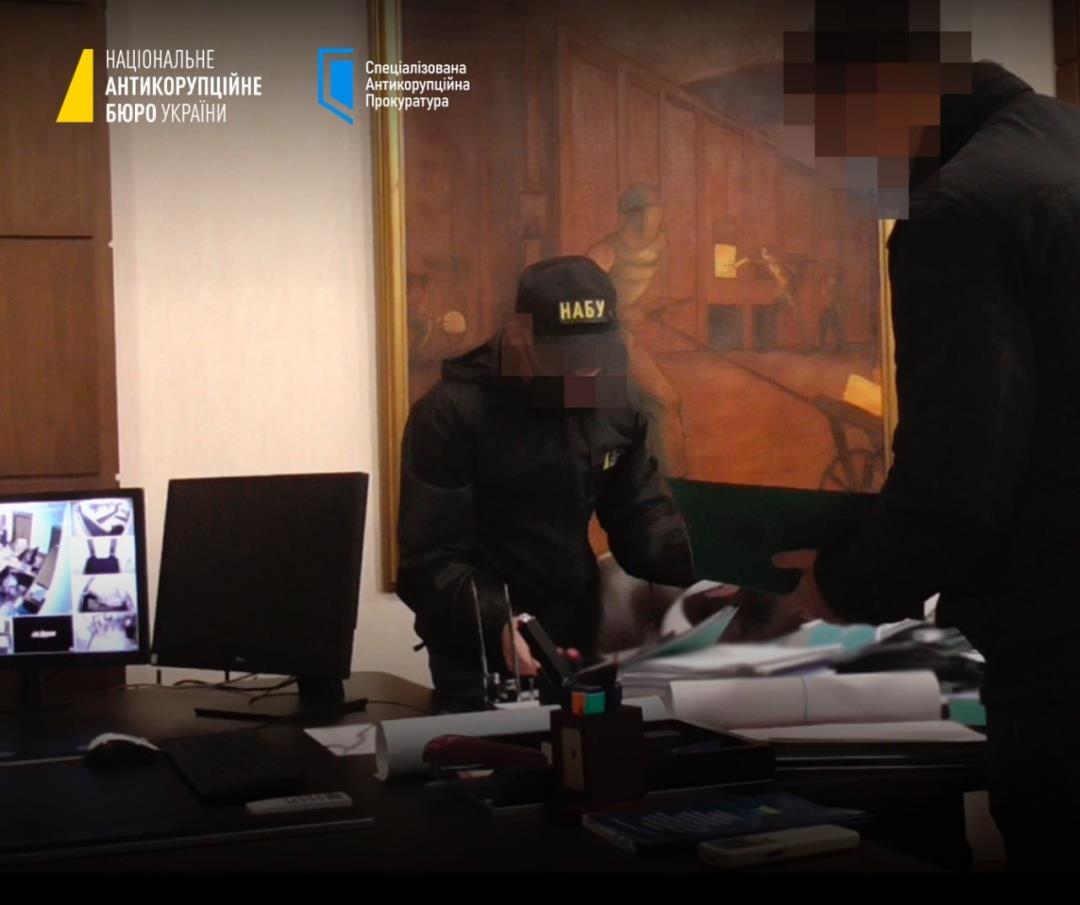

Corruption In Tax Service: UAH 15B Conversion Scheme Uncovered

The fraudulent mechanism included issuing false tax invoices for fictitious transactions with actual enterprises; registering these invoices in the Unified Register of Tax Invoices; and using the fake invoices to reduce actual companies' tax liabilities.

Law enforcers found that the scheme generated fake invoices for goods and services totaling UAH 15 billion, with fraudulent VAT claims exceeding UAH 2.3 billion. The acting head of the Tax Service at the time enabled the scheme's operations, while the Poltava region's official ensured favorable decisions for the involved companies through her role on the invoice registration commission.

As a result, actual enterprises avoided paying UAH 147 million to the state budget.

Law enforcers have formally charged 11 individuals in connection with the case.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment