Wealth Minerals Enters Into Letter Agreement To Acquire The Andacollo Oro Gold Project

AOG Project Overview 1

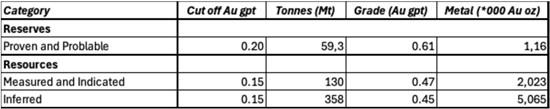

- Historical Estimate of 2.02M oz Au in the Measured and Indicated Categories for 130Mt at 0.48 Au grams per tonne Historical Estimate of 5.06M oz Au in the Inferred Category for 358Mt at 0.45 Au grams per tonne Contained within the Historical Measured and Indicated Resource Inventory is a Historical Mineral of 1.16M oz Au in the Proven & Probable Category of 59.3Mt at 0.61 Au grams per tonne (at a cutoff grade of 0.20 Au grams per tonne) Location: Coquimbo Chile (adjacent to Teck Resource's Carmen del Andacollo mine) Past Operation: Open pit heap leach Past Total Production: 1.12M oz Au (1998 to 2018) Past Production mining throughput: 20,000 tpd Past peak production rate: 135,000 oz Au/year Existing permits: mining rights, land title and water rights

1 Source: CMID SPA Mina Andacollo Oro Project, NI 43-101 Technical Report by GEOINVEST S.A.C E.I.R.L., August 23, 2021 & Updated Report for Resources by GEOINVEST S.A.C E.I.R.L. November 2024) (the "Historical AOG Report").

Henk van Alphen, Wealth's CEO, said, "The chance to acquire the AOG Project is an opportunity management believes is the right choice for shareholders. Gold, an asset class that has been around for millennia, is now "new" to the capital markets as investors increasingly worry about governments' monetary and fiscal policies globally. I see no reason to expect the drivers of this worry to change, and I expect gold's favor amongst investors to continue. The merits of the AOG Project are obvious and alluded to in this news release. Wealth will continue to advance its lithium project portfolio and seek ways to create shareholder value. Management believes that the best way for the Company to get value for the lithium projects is to have a company that has the overall scale and capital market footprint to attract capital and attention in the global mining industry. I look forward to continuing to advance Wealth's assets and this acquisition demonstrates Wealth's continued commitment to working in Chile and builds on the success of Wealth engaging with stakeholders, as demonstrated by Wealth's joint venture with the Quechua Indigenous Community of Ollagüe to develop the Kuska lithium project, and the recent inclusion of the Salar de Ollagüe in the new simplified procedure for the assignment of a Special Lithium Operating Contract (CEOL) implemented by the Chilean authorities."

Andacollo Oro Gold Project

The AOG Project is located in Region IV, the Province of Coquimbo, Chile, 60km from the Coquimbo port and 480km north of Santiago. Historically, the AOG Project produced cumulatively 1.12 million ounces of gold from 1995 to 2018 before production was suspended due to relatively low gold prices at the time.2 The AOG Project's peak annual production was 135k ounces in 1999. During the time it was operational, the AOG Project mine was a 20,000 tonne per day, open pit heap leach operation.3 The AOG Project includes mining licenses rights, land title and water rights. Extensive earth works and infrastructure are present at the site and there is significant tonnage of mineralized material stacked on the AOG Project's three leach pads that could potentially be utilized for early-stage ramp-up of operations.

The geology of the AOG Project has been extensively studied by past operators, with historically 2,547 holes drilled for a total of 287,222m.4 The AOG Project exploited a low sulphidation epithermal manto-type gold deposit.

The Historical AOG reported the following historical estimates:

To view an enhanced version of this graphic, please visit:

2,3,4 Source: Historical AOG Report.

A qualified person has not done sufficient work to classify the historical estimate as current mineral resources or mineral reserves, and Wealth is not treating the historical estimate as current mineral resources or mineral reserves.

The AOG Project is adjacent to Teck Resource's Carmen de Andacollo copper mine, which produced 40k tonnes of copper in 2024 (Source: Readers are cautioned that the Carmen de Andacollo copper mine is an adjacent property, and Wealth has no interest in or right to acquire any interest in such property. Mineral deposits on adjacent properties and any production therefrom or economics with respect thereto, are not in any way indicative of mineral deposits on the AOG Project or the potential production from, or cost or economics of, any future mining on the AOG Project.

Terms of the Letter Agreement

Under the terms of the Letter Agreement and subject to acceptance by the TSX Venture Exchange, it is currently proposed that the Transaction will be effected by way of a share purchase and sale transaction, pursuant to which Wealth (or a subsidiary of Wealth) will acquire a 100% ownership interest in an arm's length private Chilean company (the "Target"). The purchase price for the acquisition of the Target will be 12.5 million (post-Consolidation (as defined below)) common shares in the capital of Wealth, subject to adjustment for dilution prior to closing of the Transaction. In consideration for the Target granting Wealth a 30-day exclusivity period for Wealth to conduct due diligence, Wealth has paid a US$350,000 cash payment to the Target.

It is a condition to the closing of the Transaction that the Target will have closed its acquisition of a 100% royalty free interest in the AOG Project (the "Underlying Transaction"), subject to the following deferred purchase payments to be assumed by Wealth of an aggregate US$30 million cash, of which up to US$7 million can be paid in shares, over a period of 48 months (US$250,000 of which has already been paid) as follows: (i) US$1,750,000 cash on the closing of the Underlying Transaction (the "Underlying Closing Date"); (ii) US$1,000,000 cash on or before December 30, 2025; (iii) US$2,000,000 within 12 months from the Underlying Closing Date; (iv) US$4,000,000 within 24 months from the Underlying Closing Date; (v) US$6,000,000 within 36 months from the Underlying Closing Date; and (vi) US$15,000,000, of which US$7,000,000 may be paid in cash or its equivalent in shares, within 48 months from the Underlying Closing Date.

Completion of the Transaction is subject to, among other things, the satisfaction of customary conditions precedent, including, without limitation, receipt of all necessary shareholder, board and regulatory (including TSX Venture Exchange) consents and approvals.

Private Placement

In connection with the Transaction, Wealth announces a non-brokered private placement offering of a minimum of 41,666,666 units (the "Units") at a subscription price of $0.12 per Unit for minimum gross proceeds of $5,000,000. Each Unit consists of one common share (each, a "Share") and one-half of one common share purchase warrant (each such whole warrant, a "Warrant"). Each Warrant will entitle the holder thereof to purchase one common share in the capital of the Company (each, a "Warrant Share") at an exercise price of $0.18 per Warrant Share for a period of 24 months (the "Offering"). In the event that the Company's shares trade at a closing price of greater than $0.36 per share for a minimum of ten consecutive trading days at any time after the closing of the Offering, the Company may accelerate the expiry date of the Warrants by providing notice to the shareholders thereof and in such case the Warrants will expire on the 30th day after the date on which such notice is given by the Company.

Finder's fees may be payable to qualified finders, and all securities issued in the Offering are subject to a four-month and a day hold period in Canada during which time the securities may not be traded. Closing of the Offering is subject to the approval of the TSX Venture Exchange. Proceeds of the Offering will be allocated to finance the acquisition, exploration and development costs of the AOG Project, including drilling, permitting work, and geotechnical work. Approximately $1,000,000 will be used for general working capital and corporate purposes, including transaction-related expenses.

The securities offered have not been and will not be registered under the United States Securities Act of 1933 (the "U.S. Securities Act"), as amended, or any applicable state securities laws and may not be offered or sold in the United States or to "U.S. persons", as such term is defined in Regulation S under the U.S. Securities Act, absent registration or an applicable exemption from the registration requirements. This news release shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of the securities in any State in which such offer, solicitation or sale would be unlawful.

Wealth intends to rely on the "part and parcel pricing exception" provided for in the corporate finance policies of the TSX Venture Exchange.

Share Consolidation

Wealth further announces that it intends to undergo a consolidation of its issued and outstanding common shares on the basis of one post-consolidation Wealth common share for up to seven pre-consolidation Wealth common shares (the "Consolidation"). There are currently 362,363,191 Wealth common shares outstanding, and Wealth anticipates completing the Consolidation prior to the completion of the Offering and the closing of the Transaction. Assuming completion of the Consolidation prior to the completion of the Offering and the closing of the Transaction, Wealth expects that following completion of the Consolidation there will be approximately 51,766,170 Wealth common shares outstanding (on a non-diluted basis). The number of post-Consolidation Wealth common shares to be received will be rounded up to the nearest whole number for fractions of 0.5 or greater or rounded down to the nearest whole number for fractions of less than 0.5.

The Consolidation is subject to TSX Venture Exchange approval. The Company is undertaking the Consolidation to be in a better position to attract capital to advance its projects. The Company's name and trading symbol are expected to remain unchanged. The issue prices and securities offered under the Offering are disclosed on a pre-Consolidation basis and will be adjusted to reflect the prior implementation of the Consolidation (assuming completion of the Consolidation prior to the completion of the Offering).

Chad Williams

Wealth also announces the appointment of Chad Williams as a strategic advisor to the Company. Mr. Williams is the Founder and Chairman of Red Cloud Mining Capital. He was the CEO of Victoria Gold from 2007 to 2011 and a gold analyst and Head of Mining Investment Banking at Blackmont Capital from 2004 to 2007. Mr. Williams holds a degree in Mining Engineering and Business from McGill University

Qualified Person

The scientific and technical information in this news release has been reviewed and approved by Sergio Alvarado, P.Geo. (CIM No 144815), an independent Qualified Person as defined by NI 43-101. Mr. Alvarado, Principal Geologist with GEOINVEST S.A.C E.I.R.L., has reviewed the technical information and consents to the form and content of this news release.

About Wealth Minerals Ltd.

Wealth is a mineral resource company with interests in Canada and Chile. The Company's focus is the acquisition and development of lithium projects in South America. Presently the Company is working to diversify its asset base to include precious metal projects.

The Company opportunistically advances battery metal projects where it has a peer advantage in project selection and initial evaluation. Lithium market dynamics and a rapidly increasing metal price are the result of profound structural issues with the industry meeting anticipated future demand. Wealth is positioning itself to be a major beneficiary of this future mismatch of supply and demand. In parallel with lithium market dynamics, Wealth believes other battery metals will benefit from similar industry trends.

For further details on the Company readers are referred to the Company's website ( ) and its Canadian regulatory filings on SEDAR+ at .

On Behalf of the Board of Directors of

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment