Bitcoin Falls To $107K Amid Tech Stock Slump Over AI Fears

- Bitcoin's technical charts point to a possible decline towards $103,800, with a final move below $100,000 being a likely short-term scenario. Growing concerns about the speculative nature of the crypto market persist, especially amid record-high CAPEX plans from Big Tech for AI infrastructure. Market sentiment is cautious as geopolitical issues, including US-China trade tensions, continue to cast a shadow over investor confidence.

Bitcoin (BTC ) experienced a sharp sell-off toward the end of the month, dropping to $107,328 shortly after the New York market opened, before hitting an intraday low of $106,800. This decline mirrors similarly weak signals in U.S. equities, where the S&P 500 and Nasdaq Composite experienced minor losses despite stellar third-quarter earnings from leading Tech firms. The dissonance highlights the fragility of the current rally in both traditional and crypto markets.

Notably, the“Magnificent Seven” giants - Meta and Microsoft - saw their share prices decline by approximately 10% and 3%, respectively. Investors expressed skepticism over Big Tech's push into AI, with Meta increasing capital expenditure to an estimated $70–$72 billion and Alphabet forecasting up to $93 billion - raising questions about whether these investments are sustainable or indicative of overexuberance in the tech sector.

BTC, SPX, QQQ 4-hour chart. Source: TradingViewAdding to the market's cautious outlook, the optimism surrounding President Trump 's meeting with Chinese President Xi Jinping appears muted. Beyond a slight reduction in tariffs related to fentanyl and a one-year delay on China's rare earth export bans, few concrete details have emerged about negotiations, leaving the persistent US-China trade tensions as a significant risk factor for markets.

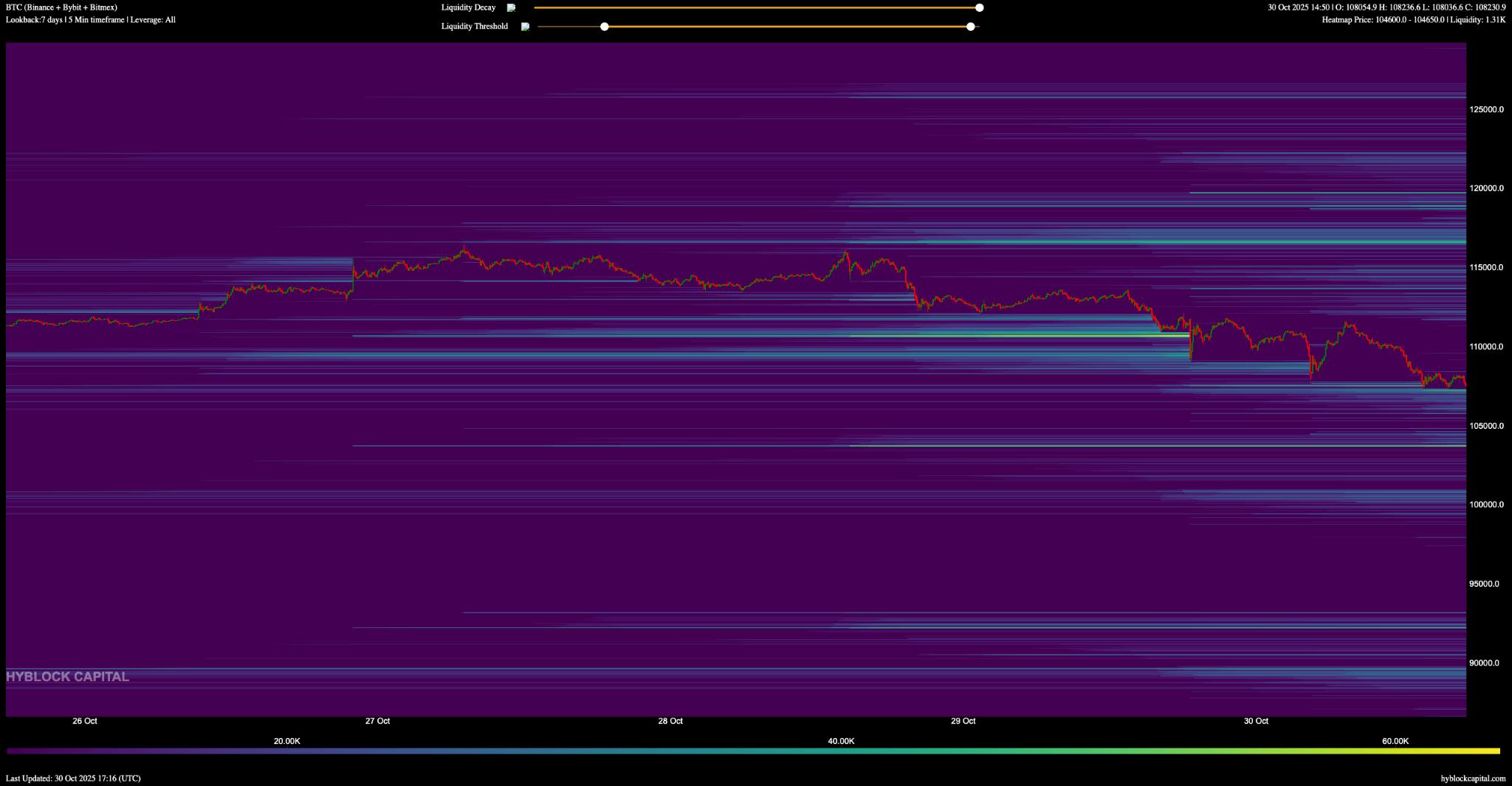

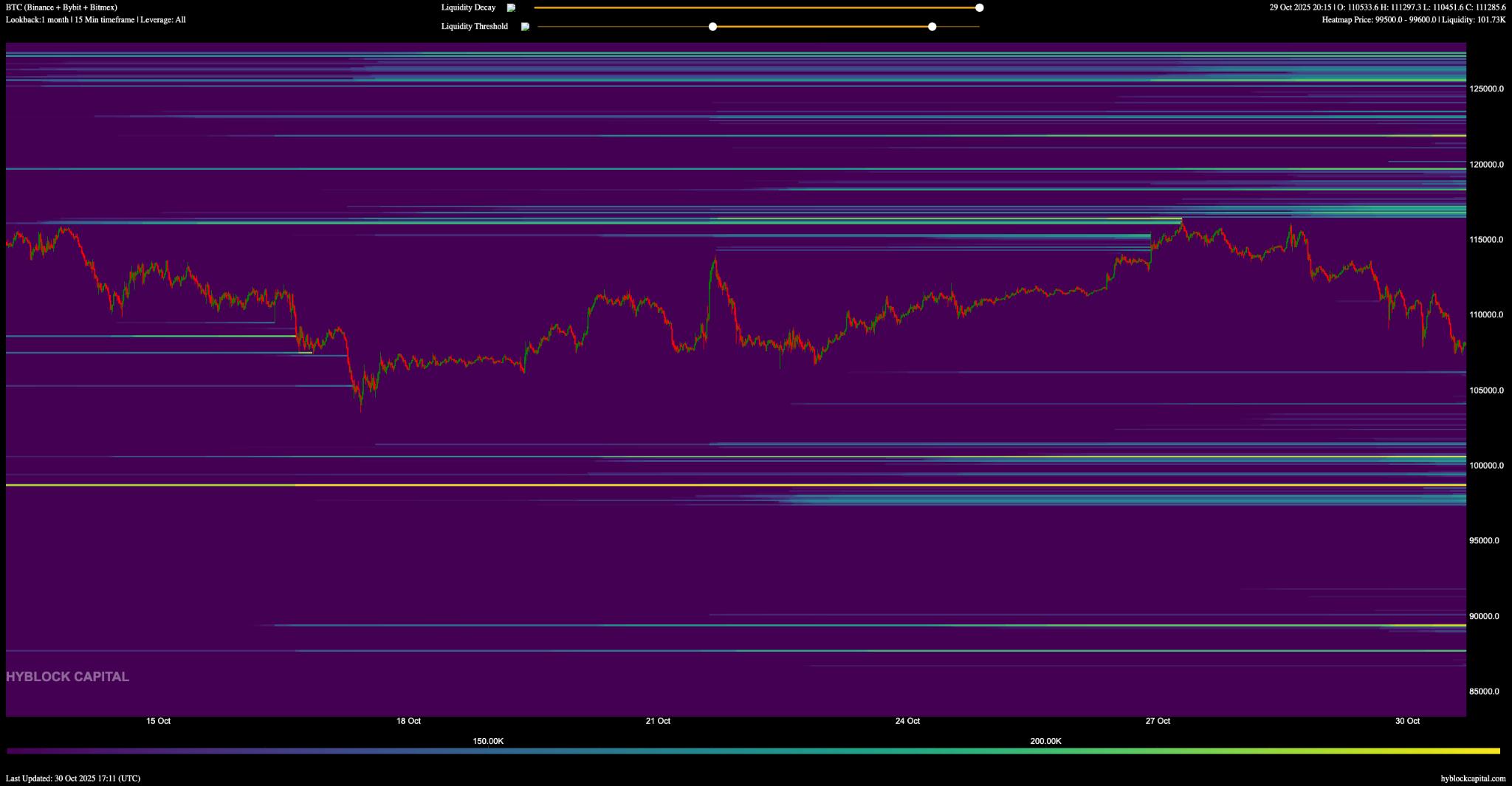

Despite expectations that a trade deal and recent Federal Reserve rate cuts might propel Bitcoin higher, its price has failed to meet these prospects. Instead, technical indicators suggest a bearish bias, with the most immediate support levels around $103,800, as revealed by liquidity heatmaps from Hyblock. The analysis further shows longer-term liquidity at key levels near $100,500 and $98,600, emphasizing the downside risks in the current environment.

BTC/USDT 7-day liquidation heatmap. Source: Hyblock

Overall, the outlook underscores a cautious approach for Bitcoin and the broader crypto markets, with technical and macroeconomic signals favoring downside momentum in the near term. Investors should remain attentive to evolving geopolitical and economic developments that could influence market dynamics in the coming weeks.

BTC/USDT 1-month liquidation heatmap. Source: Hyblock Crypto Investing Risk Warning

Crypto assets are highly volatile. Your capital is at risk. Don't invest unless you're prepared to lose all the money you invest.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment