The $100 billion example Japan needs to follow

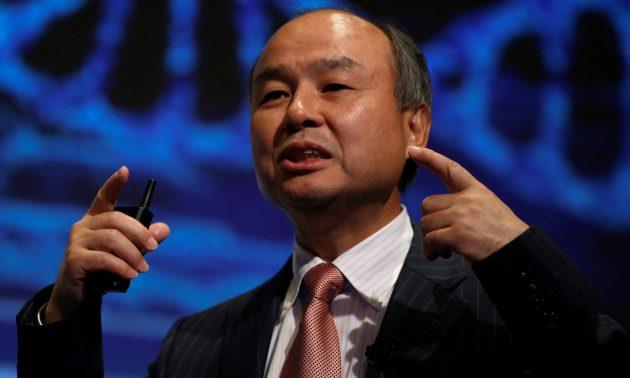

For the first time in 30 years, venture capitalists in the US and Europe are baffled by the scale, frequency and diversity of investments coming out of Japan. Well, at least the aggressive bets of one man: Masayoshi Son.

The decision by Japan's richest man -– and his nearly $100 billion investment fund — to into New York startup WeWork on Thursday adds to the sense of disorientation.

The DailyBrief Must-reads from across Asia - directly to your inboxSon's $4 billion gamble on chipmaker Nvidia, $3.3 billion wager on Fortress Investment and his $5 billion infusion into Chinese Uber rival Didi Chuxing are all so, well, un-Japanese.

After decades of debt crises, deflation and lost competitiveness, Japan Inc. found caution to be a virtue. Son, who founded SoftBank, is going the other way, offering timely lessons for Asia's No. 2 economy.

Since December 2012, much of corporate Japan has waited for Prime Minister Shinzo Abe to revive the economy.

His much-hyped Abenomics plan sought to loosen labor markets, spur innovation, increase productivity and tweak tax priorities in favor of startups. But Abe put few wins on the scoreboard.

His biggest success is tightening corporate governance. Those rather modest return-on-investment upgrades, though, are marred by scandals surrounding Takata's deadly airbags, Toshiba's accounting practices and Tokyo Electric Power Co.'s glacial nuclear cleanup efforts in Fukushima.

Son isn't waiting for Abe, a leader more interested in rewriting the postwar constitution than structural reform.

In May, Son rolled out the gargantuan Vision Fund to put his proverbial money where his mouth is. Not since the 1980s, arguably, has Japan racked up so many banner headlines for overseas acquisitions, and Son is the vanguard.

Things didn't necessarily work out last time. In the 1980s, Japan's magnates overpaid for trophy purchases of California's Pebble Beach golf course, Manhattan's Rockefeller Center, Hollywood's Universal Studios and any Monet, Picasso and Modigliani on auction.

This latest wave, though, is about tapping growing markets abroad as Japan's population shrinks. Uniqlo Brand's Fast Retailing, convenience-store chain Lawson, e-commerce giant Rakuten, beverage giant Kirin and others are scouring the globe for market share and profits.

No one has been more audacious than Son, 60. His 2006 Vodafone deal and 2013 purchase of Sprint Nextel for $22 billion had Japan Inc. fearing Son had lost his mind.

No one has been more audacious than Son, 60. His 2006 Vodafone deal and 2013 purchase of Sprint Nextel for $22 billion had Japan Inc. fearing Son had lost his mind.

His turnaround efforts are getting Warren Buffett's attention. Last month, the Wall Street Journal reported that the Sage of Omaha is eyeing some kind of Sprint deal.

Son's $32 billion purchase of U.K. designer ARM Holdings was another think-out-of-the box transaction.

And let's not forget the spectacular 2000 bet Son made on a Chinese school teacher-turned-tech-titan named Jack Ma. By 2014, that $20 million Alibaba investment paid off to the tune of $50 billion.

Obviously, Japan needs more of this kind of audacity. Son isn't waiting for Abe to deregulate the economy, he's doing it for himself and creating the pockets of dynamism Abenomics was supposed to.

Japan Prime Minister Shinzo Abe.He's also single-handedly financing a startup boom. It's a work in progress, of course. But Son's Vision Fund may inspire other billionaires to follow suit, vastly increasing his $100 billion of firepower and creating a multiplier effect.

Son raised Vision Fund cash from Abu Dhabi, Apple, Qualcomm and Saudi Arabia.

While much of it will be deployed abroad, Son is targeting a domestic industry with vast potential to create millions of high-paying jobs: renewable energy.

The March 2011 devastation in Fukushima is a live issue; radiation is still leaking 150 miles north of Tokyo. Son is one of the few leaders in Japan willing to admit nuclear reactors have no future in the seismically-active nation.

He also understands that no business opportunity is greater than inventing ways for China, India, Indonesia and others to rise without choking on pollution.

Abe's team should follow Son's lead. Instead, pro-nuclear bureaucrats are stymying his efforts to fuel a solar renewable energy boom — on which Son is spending tens of billions of dollars — by restricting access to Japan's power grids.

Abenomics needs a serious rethink, and Son is just the guy to help Tokyo do it.

Comments

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.

Comments

No comment