(MENAFN- PR Newswire)

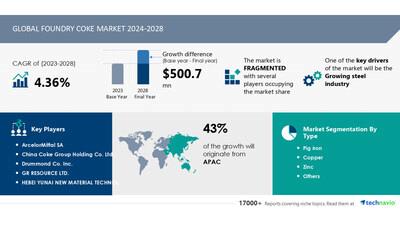

NEW YORK, July 4, 2024 /PRNewswire/ -- The global

foundry coke market

size is estimated to grow by USD 500.7 million from 2024-2028, according to Technavio. The market is estimated to grow at a CAGR of

4.36%

during the forecast period. Growing steel industry

is driving market growth,

with a trend towards

rising demand for foundry coke from emerging markets. However,

volatility in raw material prices

poses a challenge. Key market players include ArcelorMittal SA, China Coke Group Holding Co. Ltd., Drummond Co. Inc., GR RESOURCE LTD., HEBEI YUNAI NEW MATERIAL TECHNOLOGY CO. LTD., Hickman Williams and Co., Italiana Coke Srl, Jiangsu surung High carbon Co. Ltd., Majufa Traders and Exporters, Nippon Coke and Engineering Co. Ltd., OKK Koksovny a.s., Quimica del Nalon SA, Richa Refractories, RIZHAO HENGQIAO CARBON CO. LTD., Rizhao Yeneng New Energy Technology Co. Ltd, Sesa Goa Iron Ore, Shree Arihant Trade Links India Pvt Ltd., Siddhi Vinayak Impex, Walbrzyskie Zaklady Koksownicze Victoria SA, and Zhongrong Xinda Group Co. Ltd..

Continue Reading

Technavio has announced its latest market research report titled Global foundry coke market 2024-2028

Get a detailed analysis on regions, market segments, customer landscape, and companies-

View the snapshot of this report

| Foundry Coke Market Scope |

| Report Coverage |

Details |

| Base year |

2023 |

| Historic period |

2018 - 2022 |

| Forecast period |

2024-2028 |

| Growth momentum & CAGR |

Accelerate at a CAGR of 4.36% |

| Market growth 2024-2028 |

USD 500.7 million |

| Market structure |

Fragmented |

| YoY growth 2022-2023 (%) |

4.11 |

| Regional analysis |

APAC, North America, Europe, South America, and Middle East and Africa |

| Performing market contribution |

APAC at 43% |

| Key countries |

China, US, Germany, Japan, and Italy |

| Key companies profiled |

ArcelorMittal SA, China Coke Group Holding Co. Ltd., Drummond Co. Inc., GR RESOURCE LTD., HEBEI YUNAI NEW MATERIAL TECHNOLOGY CO. LTD., Hickman Williams and Co., Italiana Coke Srl, Jiangsu surung High carbon Co. Ltd., Majufa Traders and Exporters, Nippon Coke and Engineering Co. Ltd., OKK Koksovny a.s., Quimica del Nalon SA, Richa Refractories, RIZHAO HENGQIAO CARBON CO. LTD., Rizhao Yeneng New Energy Technology Co. Ltd, Sesa Goa Iron Ore, Shree Arihant Trade Links India Pvt Ltd., Siddhi Vinayak Impex, Walbrzyskie Zaklady Koksownicze Victoria SA, and Zhongrong Xinda Group Co. Ltd. |

Market Driver

The foundry coke market is witnessing growth due to the increasing demand from emerging markets, particularly in regions such as Asia Pacific, South America, and the Middle East and Africa. Rapid urbanization, infrastructure development, and industrialization in these regions are driving the need for steel, leading to a rise in demand for foundry coke. In APAC, countries like China and India are experiencing significant growth in construction activities, which require large quantities of steel. The automotive industry in these markets is also expanding, fueled by increasing incomes and growing middle-class populations, leading to a surge in demand for automobiles and their steel-intensive components. Furthermore, emerging markets have a strong focus on infrastructure development, including transportation systems, energy projects, and industrial facilities, which require substantial amounts of steel and, consequently, foundry coke. The establishment of new steel mills and the expansion of existing ones in these markets will contribute to increased consumption of foundry coke, driving the growth of the global foundry coke market.

Foundry coke is a key growth-generator in the steel industry, known for its high heat value and compact structure. Its extensive carbon content makes it an essential ingredient in cupola furnaces for casting metals like cast iron, steel, sintered metals, aluminum alloys, magnesium alloys, and ceramic. The urbanization and construction activities drive the demand for foundry coke, especially in the automobile sector. Non-recovery coke ovens are commonly used in its production, ensuring a denser structure and low ash content. The beehive process and furnace diameter play a crucial role in optimizing the process. Metal temperature and breakage are critical factors affecting the quality of the final product. Strategic collaborations between coke manufacturers and steel producers have been a trend, ensuring a steady supply of coke and maintaining revenues. Insulating materials like stone wool are used to maintain furnace temperature, and the size of the furnaces varies depending on the production requirements. The coal output and imports significantly impact the coke market, and the process continues to evolve with ongoing innovations in furnace technology.

Research report provides comprehensive data on impact of trend. For more details-

Download a Sample Report

Market

Challenges

The foundry coke market faces significant challenges due to the volatility in raw material prices, primarily driven by coal. Coal, being the primary raw material for foundry coke production, experiences fluctuations that impact production costs and profitability for manufacturers. Supply-demand dynamics and geopolitical factors contribute to this volatility. For instance, coal supply imbalances or production disruptions can lead to price fluctuations. Trade disputes or changes in government policies can also impact coal availability and cost. Shifts towards renewable energy and natural gas as alternatives to coal can reduce coal demand, negatively affecting its price. Additionally, environmental regulations and carbon pricing initiatives increase coal production costs, which may be passed on to foundry coke manufacturers. This volatility creates challenges for foundry coke producers in managing costs and pricing strategies, potentially impacting their profitability and the growth of the global foundry coke market.

The Foundry Coke market faces several challenges in various sectors. In the automobile industry, cast iron components require high-quality coke for efficient production. However, the use of cast iron is declining due to the shift towards lighter materials. End-user sectors like steel, sintered metals, aluminum alloys, ceramics, and metallic coverings also rely on coke for their manufacturing processes. Challenges include the availability of suitable coal output and coal imports for coke production. The ash content and heating value of coal significantly impact coke quality. Market participants use different types of coke, such as Bluestone Coke, Walter Coke, and ERP Compliant Coke, in their processes. Coke production involves furnaces like Coke Furnace and Cupolas, which require insulating materials like stone wool for efficient operation. Market leaders like Pohang Steelworks and Walter Energy produce various types of coke, including hard coal coke, Form-coke, and Jumbo-ovens. The by-product recovery process is essential for minimizing waste and maximizing profitability. The Foundry Coke market assessment period includes factors like carbon content, heating value, and market trends for fuel and carbon sources, including iron, copper, lead, tin, zinc, and their alloys. Carbon content and heating value are crucial factors in determining the suitability of coke for various applications.

For more insights on driver and challenges

-

Request a

sample report!

Segment Overview

This foundry coke market report extensively covers market segmentation by

Type

1.1 Pig iron

1.2 Copper

1.3 Zinc

1.4 Others

Application

2.1 Automotive parts casting

2.2 Machinery casting

2.3 Material treatment

Geography

3.1 APAC

3.2 North America

3.3 Europe

3.4 South America

3.5 Middle East and Africa

1.1 Pig iron-

Foundry coke holds a significant role in the global market, particularly in the pig iron segment. In the iron and steel manufacturing process, pig iron is produced by smelting iron ore in blast furnaces using coke as fuel and reducing agent. Foundry coke provides the necessary heat and carbon for this process. It acts as a fuel, generating high temperatures inside the blast furnace, and as a source of carbon, which combines with oxygen in the iron ore to remove impurities. This results in the reduction of iron oxides, creating a reducing atmosphere within the furnace and producing molten iron. The molten iron is then tapped and further processed to create various steel products. The steel industry's demand for pig iron, and subsequently foundry coke, remains strong due to steel's versatile applications in construction, automotive manufacturing, infrastructure development, and machinery production. Therefore, the pig iron segment's growth will continue to drive the global foundry coke market.

For more information on market segmentation with geographical analysis including forecast (2024-2028) and historic data (2017-2021) - Download a Sample Report

Research Analysis

Foundry coke, a critical ingredient in the production of cast iron, plays a significant role in the automobile sector and various end-user industries. Its manufacturing process involves the use of furnaces, such as cupolas, and insulating materials like stone wool. The coal output and imports are crucial factors in the production of foundry coke, which comes in different forms, including hard coal coke and form-coke. Jumbo-ovens and the by-product recovery process are used to produce foundry coke, which has a high heat value, compact structure, and extensive carbon content. The metal temperature during the coke-making process is crucial to ensure the desired properties of the final cast iron product. Urbanization and construction activities are growth generators for the foundry coke market due to the increasing demand for cast iron in infrastructure development. Industries like iron, copper, lead, tin, and zinc rely on foundry coke for their production processes. The compact structure and extensive carbon content make foundry coke an essential component in the production of cast iron, which is used in various industries. However, the process of making foundry coke can result in breakage, which can impact the quality of the final product. Therefore, continuous research and development efforts are being made to improve the coke-making process and reduce breakage.

Market Research Overview

Foundry coke is a critical fuel used in the production of cast iron and various other metals such as steel, sintered metals, aluminum alloys, magnesium alloys, and ceramics. The market for foundry coke is driven by the automobile sector and end-user sectors requiring cast components. The production of foundry coke involves the use of hard coal in furnaces like cupolas and coke ovens, including jumbo-ovens and non-recovery coke ovens. The by-product recovery process is essential in modern coke production, which results in the production of valuable by-products like coal tar, ammonia, and light oils. The foundry coke market is influenced by several factors, including coal output, coal imports, and the carbon content and heating value of the coke. The demand for foundry coke is driven by the extensive use of cast iron in various industries, including automotive parts casting and machinery casting. Insulating materials like stone wool and metallic coverings are also used to enhance the efficiency of the coke production process. The foundry coke market is expected to grow significantly during the assessment period due to the high demand for cast iron and other metals in urbanization and construction activities. The market participants include producers of Bluestone Coke and Walter Coke, as well as ERP Compliant Coke and SMS team. The process of producing foundry coke involves the use of various forms like hard coal coke, form-coke, and ERP Compliant Coke, which differ in their carbon content, compact structure, and breakage properties. The size and process of the furnaces, including cupola furnaces and beehive process furnaces, also impact the production of foundry coke.

Table of Contents:

1 Executive Summary

2 Market Landscape

3 Market Sizing

4 Historic Market Size

5 Five Forces Analysis

6 Market Segmentation

Type

Pig Iron

Copper

Zinc

Others

Application

Automotive Parts Casting

Machinery Casting

Material Treatment

Geography

APAC

North America

Europe

South America

Middle East And Africa

7 Customer Landscape

8 Geographic Landscape

9 Drivers, Challenges, and Trends

10 Company Landscape

11 Company Analysis

12 Appendix

About Technavio

Technavio is a leading global technology research and advisory company. Their research and analysis focuses on emerging market trends and provides actionable insights to help businesses identify market opportunities and develop effective strategies to optimize their market positions.

With over 500 specialized analysts, Technavio's report library consists of more than 17,000 reports and counting, covering 800 technologies, spanning across 50 countries. Their client base consists of enterprises of all sizes, including more than 100 Fortune 500 companies. This growing client base relies on Technavio's comprehensive coverage, extensive research, and actionable market insights to identify opportunities in existing and potential markets and assess their competitive positions within changing market scenarios.

Contacts

Technavio Research

Jesse Maida

Media & Marketing Executive

US: +1 844 364 1100

UK: +44 203 893 3200

Email:

[email protected]

Website:

SOURCE Technavio

MENAFN04072024003732001241ID1108408674

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.