects of the relative stability that the country has enjoyed over the past few years, which created a stable and predictable macroeconomic framework for businesses and individuals to operate in and to plan for capital investments on a scale last seen in the 1970's and early 1980's before the onset of the decades of conflict(i).

The second is the significant structural fundamental development accelerating the adoption of banking and bringing about a transformation of the sector and its role in the economy(ii). Supporting these two dynamics is the liquidity injected into the non-oil economy by the expansionary three-year 2023-25 budget that is providing a significant boost to non-oil GDP(iii). The combination provided the wherewithal for the leading companies in the country to deliver outstanding profit growth that has underpinned the market's rally over the last two years(iv).

In 2025, these dynamics should continue to unfold as much as they did in 2023 and 2024 and, in the same way, should drive the market's performance; however, the growth of corporate profits and non-oil GDP will be from a much higher base, and thus while it will continue, the acceleration would slow down from the heady rates of the past two years.

This is especially the case for the key beneficiaries of the second dynamic, the top banks in the country, which experienced exceptional quarter-on-quarter, and year-over-year acceleration in net profit and equity growth, yet the intensity of this acceleration should moderate meaningfully over the next few quarters, leading to a new normal for the group. In this new normal, the future growth trajectories of the top banks will be from a much higher base and from a significantly improved financial position.

Moreover, this new normal will be marked by an increased adoption of banking and of formality, coupled with a move away from the dominance of cash and informality -developments that the investment thesis for the banking sector contends would come with growth in bank lending, resulting in an expansion of the money circulating in the economy and consequently to a meaningful increase in non-oil GDP. Over time, this should support the growth in top banks' net profits, and ultimately feed into higher stock market valuations -driven by net-profit growth and by the increases in market multiples placed upon these net profits.

Similarly, the liquidity injection from the expansionary three-year 2023-25 budget will come with less stimulus in the budget's third year in 2025, primally a consequence of a higher base as non-oil GDP has expanded meaningfully in 2023 and 2024 from the budget's liquidity injections in its first two years. Market expectations for oil prices in 2025, as measured by Brent Futures contacts as the of end of 2024, are for a decline of about 9.0% in average Brent crude prices from actual prices in 2024(v).

This implies, all things being equal, that unlike 2023 and 2024, the budget would result in a large deficit that would be financed by the issuance of domestic bonds, in the process increasing the domestic sovereign debt stock from an estimated USD 65.1 billion by end 2024 up to USD 102.9 billion by the end of 2025(vi). Over the next few years, the increased need for debt to augment government spending will play a big role in developing the country's bond market, which, in turn, with the growth of the equity market, will contribute to the evolution of the country's capital markets.

The over-arching theme is that both of the two key dynamics discussed -- the cumulative positive effects of the relative stability and structural banking developments -- are in the early stages of their transformation of the Iraqi economy, a process that would unfold over the next few years, bringing with it high economic growth that would feed into higher corporate profits, and ultimately higher stock market returns.

However, significant risks remain given Iraq's recent history of conflict, extreme leverage to volatile oil prices, as well as the risk that a widening of the current Middle East conflict will not be contained and evolve to destabilise the region -even though the temporary ceasefire in Lebanon and developments in Syria lowered the likelihood of a widening, yet risks remain that this will not hold or that other negative developments, especially related to Syria, take place.

Notes:

- "Supermarkets and stability ", in December 2022

- "Construction activity and stability ", in July 2023

- "Banks and the Iraq investment thesis ", February 2022

- "The opportunity in retail banking " April 2022

- "Banks and the predictability of earnings ", November 2022

- "Banks to fuel the market's next phase ". September 2023

- "Private sector loan growth to fuel Iraq's economic recovery ", October 2023

- "Banks end the year with a bang ", April 2024

- "An unfolding structural economic transformation ", July 2024

- "Companies' earnings growth continues, while market takes a breather ", September 2024

- "Corporate earnings growth underpins market rally ", December 2024

- "Market rallies as it begins to discount the budget's passage ", August 2023

- "IMF sees budget boosting non-oil GDP ", June 2024

- Brent Futures sourced from the Wall Street Journal's markets and finance section, data as of 31st December 2024

- Europe Brent spot price FOB (free on board) is used as a proxy for spot prices, sourced from the U.S. Energy Information Administration (IEA ), as of 31st December 2024

- "Iraq's 2024 budget: Not what it appears when it first meets the eye ", Ahmed Tabaqchali, Atlantic Council, November 6th, 2024

Please click here to download Ahmed Tabaqchali's full report in pdf format .

Mr Tabaqchali (@AMTabaqchali ) is the Chief Strategist of the AFC Iraq Fund, and is an experienced capital markets professional with over 25 years' experience in US and MENA markets. He is a Visiting Fellow at the LSE Middle East Centre, Senior Fellow at the Institute of Regional and International Studies (IRIS), and a Senior Non-resident Fellow at the Atlantic Council.

His comments, opinions and analyses are personal views and are intended to be for informational purposes and general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any fund or security or to adopt any investment strategy. It does not constitute legal or tax or investment advice. The information provided in this material is compiled from sources that are believed to be reliable, but no guarantee is made of its correctness, is rendered as at publication date and may change without notice and it is not intended as a complete analysis of every material fact regarding Iraq, the region, market or investment.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment