Built in just 19 months in 2020-2021, the automated Tianjin port isn't just a means to send Chinese exports to the world. A high-definition video on an enormous curved screen in the visitor center reminds the visitor that the most important export item is the port itself. Tianjin was built to be cloned worldwide.

Call it the Sino-forming of world trade: Supply-chain bottlenecks due to port congestion, endemic in the Global South, can be alleviated by this artificial intelligence-driven system that dispatches cranes communicating on a 5G network, and empties a large container ship in just 45 minutes. At the biggest US port at Long Beach, California, unloading the same ship takes between 24 and 48 hours.

Crane operators that used to scrunch up in a booth at the top of their equipment now control the blue behemoths with joysticks from a remote tower, with each worker monitoring several machines. An AI algorithm works out the fastest route from ship to land transport.

This is China's“Field of Dreams.” Build it, and they will come is the essence of China's long-term strategy. The“it” in this case includes the world's largest 5G network, the world's newest and most efficient infrastructure and a national commitment to apply AI to the so-called Internet of Things, including manufacturing, transportation, logistics, medicine, urban management, and finance.

“They” are China's private entrepreneurs, who are slow to get past a series of speed bumps: the draconian 2022 Covid lockdowns, the government's crackdown on Alibaba and other Big Tech companies, and the freeze-up in China's property market, which is locking up a great deal of private capital.

The Fourth Industrial Revolution is underway in China, although its applications are limited to a few big installations. Some of the productivity gains are remarkable. Near Shenzhen, this writer visited an automated factory where Huawei manufactures thousands of 5G base stations a day, adding to the 2.3 million that China already has installed out of 3 million worldwide.

It has several assembly lines that each require 15 workers, compared to nearly 80 workers three years ago. Most of them are there to check that the automated assembly and testing equipment is doing its job properly; only one stage of assembly required human hands.

Latest stories

eris variant's spread shows covid not dead yet

punitive tax plan for western firms still in russia

can a ukrainian doggy meme fight the wolf warriors?

Detailed data isn't available, but China's auto industry-the world's biggest buyer of industrial robots-has achieved remarkable gains in efficiency, allowing BYD and SAIC to offer electric vehicles at a price of around US$10,000. That's less than China's per capita gross domestic product (GDP), and comparable to the $800 price at which Henry Ford sold his first Model T in 1908, cheap enough so that any modestly prosperous family could afford a car.

China exported more than a million vehicles in the first three months of 2023, overtaking Japan as the world's largest auto exporter, and its offerings at the low end of the EV price spectrum will help raise its market share in Europe as well as the Global South.

China's authorities know that the Fourth Industrial Revolution will stall unless private entrepreneurs embrace the new technologies. The national development and reform commission issued a July 24 directive calling on authorities at all levels to“mobilize the enthusiasm of private investment.”

Government bodies, the directive said, should“boost private investment confidence,”“focus on key areas and support private capital participation in major projects,” and“give full play to the important role of private investment.”

The NRDC will“select a group of enterprises with large market share and strong development potential,”“in line with the requirements of major national strategies and industrial policies” and“conducive to promoting high-tech enterprises.”

But the animal spirits of private entrepreneurs are not fired up by directives from bureaucrats, who aren't qualified to pick winners among private firms. Beijing's belated acknowledgment that China's economic future depends on private risk-taking isn't enough.

Chinese firms have to believe that the government won't repeat its 2020-2021 crackdown on Alibaba and other Big Tech companies. And Chinese households, who have about 10% of their assets in stocks and 70% in real estate, have to invest in technology instead of houses. None of that will change overnight.

In July, Huawei's Cloud division CEO, zhang pingan , unveiled Pangu, an AI system for a wide range of business applications. In contrast to ChatGPT and other so-called Large Language Models, the Huawei executive told the 6th World Artificial Intelligence Conference in Shanghai,“The Pangu model does not compose poetry, nor does it have time to compose poetry, because its job is to go deep into all walks of life, and help AI add value to all walks of life.”

Huawei's Zhang Pingan says Pangu will impact all walks of life. Image: Twitter

The platform is powered by Huawei's own Kunpeng chipset and Ascend AI processor. It's a do-it-yourself system for training AI models on proprietary data. Huawei Cloud offers its customers“large-scale industry development kits. Through secondary training on customer-owned data, customers can have their own exclusive industry large models,” the company said.

Although“Nvidia's V100 and A100 GPUs remain the most popular GPUs for training Chinese large-scale models,” a

recent study

notes,“Huawei used its own Ascend 910 processors” to train the Pangu model.

Second, China

appears able

to produce proprietary AI chips like Ascend, which requires 7-nanometer processors. US sanctions were supposed to prevent China from making 7nm chips for years, but Chinese chip fabricators appear to have worked around US restrictions-at a cost.

It's hard to tell through the fog of tech war whether and to what extent US tech sanctions are holding back China's rollout of business AI applications. Announcing Alibaba's better-than-expected second-quarter results on August 10, the company's cloud division ceo mentioned that a short-term shortage of GPUs was a constraint on growth.

How rapidly Chinese businesses will adopt AI systems such as Pangu and its competitors is hard to predict. Pangu's first commercial application to coal mining debuted in late July in a Huawei joint venture with Shandong Energy Group. Late in 2022, China's largest appliance maker Midea opened China's“first fully connected 5G smart factory,” according to a huawei video .

China's private entrepreneurs face some significant hurdles. It's hard to quantify them, but a couple of simple parameters are helpful. The price-earnings multiple of China's CSI 300 stock index is about 13, compared to 21 for America's S&P 500. Equity is much cheaper in China, which means that entrepreneurs pay a lot more for capital than their American counterparts.

The riskiness of the Chinese equity index, moreover, is nearly double that of the S&P 500. The implied volatility of options on MCHI, the broad Chinese stock market ETF that tracks the MSCI China Index, is now roughly 30%, compared to just 16% for the VIX index of implied volatility for the S&P 500.

As recently as 2021, the implied volatility of the US and China indices was roughly equal. China employed AI-based systems to track and predict Covid outbreaks in 2020 and 2021, and China's economy was the first to bounce back from the Covid recession. The more contagious strains of the virus defeated China's systems in 2022, and the government responded with prolonged lockdowns (see“china's avoidable covid crisis ,” Asia Times, May 13, 2022).

Another depressant is the continued upheaval in the property market, which in reality is a political standoff between the central government and local authorities who took on between RMB35 trillion and RMB70 trillion of so-called hidden debt.

The central government won't bail out the cities without assuming control of their finances. On paper, municipalities own enterprises with RMB205 trillion in assets, and on the whole are solvent, but the political tug-of-war will keep the property market in crisis mode for some time.

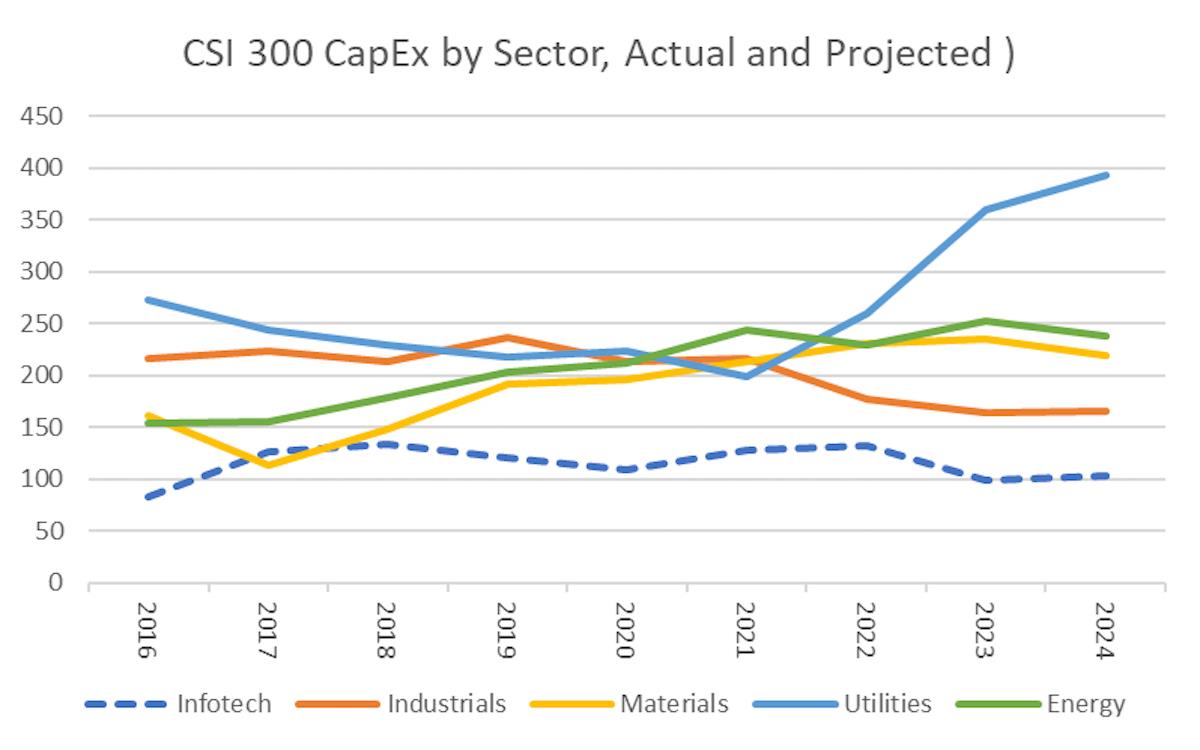

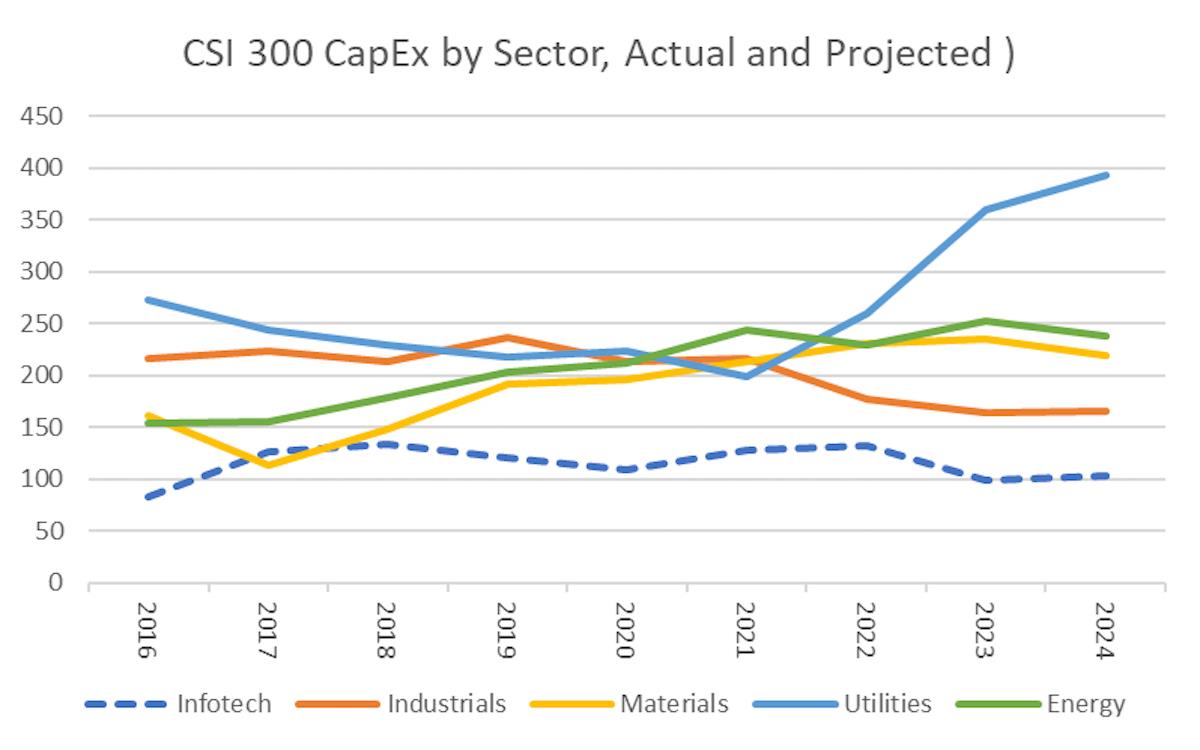

If we believe analysts' estimates for capital investment in China, private business remains cautious. Shown in the chart below are the Bloomberg consensus estimates for CapEx in several major sub-sectors of China's CSI 300 Index. The only big increases in expected spending are in energy and utilities, both dominated by state-owned enterprises. Industrial and information technology company CapEx plans remain subdued.

Graphic: Asia Times

The future of business AI, though, doesn't depend entirely on large-capitalization companies. AI is a force multiplier for small and medium businesses, a Huawei executive told me during a tour of the company's exhibition halls in Shenzhen.

Smaller shops can achieve very high efficiency in flexible manufacturing by applying AI to automated factories. Ultimately, industrial AI may incubate a new generation of manufacturing entrepreneurs, just as the internet upended retailing.

Huawei is a protean enterprise that is transforming itself from a telecom equipment maker into a global business facilitator. 5G2C (5G for consumers) is a mature business with limited growth prospects, and the company envisions a future based on 5G2B (5G for business), with a full suite of AI-based solutions.

Whether China's entrepreneurs will come to the“Field of Dreams” built on high-speed broadband and AI remains an open question, but it's still early days. As Alibaba and Huawei executives emphasize, the new Cloud-based AI systems just came online.

The political will and profit opportunities are visible, and China may yet surprise the world as much as it did during the 1990s and 2000s.

Follow David P Goldman on Twitter at @davidpgoldman

Like this:Like Loading... Related

Comments

No comment