(MENAFN- The Peninsula) The Peninsula

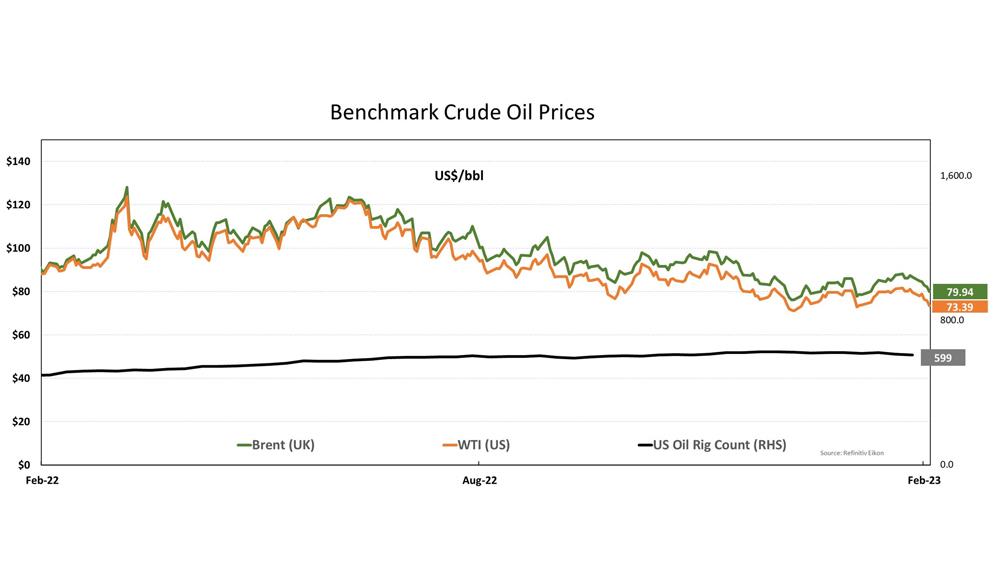

Doha: Oil prices fell to over three-week lows on Friday in a volatile session, after strong US jobs data raised concerns about higher interest rates and as investors sought more clarity on the imminent EU embargo on Russian refined products. Brent crude futures fell $2.23 to $79.94 a barrel, US West Texas Intermediate crude (WTI) ended down $2.49 at $73.39. Brent registered a 7.8 peercent decline this week while WTI dropped 7.9 percent.

US job growth accelerated sharply in January amid a persistently resilient labour market, but a further moderation in wage gains should give the Federal Reserve some comfort in its fight against inflation. The US central bank on Wednesday scaled back to a milder rate increase than those over the past year, but policymakers also projected that“ongoing increases” in borrowing costs would be needed. Increases in interest rates in 2023 are likely to weigh on the US and European economies, boosting fears of an economic slowdown that is highly likely to dent global crude oil demand.

Meanwhile, European Union countries agreed to set price caps on Russian refined oil products to limit Moscow's funds for its invasion of Ukraine, the Swedish presidency of the EU said on Friday.

Prices of Asian spot liquefied natural gas eased for a seventh consecutive week, falling to a near one-and-a-half year low, amid ample inventories in North Asia and Europe. Industry sources estimated the average LNG price for March delivery into Northeast Asia at $18.50 per million British thermal units (mmBtu), its lowest levels since August 2021.

This is $1, or 5.1 percent, lower than the previous week, and down 34 percent since the start of the year.

Both Europe and North Asia are expected to exit winter with comfortable gas storage cushions and are not under pressure for prompt procurement, analysts said. Amid easing spot prices, some energy companies in Asian emerging markets such as Thailand's PTT as well as GAIL Ltd and Petronet from India began seeking cargoes for delivery during February to April.

In the US, natural gas futures slid about 2 percent to a 25-month low on Friday on forecasts for milder winter weather than expected over the next two weeks, and lower heating demand.

Meanwhile, expectations that the Freeport LNG export plant in Texas could start pulling in big amounts of gas as it restarts LNG production in the coming weeks, are improving sentiment and softer prices.

Comments

No comment