403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

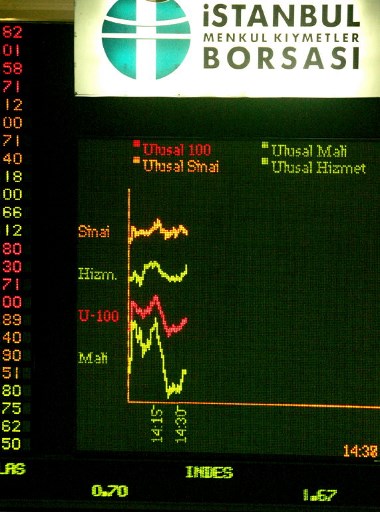

Türkiye’s BIST 100 opens Friday’s session with losses

(MENAFN) Türkiye’s benchmark stock index, the BIST 100, experienced a slight decline of 0.33 percent on Friday, dropping 29.21 points to open trading at 8,843.64 points. This decrease follows a strong performance the previous day, where the index surged by 1.81 percent, concluding at 8,872.85 points. On Thursday, the market saw a robust daily transaction volume of 61 billion Turkish liras, equivalent to approximately USD1.78 billion, indicating significant investor activity in the stock market.

As of 10:30 AM local time (0730 GMT), the exchange rates for major currencies against the Turkish lira reflected a stable yet competitive currency environment. The US dollar was trading at 34.2890 TRY, while the euro was valued at 37.1155 TRY, and the British pound stood at 44.4840 TRY. These rates are crucial for investors and traders as they navigate the financial landscape, particularly in light of Türkiye’s ongoing economic developments and policy adjustments.

In the commodities market, gold prices remained elevated, with the ounce priced at USD2,728.27. This figure highlights gold's continued appeal as a safe-haven asset amid economic uncertainties. Meanwhile, Brent crude oil was trading at approximately USD74.30 per barrel, indicating a stable energy market as global demand fluctuates. These commodity prices are significant for Türkiye, given its reliance on imports for energy and its investment in gold as a financial safeguard.

Overall, the fluctuations in the BIST 100 index, along with the foreign exchange rates and commodity prices, underscore the dynamic nature of Türkiye's financial markets. Investors will be closely monitoring these indicators as they inform decisions on investment strategies and economic forecasts in an ever-changing economic environment. The performance of the stock index and the trends in currency and commodities will likely continue to play a pivotal role in shaping the financial landscape of Türkiye in the coming weeks.

As of 10:30 AM local time (0730 GMT), the exchange rates for major currencies against the Turkish lira reflected a stable yet competitive currency environment. The US dollar was trading at 34.2890 TRY, while the euro was valued at 37.1155 TRY, and the British pound stood at 44.4840 TRY. These rates are crucial for investors and traders as they navigate the financial landscape, particularly in light of Türkiye’s ongoing economic developments and policy adjustments.

In the commodities market, gold prices remained elevated, with the ounce priced at USD2,728.27. This figure highlights gold's continued appeal as a safe-haven asset amid economic uncertainties. Meanwhile, Brent crude oil was trading at approximately USD74.30 per barrel, indicating a stable energy market as global demand fluctuates. These commodity prices are significant for Türkiye, given its reliance on imports for energy and its investment in gold as a financial safeguard.

Overall, the fluctuations in the BIST 100 index, along with the foreign exchange rates and commodity prices, underscore the dynamic nature of Türkiye's financial markets. Investors will be closely monitoring these indicators as they inform decisions on investment strategies and economic forecasts in an ever-changing economic environment. The performance of the stock index and the trends in currency and commodities will likely continue to play a pivotal role in shaping the financial landscape of Türkiye in the coming weeks.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment