Cronos Cancels Trump Gains As CRO Faces Doubts Over Demand

- Cronos experienced a rapid 40% rally after the announcement of a $6.4 billion crypto treasury linked to Trump Media Group, but has since sharply declined. The token's market cap has nearly halved, losing over $6 billion and dropping out of the top 30 cryptocurrencies by market value. Market analysts cite sluggish demand and utility issues as reasons for continued decline, amidst a broader sell-off in crypto markets. Crypto markets have been under intense pressure, with Bitcoin falling below $110,000 and the Crypto Fear & Greed Index hitting April 2025 lows. Regulatory attention increases as U.S. authorities probe the surge in crypto treasury announcements by public companies, including Crypto.

Since peaking during the Trump Media Group's announcement, Cronos has shed more than half of its market capitalization, a decline that amounts to over $6 billion. The token, which had initially surged following news of a joint $6.4 billion CRO treasury, has fallen back below $0.19 - nearly erasing the gains made during the rally. Currently, CRO ranks as the 33rd largest crypto asset, outside the top 30 by market value, according to CoinGecko data.

Source: CrypT.0 (humbledpath)

Meanwhile, a Reddit user commented,“We're getting rugged, just as I expected when that partnership was announced,” highlighting concerns that the hype around CRO may have been overblown.

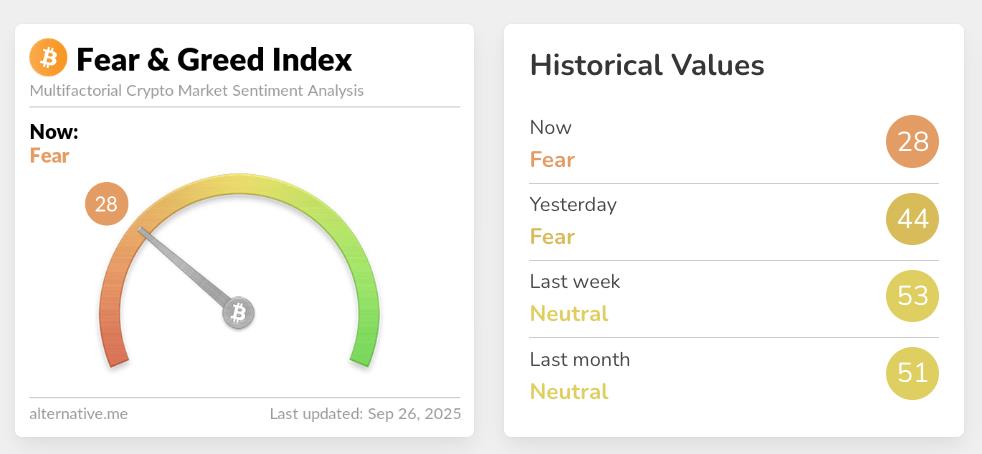

Broader Market Dynamics and Regulatory ScrutinySome analysts argue that the decline in CRO is part of a wider market correction impacting the entire cryptocurrency sector. The ongoing sell-off has seen Bitcoin dip below $110,000, while the Crypto Fear & Greed Index has plunged to levels not seen since April 2025, signaling increased fear among investors.

The Crypto Fear & Greed Index. Source: Alternative

While community sentiment remains mixed, Crypto CEO Kris Marszalek has so far refrained from publicly commenting on the token's plummet, even as regulatory oversight intensifies. Recently, Marszalek expressed support for a U.S. Commodity Futures Trading Commission initiative promoting tokenized collateral and stablecoins, including CRO, to meet regulatory margin requirements.

However, regulatory agencies, such as the U.S. Securities and Exchange Commission (SEC), have yet to approve the $6.4 billion CRO treasury plan. Reports indicate that authorities are scrutinizing recent crypto treasury announcements by public companies, with over 200 firms contacted over concerns about potential breaches of securities rules related to the mishandling of material nonpublic information.

The evolving regulatory landscape adds uncertainty to CRO's future, as market participants weigh the token's utility and demand prospects amidst a broader crypto environment characterized by increased oversight and market caution.

Crypto Investing Risk WarningCrypto assets are highly volatile. Your capital is at risk. Don't invest unless you're prepared to lose all the money you invest.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment