Which Will Mess Up The Most Fed, BOJ Or PBOC?

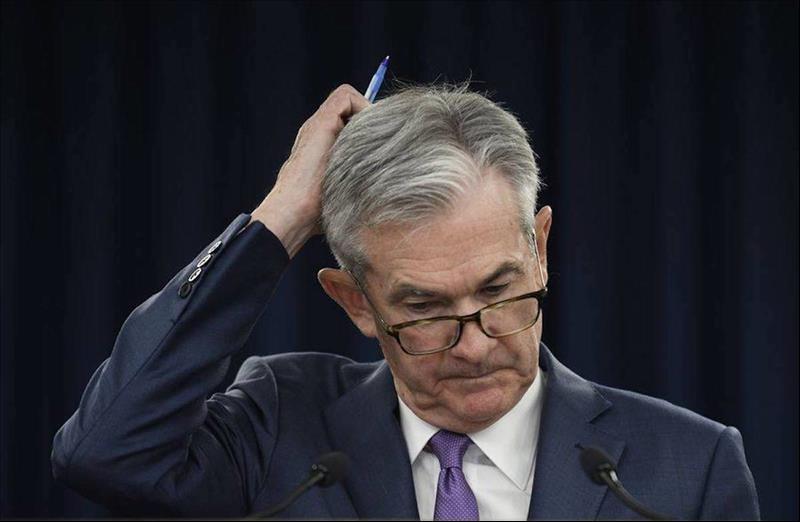

Traders have stopped laughing at former Treasury Secretary Lawrence Summers' contention the Fed's next step will be to tighten, not ease. There's little humor to be found in the Fed's dilemma as inflation gyrates, the dollar soars and US electioneering descends into chaos.

Loads of prominent economists still think Summers is dreaming. Among them is Mark Zandi, chief economist at Moody's Analytics.

“The Federal Reserve should cut interest rates – now,” Zandi argues.“The central bank's current higher-for-longer interest rate strategy – steadfastly holding the

federal funds rate that 's

directly controlled by the Fed at a high 5.5% – threatens to undermine the economy.”

Bill Dudley, former president of the Fed Bank of New York, thinks that would be a mistake.“Perhaps the Fed's mantra, instead of 'higher for longer,' should be 'higher indefinitely' until inflation moves more convincingly in the desired direction,” Dudley wrote on Bloomberg.

The Fed isn't the only central bank on the verge of what could be a serious policy mistake. The Bank of Japan and People's Bank of China also may have some serious explaining to do a year from now for errors committed today.

The BOJ, for example, has almost certainly lost its window to end quantitative easing and normalize interest rates. Since taking the helm in April 2023, BOJ Governor Kazuo Ueda has passed up every opportunity to pivot toward a less accommodative policy.

Now, as Japan's economy contracts – by 2.9% in the first quarter year on year – and inflation outpaces wage growth, it's an open question whether any hike rates will come in 2024.

As the BOJ dithers, the yen is extending its decline – down 15% so far this year – in ways that could upend world markets. It might cause other top Asian economies to depreciate exchange rates. And it could put Asia in an uncomfortable spotlight ahead of the US election in November.

The BOJ could conceivably mess up in both directions. Tapping the brakes too soon could send the economy into a deeper recession and roil markets as the yen surges. Act too slowly and Japan slides deeper into the QE quicksand, making it even harder to exit.

The PBOC faces a daunting balancing act all its own. As Asia's biggest economy slows, Governor Pan Gongsheng has been slow to lower borrowing costs. Many economists worry this caution is at odds with concerns about slowing economic growth.

In June, for example, mainland services activity grew at the slowest pace in eight months. The Caixin China services purchasing managers' barometer came in at a weaker-than-expected 51.2 versus 54 in May.

Such data add to worries that healthy export gains aren't translating into stronger domestic demand. Deflationary pressures remain a concern as China's property crisis continues to weigh on growth despite government efforts to stabilize the situation.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment