(MENAFN- ValueWalk)

Q4 2020 hedge fund letters, conferences and more

Black And Latino Small Business Owners Had Less Access To Lease And Loan Modifications

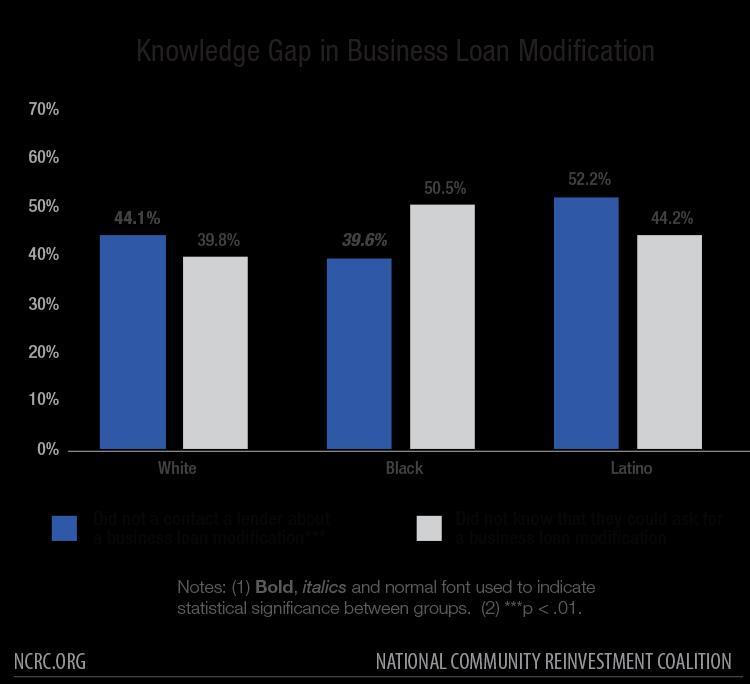

The federal government's Paycheck Protection Program provided forgivable loans to help businesses survive the COVID-19 economic collapse. But that wasn't enough. About four million small businesses closed permanently in 2020, and many needed other options, like modifications to outstanding loans and credit card debt. New research from the National Community Reinvestment Coalition (NCRC) found that Black and Latino small business owners had less access to those options than White small business owners.

DG Value Adds 23.7% In 2020, Plans New SPAC Fund

Dov Gertzulin's DG Value Funds returned approximately 19.2% in the quarter ending December 31, 2020, according to a copy of the hedge fund's full-year 2020 letter to investors, a copy of which ValueWalk has been able to review. Following the fourth-quarter performance, DG's flagship value strategy ended 2020 with a positive return of 23.7%. That Read More

NCRC surveyed 938 small business owners across nine metropolitan areas from October 23, 2020, to December 29, 2020. The purpose of the survey was to determine whether small business owners explored other options, such as lease and loan modifications to save their businesses, and if so, did they access them.

The survey found significant differences in the rates at which Black, White and Latino small business owners contacted lenders to inquire about credit product modifications, and in the rates of approvals of loan modifications. White small business owners received modification approvals at a significantly higher rate (26.7%) than Black (10.9%) and Latino (12.0%) small business owners who contacted commercial financial institutions.

Rooting Out Discrimination

'These troubling findings underline the need for financial institutions to strengthen their internal systems to root out discrimination that still pervades the lending experience for borrowers,' said Jesse Van Tol, CEO of NCRC. 'Regulators need to strengthen their enforcement of fair lending laws, banks need to scrutinize their lending files for evidence of discrimination, and they need to incorporate rigorous testing and training programs to ensure compliance with fair lending laws. Our findings also highlight the need to expand access to education for small business owners.'

In addition to the differences in access to and approval of loan modifications, NCRC found that White small business owners had significantly more access to business credit cards and business lines of credit than Black and Latino small business owners.

NCRC previously found evidence of discrimination in how banks responded to PPP loan inquiries.

Read the full report here by NCRC.org

MENAFN03022021005205011743ID1101537641

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.