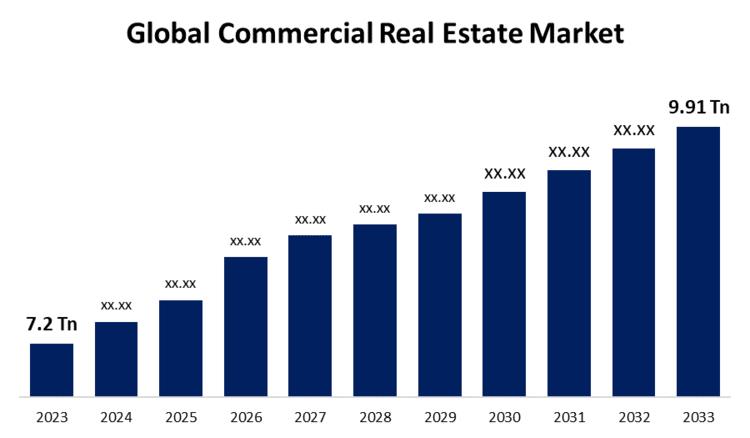

(MENAFN- GlobeNewsWire - Nasdaq) The Global Commercial Real estate market Size was Valued at USD 7.2 Trillion in 2023 and the Worldwide Commercial Real Estate Market Size is Expected to Reach USD 9.91 Trillion by 2033, according to a research report published by Spherical Insights & Consulting. Companies covered: Brookfield Asset Management Inc., ATC IP LLC., Prologis, Inc., SIMON PROPERTY GROUP, L.P., Coldwell Banker, RE/MAX, LLC., Keller Williams Realty, Inc., CBRE Group, Inc., Sotheby's International Realty Affiliates LLC., Colliers, Boston Commercial Properties Inc., Dalian Wanda Group, DLF Ltd., Link Asset Management Limited, and other key companies.

New York, United States, July 04, 2024 (GLOBE NEWSWIRE) -- The Global Commercial Real Estate Market Size is to Grow from USD 7.2 Trillion in 2023 to USD 9.91 Trillion by 2033, at a Compound Annual Growth Rate (CAGR) of 3.25% during the projected period.

Get a Sample PDF Brochure:

Commercial real estate (CRE) is the market mainly utilized for business or investment goals. This encompasses hotels, homes, shops, corporate buildings, warehouses, medical facilities, and other distinctive properties in real estate. The commercial real estate market is focused on investors, developers, and corporations who use real estate assets for profit, while the residential real estate market is geared towards individual homeowners. Variables like GDP growth, employment rates, and consumer spending, as well as the growing need for office, retail, and industrial spaces, are crucial in boosting the economy's strength and expansion. The primary driver of market expansion is the growth of the international business industry. Anticipated increases in urbanization and industrialization in nations such as Thailand, China, Malaysia, and Indonesia are projected to have a positive effect on commercial construction. Commercial spaces, institutional buildings, manufacturing units, and public works in the Middle East have seen an increase in construction activity. However, the increasing demand for remote work poses a significant obstacle to the expansion of the commercial real estate sector. The increasing acceptance of working from home has greatly impacted industry expansion in recent times. Businesses have reduced expenses by putting remote work policies in place, especially in densely populated city areas.

Browse key industry insights spread across 290 pages with 110 Market data tables and figures & charts from the report on the " Global Commercial Real Estate Market Size, Share, and COVID-19 Impact Analysis, By Type (Rental, and Sales), By Property (Offices, Retail, Leisure, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033."

Buy Now Full Report:

The rental segment is anticipated to hold the greatest share of the global commercial real estate market during the projected timeframe.

Based on the type, the global commercial real estate market is divided into rental and sales. Among these, the rental segment is anticipated to hold the greatest share of the global commercial real estate market during the projected timeframe. The rise in renters is a result of escalating home prices in developed nations, contributing to the expansion of this demographic. Market expansion is being propelled by the changing business landscape and the growing array of industries. The leading companies require office spaces, retail stores, and industrial buildings to efficiently carry out their activities and operations.

The offices segment is anticipated to hold the greatest share of the global commercial real estate market during the projected timeframe.

Based on the property, the global commercial real estate market is divided into offices, retail, leisure, and others. Among these, the offices segment is anticipated to hold the greatest share of the global commercial real estate market during the projected timeframe. Companies lease office spaces to conduct daily operations, administrative duties, and professional services. Factors such as location, building quality, amenities, and market demand typically influence the price of leasing office space.

Inquire Before Buying This Research Report:

Asia Pacific is expected to hold the largest share of the global commercial real estate market over the forecast period ..

Asia Pacific is expected to hold the largest share of the global commercial real estate market over the forecast period. The rise is primarily attributable to the growing number of individuals who own homes in the region. The surge in tourists in developing countries like India, the Philippines, Indonesia, Thailand, and Vietnam is projected to enhance market growth due to rapid economic development, urbanization, and evolving demographics in the region. China and Japan both have the largest real estate markets in the area, with a high demand for office, retail, and logistics properties.

North America is predicted to grow at the fastest pace in the global commercial real estate market during the projected timeframe. Several elements, such as a robust economy, low unemployment rates, and an expanding population, are accountable for this. Moreover, businesses can now easily engage in commercial real estate deals due to increased access to capital and low interest rates. The commercial real estate industry in North America is being fueled by growth in the technology sector. Businesses in this industry are growing quickly, leading to a need for additional office space. This has caused an increase in the demand for commercial real estate in the region. The growing preference for mixed-use developments is also a factor propelling the commercial real estate industry in North America.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market. Major vendors in the Global Commercial Real Estate Market include Brookfield Asset Management Inc., ATC IP LLC., Prologis, Inc., SIMON PROPERTY GROUP, L.P., Coldwell Banker, RE/MAX, LLC., Keller Williams Realty, Inc., CBRE Group, Inc., Sotheby's International Realty Affiliates LLC., Colliers, Boston Commercial Properties Inc., Dalian Wanda Group, DLF Ltd., Link Asset Management Limited, and other key companies.

Get Discount At @

Recent Developments

In October 2022 , M&G Plc's property sector purchased a top office building in Yokohama for over USD 700 million, part of the company's ongoing growth in Japan. M&G Real Estate bought the 21-story Minato Mirai Center Building for the M&G Asia Property Fund.

Key Target Audience

Market Players Investors End-users Government Authorities Consulting And Research Firm Venture capitalists Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Global Commercial Real Estate Market based on the below-mentioned segments:

Global Commercial Real Estate Market, By Type

Global Commercial Real Estate Market, By Property

Offices Retail Leisure Others

Global Virtual Warehousing Market, By Regional

North America Europe Germany UK France Italy Spain Russia Rest of Europe

Asia Pacific China Japan India South Korea Australia Rest of Asia Pacific

South America Brazil Argentina Rest of South America

Middle East & Africa UAE Saudi Arabia Qatar South Africa Rest of the Middle East & Africa

Browse Related Reports

Global Trade Surveillance Market Size, Share, and COVID-19 Impact Analysis, By Component (Solution, Services), By Deployment (On-Premise, Cloud), By Enterprise Size (Large Enterprises, SMEs), By End User (Banks, Institutional Brokers, Retail Brokers, Market Centers & Regulators, Others) and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032

Global B2B Payments Market Size, Share, and COVID-19 Impact Analysis, By Payment Type (Domestic Payments, and Cross-Border Payments), By Payment Method (Bank Transfer, Card, and Online Payments), By Verticle Type (BFSI, IT and ITES, Retail and E-commerce, Travel and Hospitality, Healthcare, Media and Entertainment, Transportation and Logistics, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033

Global Neobanking Market Size, Share, and COVID-19 Impact Analysis, By Account Type (Business account, Savings account), By Services (Mobile-banking, Payments, money transfers, savings, Loans, Others), By Application Type (Personal, Enterprises, Other applications), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032

Global Revenue Management Market Size, Share, and COVID-19 Impact Analysis, By Component (Solution, Services), By Solution (Billing & Payment, Price Management, Revenue Assurance & Fraud Management, Channel Management, Others), By Deployment Mode (On-premises, Cloud), By Organization Size (Large Enterprises, Small & Medium Enterprises), By Vertical (Telecom, Hospitality, Transportation, Healthcare, Retail & eCommerce, BFSI, Utilities, Others) and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: ... , ...

Contact Us:

Follow Us: LinkedIn | Facebook | Twitter

MENAFN04072024004107003653ID1108405864