403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

Duke Energy Signal 29/09: Should You Power Up? (Chart)

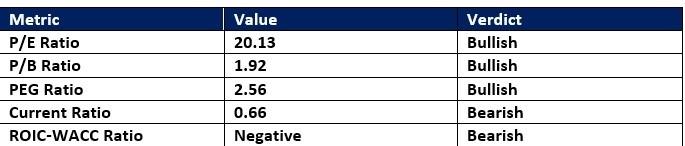

(MENAFN- Daily Forex) Long Trade IdeaEnter your long position between $121.33 (the upper band of its horizontal support zone) and $123.45 (Friday's intra-day high).Market Index Analysis

- Duke Energy (DUK) is a member of the S&P 100 and the S&P 500 indices. Both indices remain near record highs, but breakdown signals have risen. The Bull Bear Power Indicator for the S&P 500 shows a negative divergence and does not confirm the uptrend.

- The DUK D1 chart shows price action breaking out above its horizontal support zone. It also shows price action below its ascending Fibonacci Retracement Fan. The Bull Bear Power Indicator turned bullish with an ascending support level. The average bullish trading volumes are higher than the average bearish trading volumes during the breakout week. DUK failed to match the record highs of the S&P 500, a bearish signal, but its recent breakout could lead to more upside.

- DUK Entry Level: Between $121.33 and $123.45 DUK Take Profit: Between $131.25 and $133.88 DUK Stop Loss: Between $117.45 and $118.90 Risk/Reward Ratio: 2.56

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Reseach

- B2PRIME Strengthens Institutional Team's Growth With Appointment Of Lee Shmuel Goldfarb, Formerly Of Edgewater Markets

- BTCC Exchange Scores Big In TOKEN2049 With Interactive Basketball Booth And Viral Mascot Nakamon

- Ares Joins The Borderless.Xyz Network, Expanding Stablecoin Coverage Across South And Central America

- Primexbt Launches Stock Trading On Metatrader 5

- Solana's First Meta DEX Aggregator Titan Soft-Launches Platform

- Moonacy Protocol Will Sponsor And Participate In Blockchain Life 2025 In Dubai

- Primexbt Launches Instant Crypto-To-USD Exchange

Comments

No comment