Kodiak Reaches Key Milestone With Initial Mineral Resource Estimate At The MPD Copper-Gold Project

| MPD Initial Mineral Resource Estimate | |||||||||||

| Zone | Resource Category | Tonnes | Average Grade | Metal Content | Date Reported | ||||||

| | | (Mt) | Cu (%) | Au (g/t) | Ag (g/t) | CuEq (%) | Cu (Mlbs) | Au (Moz) | Ag (Moz) | CuEq (Mlbs) | |

| Gate | Indicated | 56.4 | 0.31 | 0.14 | 1.18 | 0.42 | 385 | 0.25 | 2.14 | 522 | 2025-06-25 |

| West | Indicated | 14.2 | 0.21 | 0.24 | 0.80 | 0.37 | 66 | 0.11 | 0.37 | 116 | 2025-12-09 |

| South | Indicated | 12.3 | 0.25 | 0.07 | 1.17 | 0.30 | 68 | 0.03 | 0.46 | 82 | 2025-12-09 |

| Gate | Inferred | 114.5 | 0.27 | 0.13 | 1.07 | 0.36 | 681 | 0.48 | 3.94 | 909 | 2025-06-25 |

| Ketchan | Inferred | 66.0 | 0.24 | 0.12 | 1.09 | 0.33 | 349 | 0.25 | 2.31 | 480 | 2025-06-25 |

| Dillard | Inferred | 51.9 | 0.20 | 0.09 | 0.39 | 0.26 | 229 | 0.15 | 0.65 | 298 | 2025-06-25 |

| Man | Inferred | 8.3 | 0.17 | 0.30 | 0.56 | 0.37 | 31 | 0.08 | 0.15 | 68 | 2025-06-25 |

| West | Inferred | 24.7 | 0.22 | 0.20 | 0.77 | 0.36 | 120 | 0.16 | 0.61 | 196 | 2025-12-09 |

| Adit | Inferred | 20.1 | 0.34 | 0.03 | 2.79 | 0.38 | 151 | 0.02 | 1.80 | 168 | 2025-12-09 |

| South | Inferred | 70.9 | 0.21 | 0.06 | 1.25 | 0.26 | 328 | 0.14 | 2.85 | 406 | 2025-12-09 |

| Total Indicated | 82.9 | 0.28 | 0.15 | 1.11 | 0.39 | 519 | 0.39 | 2.97 | 719 | 2025-12-09 | |

| Total Inferred | 356.3 | 0.24 | 0.11 | 1.07 | 0.32 | 1,889 | 1.28 | 12.31 | 2,524 | 2025-12-09 |

Notes:

1. The Mineral Resources were estimated using the Canadian Institute of Mining, Metallurgy and Petroleum (CIM), Definition Standards for Mineral Resources and Reserves, as prepared by the CIM Standing Committee and adopted by CIM Council.

2. A cut-off grade of 0.2% CuEq was applied to the MRE models within the pit shells.

3. Pit shell optimization used average recoveries derived from metallurgical test work of Cu 82%, Au 60% and Ag 54%, exchange rate of 1.35 CAD:USD, mining cost of C$2.3/t, process cost of C$8.5/t, and pit slope of 45 degrees.

4. Copper equivalence (CuEq) and constraining pit shells assume metal prices (US$) of: $4.2/lb copper, $2,600/oz gold, $30/oz silver.

5. The copper equivalency equation used is: CuEq(%) = Cu(%) + Au(g/t) x 0.6606 + Ag(g/t) x 0.0069

6. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. There is no certainty that all or any part of the mineral resources will be converted into mineral reserves in the future. The MRE may be materially affected by considerations including, but not limited to, permitting, legal, sociopolitical, environmental issues, market conditions or other factors.

7. All figures are rounded to reflect the relative accuracy of the estimate. Totals may not sum due to rounding as required by reporting guidelines.

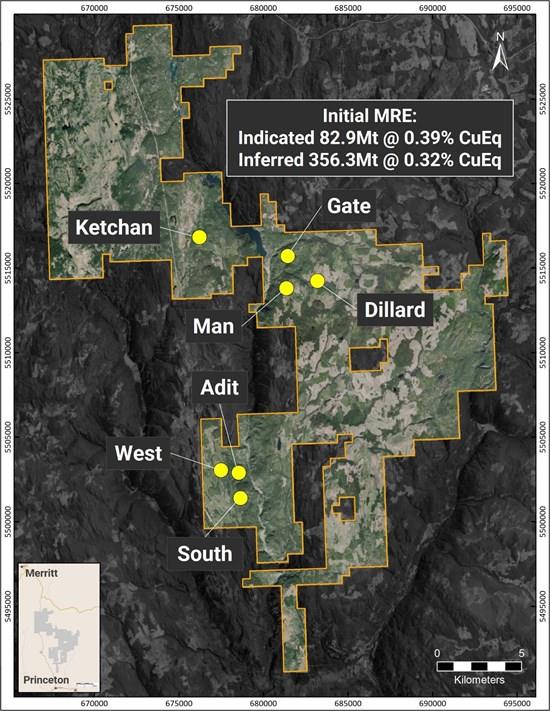

Figure 2: MPD Project -Aerial View of Mineral Resource Block Models and associated RPEEE 3D pit shells

To view an enhanced version of this graphic, please visit:

Figure 3: MPD Project - Underground view of Mineral Resource Block Models and associated RPEEE 3D pit shells

To view an enhanced version of this graphic, please visit:

Sensitivity Cut-off Grades

In addition to the base case cut-off grade ("COG") of 0.2% CuEq a range of cut-off grades from 0.12% to 0.22% CuEq were applied to the Resource models to evaluate the potential effect on tonnage, grade and metal content (Table 2). Lower cut-off grade sensitivity cases demonstrate a notable increase in tonnage and in-situ metal, with a decrease in average grades. The values in the COG sensitivity cases are for comparison purposes only and should not be considered Mineral Resources.

Table 2: Cut-Off Grade Sensitivity Summary

| MPD Initial Mineral Resource Estimate & Cut-Off Grade Sensitivity Scenarios | ||||||

| Cut-Off Grade | Indicated | Inferred | ||||

| (CuEq %) | Tonnes (Mt) | CuEq (%) | CuEq (Mlbs) | Tonnes (Mt) | CuEq (%) | CuEq (Mlbs) |

| 0.22 | 73.4 | 0.42 | 674 | 297.5 | 0.34 | 2,237 |

| 0.20 | 82.9 | 0.39 | 719 | 356.3 | 0.32 | 2,524 |

| 0.18 | 92.4 | 0.37 | 747 | 424.0 | 0.30 | 2,830 |

| 0.15 | 107.1 | 0.34 | 806 | 537.7 | 0.27 | 3,216 |

| 0.12 | 120.6 | 0.31 | 838 | 657.1 | 0.24 | 3,551 |

Notes: 1. Copper equivalence (CuEq) assumes metal prices (US$) of: $4.2/lb copper, $2,600/oz gold, $30/oz silver.

2. CuEq is based on average recoveries derived from metallurgical test work as applied in the pit optimization process. Average recoveries are: Cu 82%, Au 60% and Ag 54%.

3. The copper equivalency equation used is: CuEq(%) = Cu(%) + Au(g/t) x 0.6606 + Ag(g/t) x 0.0069

Next Steps

Kodiak is actively advancing the MPD Project through the following key work streams and upcoming catalysts in 2026:

- File NI 43-101 Technical Report on SEDAR+ - Q1 Metallurgical test results - Q1 Soil results and drill targets - Q1 Resource expansion drilling - Q2 onwards Exploration drilling, testing new targets - Q2 onwards Geophysical programs - Q2 onwards Resource update - Q1 2027 Ongoing structural studies Continued environmental baseline studies Ongoing engagement with indigenous rightsholders and local stakeholders

Estimation Methods for the South, West and Adit Deposits

The Resource estimate was completed by James N. Gray, P.Geo. of Advantage Geoservices Ltd., an Independent Qualified Person as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects (NI 43-101) in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Standards on Mineral Resources and Mineral Reserves, adopted by CIM Council, as amended. Estimation methods for the South, West and Adit deposits are summarized below. The estimation methods for the Gate, Man, Dillard and Ketchan deposits are presented in the June news release (see news release June 25, 2025 ).

The West, Adit and South Resource estimates are controlled by lithology and alteration models based on a three-dimensional interpretation of drill results. Where appropriate, structural features were also included in the geological models. A total of 135 holes, completed by Kodiak and previous operators through 2025, have been used for grade estimation; 50 holes at West, 31 at Adit, and 54 at South. Sixty-seven of the 135 core holes drilled were completed under the supervision of Kodiak. To appropriately control the impact of outliers on copper, gold, and silver distributions, minor high-grade capping was applied to assay values prior to compositing at a length of three metres. Grades at all three project areas were estimated by inverse distance weighting. Block size was 10 x 10 x 10 metres for each deposit. Average rock densities were applied based on models of lithology. A total of 2,074 density measurements from core samples was used to assign average block densities. Bulk density values average 2.69 tonnes/m3 at West, 2.60 tonnes/m3 at Adit and 2.73 tonnes/m3 at South.

Block models were classified based on calculated drill spacing. Blocks were assigned as an Inferred Mineral Resource where drill spacing was less than 150 metres. At West and South, where more drill information has allowed a higher degree of confidence in the geologic model, blocks at a drill spacing of up to 70 m have been classified as Indicated.

Reasonable prospects of eventual economic extraction (RPEEE) were established by JDS Energy & Mining Inc ("JDS") to constrain the MRE. To consider the RPEEE, JDS produced Lerchs-Grossmann optimized pit shells at each project area using the following parameters: Cu US$4.2/lb, Au US$2,600/oz, Ag US$30/oz, an exchange rate of 1.35 CAD:USD, average recoveries of: 82% Cu, 60% Au and 54% Ag, slope of 45°, mining cost of C$2.30/t and an average process cost of C$8.50/t (including G&A). Recovery assumptions were determined by JDS from the initial metallurgical testwork conducted earlier this year. All material included in the MRE is contained within the optimized pit shells.

Quality Assurance and Quality Control procedures employed by Kodiak for the laboratory analysis of drill core included the inclusion of certified standards, blanks and duplicates. All Kodiak samples were sent for analysis to either ALS Canada Ltd or Activation Laboratories Ltd, both of which meet all requirements of International Standards ISO/IEC 17025:2005 and ISO 9001:2015. The historic results included in the Mineral Resources were reviewed and are believed to be from reliable sources using industry standards at the time, however the company has not independently verified, or cannot guarantee, the accuracy of historical information. The historical results will be summarized in the accompanying NI 43-101 technical report.

Qualified Person

The MRE was prepared by James Gray, P.Geo., of Advantage Geoservices Ltd., with contributions from Tysen Hantelmann, P.Eng., of JDS Energy & Mining Inc. for cut-off grade and Pit Shell optimization and Shane Tad Crowie, P.Eng., of JDS Energy & Mining Inc., for metallurgical parameters, in accordance with the 2014 Canadian Institute of Mining, Metallurgy and Petroleum Definition Standards and Canadian National Instrument 43-101 ("NI 43-101"). James Gray, Tysen Hantelmann and Shane Tad Crowie, are independent Qualified Persons as defined by NI 43-101 and have reviewed and approved the contents of this news release. Dave Skelton, P.Geo. (AB), Vice President Exploration and a Qualified Person as defined by National Instrument 43-101, has approved and verified the technical information used in this news release. The historic work referenced herein is believed to be from reliable sources using industry standards at the time, based on Kodiak's review of available documentation. However, the Company has not independently validated all historic work, and the reader is cautioned about its accuracy.

On behalf of the Board of Directors

Kodiak Copper Corp.

Claudia Tornquist

President & CEO

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment