Dutch Pension Funds Shun Risk Until Transition

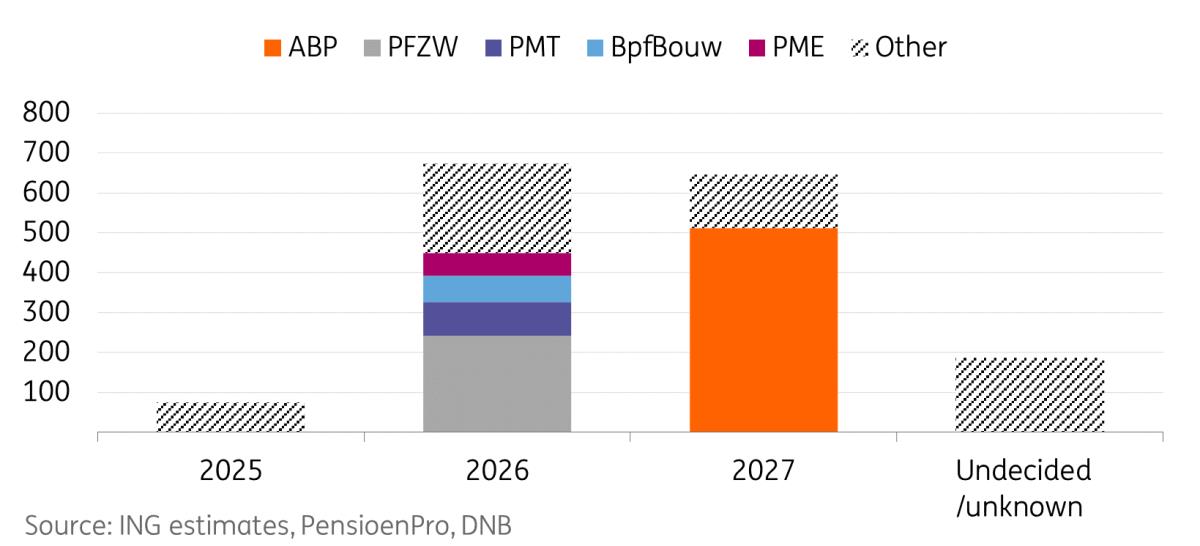

Since our previous article in May, more pension funds have delayed their intended transition date to a defined contributions model. None of the five largest Dutch funds will be transitioning in 2025, with the bulk of the funds aiming for 2026. ABP, the largest fund, with more than €500bn under management, is set to move to a defined contributions system in 2027. The recent political developments should not impact the reforms, as pensions were not part of the coalition agreement, but remain a tail risk (for further delays).

Only a few smaller pension funds left for transition in 2025

Period leading to transition day calls for reducing risk exposure

Over the past few years, pension funds have increased their interest rate hedges to lock in higher rates (see chart below), and in preparation for the transition, we expect the demand for fixed receivers to remain elevated. To ensure a smooth transition process, pension funds have an incentive to reduce the volatility of their assets and liabilities. On the day of transition (“invaren”), assets are allocated to the participants based on individual future liabilities and to fund-wide reserves. If the coverage ratio of a fund is sufficiently high, at least above 105%, then every participant will at least – at face value – benefit from the transition.

Interest rate hedges have increased in recent yearsIf, however, the coverage ratio (“dekkingsgraad”) of a pension fund falls below a certain threshold, the distribution of assets will become a more contentious process, whereby certain groups of participants may end up worse than under the current system. For this reason, funds will try to steer their exposures in such a way as to mitigate the risks of the coverage ratio falling below 105%. In theory, swaptions and equity options would be effective steering tools, but due to their costs and complexity, most pension funds are likely to stick to dynamic hedging strategies using swaps.

A market downturn would justify even higher hedges

The currently high interest rates and high equity prices are a goldilocks environment for pension funds, but we see significant risk that this can change before many funds transition. The chart below shows how the coverage ratios of the major funds are now all above 105% thanks to record stock prices and high interest rates. This is in sharp contrast with the period before when exceptionally low interest rates magnified liabilities.

Adequate coverage ratios key for smooth transitionAn equity market sell-off combined with falling interest rates would be an adverse combination for pension fund cover ratios. Funds would want to hedge the risk of their coverage ratio falling below 105% since this would compromise a smooth transition. Given that the largest funds' coverage ratios are not far above 105%, even a mild market downturn justifies an increase in risk hedges.

Demand for fixed receivers will be more concentrated around the 20y tenorThe new defined contribution model reduces the need for fixed receiver swaps for 30 years and beyond. We therefore believe that funds will already move to 20y tenors to steer interest rate risks until the transition. Any shorter tenors will fail to cover the risks stemming from longer-dated liabilities, which will still need to be covered until the transition date. While longer tenors would fall obsolete after the transition date.

Our fair value model for the 20s30s on the swap curve suggests a potential steepening of around 20bp in the coming months. A model decomposition shows that the narrowing YTD was mostly explained by the pricing out of rate cut expectations (3m1y contribution in chart), but this should fade going forward as the European Central Bank rate-cutting narrative starts building. In the background, the pension story works in the same direction and could even accelerate due to the rise in hedging demand when yields fall. On top of that, concerns about the US fiscal deficit may spill over to the global term risk premium.

Building of rate cut expectations helps steepen the curveThe 3-month carry on a 20s30s steepener would be -0.2bp but is offset by an equally sized but positive roll down of 0.2bp and thus the position is more attractive than other steepeners in our view (see chart). A 10s30s, for example, has a carry + roll down of negative -0.9bp and doesn't capture the specific hedging flows we expect from the Dutch pension fund reforms. A key risk to our steepener view would be a revival of eurozone or US inflation, but the momentum seems to be in the right direction at the moment.

Carry and roll down on 20s30s steepener most attractive

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment