Flora Growth Unveils $401M Treasury To Power 0G AI Blockchain Innovation

The deal was led by Solana (SOL ) treasury firm DeFi Development Corp. (DFDV), with participation from Hexstone Capital, Carlsberg SE Asia PTE Ltd., Dao5, Abstract Ventures, and Dispersion Capital. DFDV's CEO, Joseph Onorati, expressed enthusiasm about the collaboration, highlighting the potential to innovate within decentralized AI infrastructure by integrating 0G and Solana 's blockchain ecosystem. Flora will also hold a segment of its treasury assets in SOL tokens, reinforcing its strategic partnership within the Solana network.

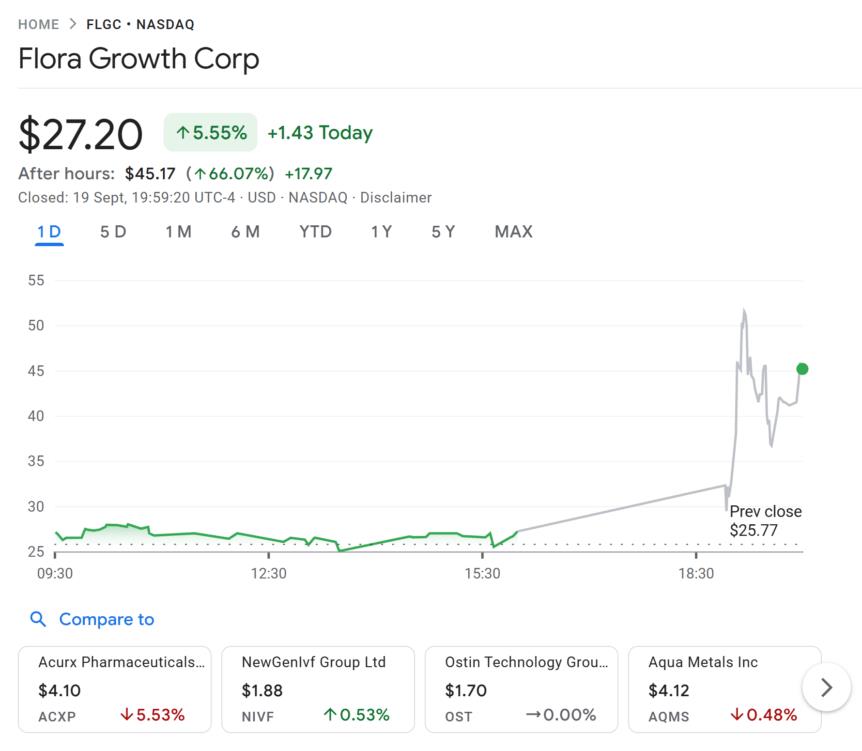

Flora Growth shares surged 5% after the announcement. Source: Google Finance Zero Gravity leads a groundbreaking AI endeavor

The funds aim to expand 0G's advanced AI infrastructure, which has demonstrated the capability to train a 107-billion-parameter model using distributed clusters-surpassing benchmarks set by industry giants like Google. The project claims an efficiency improvement of 357 times over conventional distributed AI frameworks, marking a significant technological breakthrough.

Daniel Reis-Faria, incoming CEO of 0G, emphasized that this treasury infusion provides institutional investors an opportunity to gain exposure to a transparent, privacy-focused AI infrastructure that is both verifiable and innovative. The transaction is expected to close by September 26, subject to shareholder approval, with some investors receiving pre-funded warrants linked to their holdings of 0G tokens.

Market insights: Challenges for digital asset treasuriesIn related news, Standard Chartered warned of mounting risks within the digital asset treasury sector, citing a sharp decline in market net asset values (mNAVs). Once buoyed by successful Bitcoin accumulation strategies, many firms now face reduced valuations, limiting their ability to issue new shares or expand crypto holdings. As mNAVs fall below the critical threshold of 1, access to low-cost capital diminishes, stalling growth and leading to potential sector consolidation.

The bank forecasts that larger, well-capitalized players such as Strategy and Bitmine are positioned to emerge stronger from this shakeout, while smaller firms with depressed valuations may become acquisition targets, reshaping the landscape of crypto markets and DeFi investments.

Crypto Investing Risk Warning

Crypto assets are highly volatile. Your capital is at risk. Don't invest unless you're prepared to lose all the money you invest.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Reseach

- B2PRIME Strengthens Institutional Team's Growth With Appointment Of Lee Shmuel Goldfarb, Formerly Of Edgewater Markets

- BTCC Exchange Scores Big In TOKEN2049 With Interactive Basketball Booth And Viral Mascot Nakamon

- Ares Joins The Borderless.Xyz Network, Expanding Stablecoin Coverage Across South And Central America

- Primexbt Launches Stock Trading On Metatrader 5

- Solana's First Meta DEX Aggregator Titan Soft-Launches Platform

- Moonacy Protocol Will Sponsor And Participate In Blockchain Life 2025 In Dubai

- Primexbt Launches Instant Crypto-To-USD Exchange

Comments

No comment