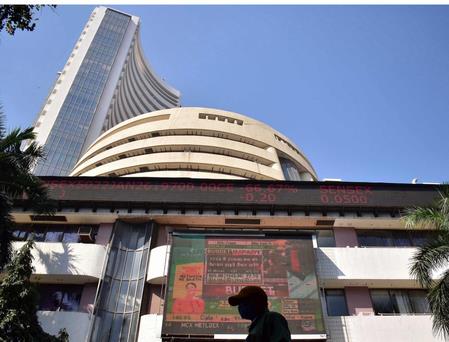

Sensex, Nifty End Lower After Volatile Session

Markets also remained cautious amid mixed global cues following a US military operation in Venezuela that resulted in the capture of President Nicolas Maduro.

At the close of trade, the Nifty ended at 26,250.30, slipping 78.25 points or 0.3 per cent.

“The 26,300–26,350 band now stands as a key overhead resistance; a decisive and sustained breakout above this range could revive bullish momentum and open the path toward 26,500 in the near term,” an analyst said.

“On the downside, a clear break below 26,200 may invite a corrective move toward 26,050–26,000,” according to the analyst.

The Sensex also finished in the red, settling at 85,439.62, down 322.39 points or 0.38 per cent.

Earlier in the day, markets had moved higher, with the Nifty touching a fresh record high of 26,373.20.

However, the gains were short-lived as investors booked profits at higher levels, leading to a pullback in the latter half of the session.

Heavyweight stocks such as HDFC Bank, Infosys, HCLTech, Bajaj Finance and TCS were among the top losers on the Sensex, dragging the benchmark indices lower.

On the other hand, shares of Bharat Electronics, Hindustan Unilever, Tata Steel, UltraTech Cement and Axis Bank provided some support and ended the day as top gainers.

The broader market showed a mixed trend. The Nifty Midcap index ended marginally lower by 0.16 per cent, while the Nifty Smallcap index declined by 0.53 per cent.

On the sectoral front, technology and oil and gas stocks saw the maximum pressure, with the Nifty IT and Nifty Oil and Gas indices falling around 1 per cent each.

In contrast, real estate stocks outperformed the market, as the Nifty Realty index rose over 2 per cent.

FMCG and consumer durable stocks also ended higher -- reflecting continued buying interest in defensive and consumption-driven sectors.

Looking ahead, Q3 earnings will dominate focus and guide near-term market trends, with sentiment remaining moderately positive, market watchers stated.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment