Judging from the large number of exhibitors and wide range of technologies presented at the events, it is obvious that the global semiconductor industry is endeavoring to maintain cohesion despite the interference and interventions of tech war-agitating politicians.

SEMICON China 2023 was held at the Shanghai New International Expo Center from June 29 to July 1, attracting a record 1,100 exhibitors from China, Japan, Korea, Europe and the US.

Related forums discussed integrated circuit (IC) manufacturing technology and supply chain issues, automotive IC design, power and compound semiconductors, carbon neutrality and sustainability, and workforce development.

It was the largest of the regional SEMI exhibitions, which in the words of its sponsor was“a key enabler of collaboration and innovation across the entire electronics supply chain including chip design, manufacturing, assembly and test, equipment and materials.”

The exhibition was preceded by the China Semiconductor Technology International Conference (CSTIC), organized by SEMI and the Institute of Electrical and Electronics Engineers (IEEE) together with the Institute of Microelectronics, Chinese Academy of Sciences.

The conference featured symposiums covering manufacturing processes, systems integration, materials, equipment, device and circuit design, and emerging semiconductor technologies.

Topics such as artificial intelligence, 6G, neuromorphic computing, advanced memory, 3D integration and Micro Electro Mechanical Systems (MEMS) were also addressed.

Sponsors included Advanced Micro-Fabrication Equipment (AMEC), Naura and Anji from China; Tokyo Electron and Fujifilm from Japan; ASM, Edwards and Zeiss from Europe; Applied Materials, Lam Research and KLA from the US; and ACM Research, which was founded in California but now conducts most of its product development, manufacturing and service activities through its subsidiary in Shanghai.

ACM Research owns an extensive patent portfolio in deposition and photoresist processing, single wafer and batch wet cleaning, electroplating, stress-free polishing, wafer manufacturing and packaging. It remains active in North America and also has operations in Europe, South Korea and elsewhere in Asia.

ACM Research's example shows how difficult actual decoupling might be and how much semiconductor-related technology is already available in China.

Latest stories

how hun manet will differ from his father

turkey once again turning its face toward the west

how china sees russia's wagner fiasco

Chip-makers and chip-making equipment firms showed their wares and discussed latest industry trends at SEMICON events. Image: Facebook

AMEC makes etch and deposition equipment. It has gained traction both in China and overseas, notably with Taiwan's TSMC, the world's largest chip producer. AMEC recently won a legal battle in a Shanghai court against Lam Research, which had accused it of infringing on its etch-related patents.

The diversified Naura Technology Group makes etch, deposition, oxidation/diffusion, cleaning, annealing and other types of semiconductor production equipment.

Preliminary figures from AMEC and Naura indicate that their profits more than doubled year-on-year in the six months to June on sales growth of nearly 30% for AMEC and more than 60% for Naura.

This performance is attributed to US sanctions, which have led Chinese semiconductor makers to turn to domestic equipment makers.

Anji Microelectronics manufactures chemical mechanical polishing (CMP) slurries, post-CMP and post-etch cleaning solutions, photoresist strippers and other wet chemicals and additives used in the semiconductor manufacturing process.

SEMICON West 2023, North America's most prominent microelectronics exhibition and conference, was held from July 11 to 13 at the Moscone Center in San Francisco.

Its overarching themes were supply chain disruptions, climate change and sustainability, and talent shortages – issues key to the long-term growth of the semiconductor industry.

Government investment in chip manufacturing, smart manufacturing with data and AI, heterogeneous design and integration using advanced packaging technology, smart mobility, smart medtech and other topics were also addressed.

Advanced packaging received particular attention from Interuniversity Microelectronics Centre (imec), Applied Materials and others.

Cerebras Systems of Sunnyvale, California, won the 2023 SEMI Award for North America for process and technology integration for developing the world's largest integrated circuit chip for complex artificial intelligence (AI) computation applications training with very large AI databases.

As reported in the daily SEMICON digest on July 12, Cerebras,“implemented wafer-scale integration with advanced packaging and system design for AI and other deep-learning applications as standalone units and in clusters for large-scale data centers.”

The Design Automation Conference (DAC) 2023, which ran from July 9 to 13, was held across the street from SEMICON West. DAC exhibitors and participants covered electronic design automation, artificial intelligence and machine learning, embedded systems and software, automotive applications, RISC-V, and intellectual property and data security issues. Both events were crowded, with attendance reaching pre-Covid levels.

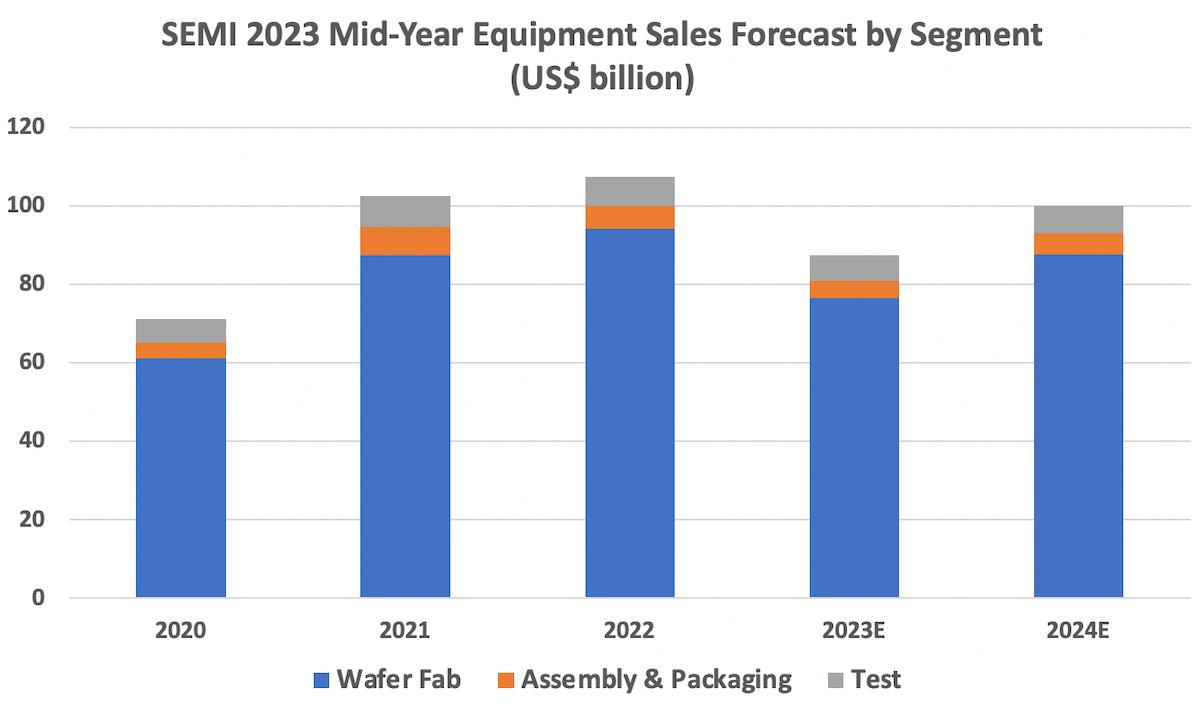

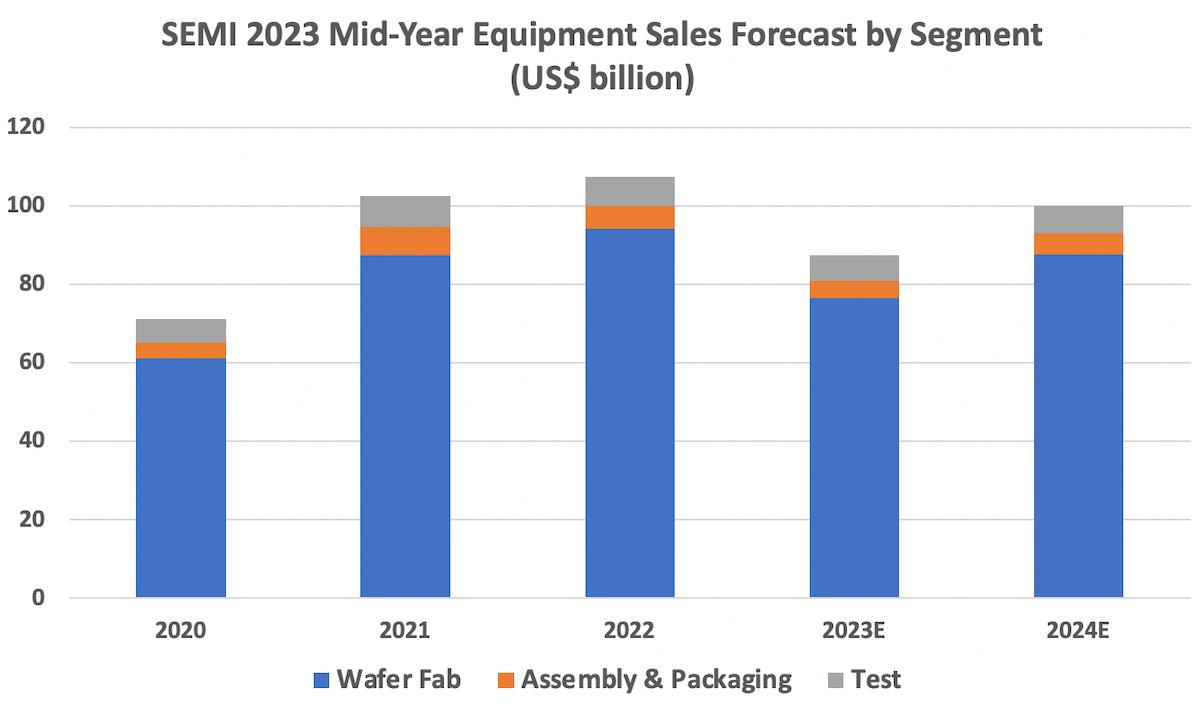

SEMI also released its mid-year semiconductor equipment forecast at SEMICON West, predicting an 18.6% decline in total sales of wafer fab, assembly & packaging, and test equipment to US$87.4 billion in calendar 2023, followed by a 14.4% rebound to an even $100 billion in 2024.

Forecasting a big round number would seem to indicate a fair amount of uncertainty, but SEMI is not alone in this regard.

SEMI did not publish a forecast for 2025, but its president and CEO, Ajit Manocha, said“Projections for robust long-term growth driven by high-performance computing and ubiquitous connectivity remain intact.”

Manocha, formerly CEO at GlobalFoundries, added that“Despite current headwinds, the semiconductor equipment market is set to see a strong rebound in 2024 after an adjustment in 2023 following a historic multi-year run.”

Sales of wafer fab equipment – including wafer processing, clean room and other facilities and mask/reticle equipment – are forecast to drop 18.8% to $76.4 billion in 2023 and then rebound by 14.8% in 2024, accounting for a fairly steady 87-88% of the total.

Sales of assembly & packaging equipment are expected to be more volatile and sales of test equipment less so, but they have a relatively small impact on the overall trend in capital spending.

The cycle is being driven by memory chips. Equipment sales to makers of NAND flash memory are forecast to drop by 51% to $84 billion this year and then rebound by 59% to $13.3 billion in 2024.

DRAM equipment sales, meanwhile, are forecast to drop by 28% to $8.8 billion this year and rebound by 31% to $11.6 billion in 2024.

Logic IC and foundry related demand is much more stable. It is forecast to decline by 6% to $50.1 billion this year and then rise by 3% to $51.6 billion in 2024.

China, Taiwan and South Korea remain the three largest markets for semiconductor equipment. SEMI expects Taiwan to take the lead this year and China to regain it in 2024.

SEMI data; Asia Times chart

The Semiconductor Equipment Association of Japan (SEAJ) has cut its sales forecast for fiscal 2023 (ends March 2024) from -5% to -23%.

The downturn has turned out to be more severe than the SEAJ had originally anticipated and reality has set in as fantasies about the metaverse and a quick rebound in PC and smartphone sales have faded.

Tokyo Electron, Japan's leading semiconductor production equipment maker, had been touting a concept called MAGIC (metaverse, autonomous vehicles, green energy, IoT & information, and communications).

Now, CEO Toshiki Kawai, who is also chairman of the SEAJ, says the recovery of memory demand has been slower than initially expected.

Meanwhile, Samsung's DRAM production is at a two-year low and, according to reports from South Korea, is likely to remain subdued for the rest of this year, with capacity expansion pushed out until there are clear signs of recovery in demand.

The SEAJ now expects semiconductor capital spending to come roaring back stronger than ever in fiscal 2024 and 2025, with rises in sales of Japanese equipment of 30% next year and 10% the year after catapulting the industry to new record highs.

It its view, the metaverse has been replaced by ChatGPT, electric vehicle and renewable energy demand remains strong, and a smart phone replacement cycle appears to have begun.

SEAJ data; Asia Times chart

A forecast must be made, but that doesn't mean it will turn out to be correct. A year ago, the SEAJ forecast 3.7% sales growth for fiscal 2023.

And it remains to be seen how sanctions on China and China's retaliatory restrictions on exports of the niche chip-making metals gallium and germanium might drag down sales over the coming year.

Follow this writer on

Twitter: @ScottFo83517667

Like this:Like Loading... Related

Comments

No comment