The Commodities Feed: Specs Boost Brent Longs

Oil prices gave back almost all of their gains in the early trading session on Friday after it became clear that Iran was downplaying Israel's limited retaliatory attack. However, what is quite surprising is despite the elevated risk and tension in the Middle East, oil prices do not appear to be overly concerned. ICE Brent settled almost 3.5% lower on the week. The market is obviously of the view that spare OPEC production capacity will come into play in the event of any supply shocks, or that ongoing tension is unlikely to lead to significant supply losses.

The US is in the process of imposing tougher oil sanctions against Iran following recent events. The US House of Representatives has passed these new sanctions as part of the broader foreign aid package. The new sanction measures will also need to pass through the Senate, which is expected to happen this week. While we expect the US to impose tougher sanctions, we will need to see if they will actually have an impact on flows. Iranian oil exports have trended higher since the Russia-Ukraine war, and the US appears to have not enforced current sanctions strictly.

Despite the move lower in crude oil, speculators boosted their net long in ICE Brent over the last reporting week. Speculators bought 30,997 lots to leave them with a net long of 334,932 lots as of last Tuesday. This is the largest position speculators have held since March 2021. The move over the week was driven by fresh buying rather than short covering. Positioning in NYMEX WTI moved in the opposite direction over the period, with speculators selling 34,253 lots to leave them with a net long of 203,897 lots. This move was largely driven by fresh shorts entering the market.

Given the weakness in middle distillates more recently, it isn't too surprising that speculators reduced their net long in ICE gasoil by 11,437 lots over the week to leave them with a net long of 81,125 lots as of last Tuesday. Middle distillates have become more bearish in recent weeks with inventory data in Europe, the US and Asia all looking a lot more comfortable. However, risks remain around Russian middle distillate supply, given the ongoing Ukrainian drone attacks on Russian refineries.

The latest data from Baker Hughes shows that US drillers increased their oil rig count by 5 over the week to 511. This is the highest number of active oil rigs since September last year when we saw WTI trading above US$90/bbl several times. However, the gas rig count was less positive, falling by 3 over the week to 106. The broader downward trend in the gas rig count shouldn't be too surprising given the weakness in US natural gas prices.

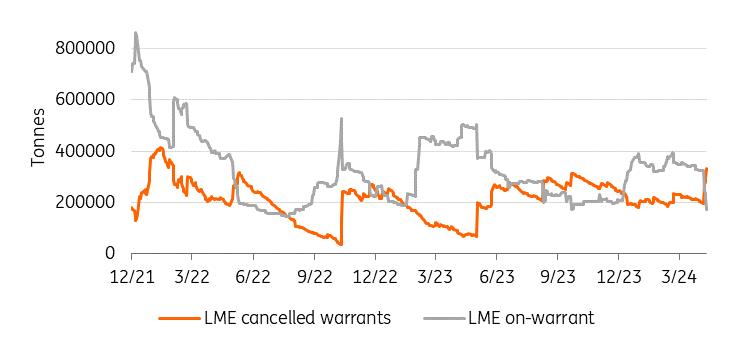

Metals - LME aluminium warrant cancellations surgeThe main focus for the aluminium market last week was the surge in LME warrant cancellations. On Friday, the total amount of cancelled warrants was reported at 332,800 tonnes, up 135,700 tonnes since the previous Friday. Most of the cancellations happened in Gwangyang, South Korea. LME stocks were last at 504,000 tonnes, down 17,600 tonnes from last Friday and down 37,350 tonnes since the start of April. This comes after the LME banned delivery of new Russian aluminium, copper and nickel following sanctions imposed by the US and UK. At the end of March, 91% of aluminium in the LME's warehouses system was of Russian origin. Although the ban doesn't prevent Russia from selling its metals to buyers outside the US or UK, it will still have an impact on the global trade of metals. We are likely to see some short-term upside support for prices. The LME aluminium price ended last week at the highest level since January 2023.

The latest positioning data from the CFTC shows that speculators increased their net longs of COMEX copper by 2,263 lots to 52,950 lots as of 16 April 2024, which is the largest position speculators have held since October 2021.

LME aluminium warrant cancellations surge

LME, ING Research

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment