India Children's Wear Market 2025-2033: Industry Size, Share, Growth, Top Companies And Forecast Report

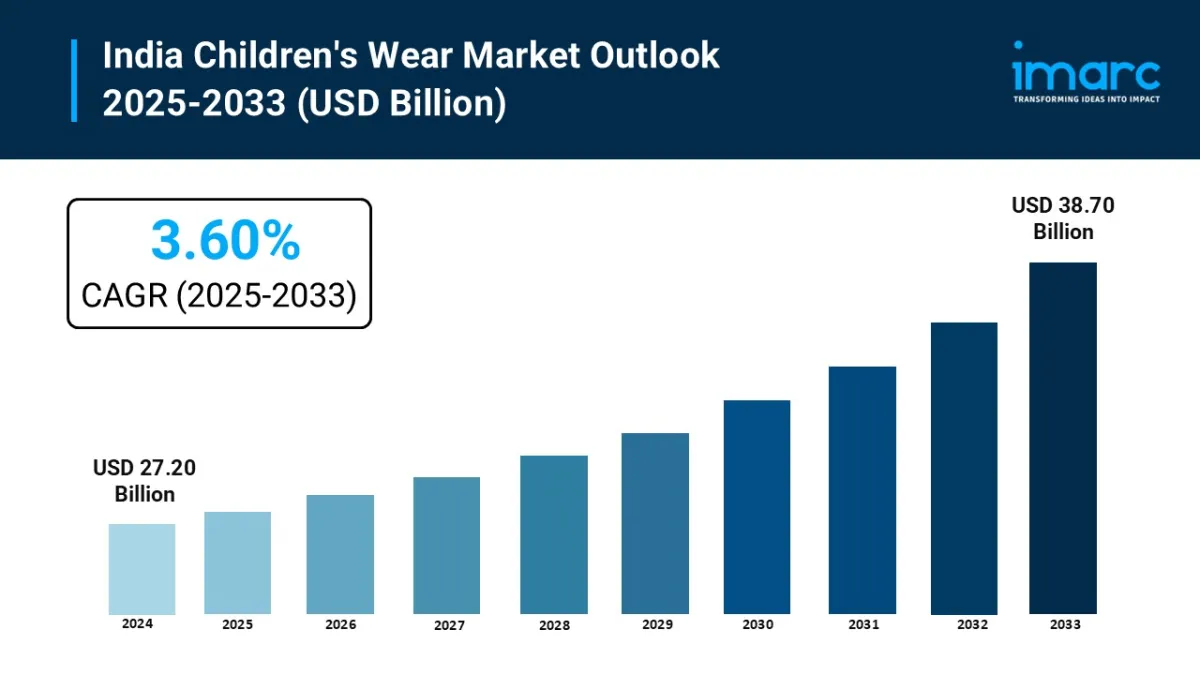

India's children's wear market was valued at USD 27.20 billion in 2024 and is projected to reach USD 38.70 billion by 2033 , reflecting a CAGR of 3.60% (2025–2033) . Growth is supported by rising disposable incomes, rapid e-commerce penetration, urbanization, and stronger brand consciousness among parents, alongside increasing interest in sustainable and skin-safe fabrics.

Key Highlights-

Market size (2024): USD 27.20 billion .

Forecast (2033): USD 38.70 billion .

CAGR (2025–2033): 3.60% .

Growth contributors / industry activity:

-

Deeper online reach and social commerce driving discovery and conversion.

Premiumization and brand-led parent buying behavior in metros and Tier-2/3 cities.

Rising demand for organic/GOTS-certified and hypoallergenic fabrics.

Frequent capsule drops and influencer collaborations to shorten fashion cycles.

Get instant access to a free sample copy and explore in-depth analysis: https://www.imarcgroup.com/india-children's-wear-market/requestsample

How Is AI Transforming the Children's Wear Market in India?-

Predictive demand planning: AI models forecast size/age-grade demand by region/season to optimize buys and reduce stockouts/markdowns.

Personalized journeys: On-site recommendations and size advisors improve fit confidence, conversion, and returns management-especially for fast-growing age groups.

Design & trend mining: Computer vision scans social and UGC feeds to spot micro-trends (prints/palettes/silhouettes), compressing concept-to-shelf timelines.

Dynamic pricing & promo optimization: Reinforcement learning tunes discounts by cohort, weather, and festival calendar to protect margins in value and mid-premium bands.

-

Consumer & income tailwinds: Uptrending disposable incomes and urban household upgrades lift branded and premium kidswear baskets.

Digital retail scale-up: Marketplace and D2C growth, faster deliveries, and social commerce broaden access beyond metros.

Sustainability shift: Adoption of organic cotton/bamboo and non-toxic dyes; growing demand for certified, skin-safe apparel.

Brand & store expansion: Leading fashion retailers are back to network expansion with a sharper focus on profitability and omnichannel experiences.

International collaboration & sourcing: Global–India tie-ups and“Make in India” supplier ramp-ups strengthen local manufacturing footprints.

Festival & occasion wear: Strong festive calendar sustains ethnic/kids occasion-wear volumes alongside everyday casuals. (Industry coverage.)

Explore the Full Report with Charts, Table of Contents, and List of Figures: https://www.imarcgroup.com/india-children's-wear-market

Market SegmentationBy Product Category

-

Apparel

Footwear

Others

By Consumer Group

-

Infant (0-12 Months)

Toddler (1-3 Years)

Preschool (3-5 Years)

Gradeschooler (5-12 Years)

By Gender

-

Boys

Girls

Unisex

By Distribution Channel

-

Offline

Online

-

North India

South India

East India

West India

-

Capital markets & omnichannel scale: FirstCry (Brainbees) attracted multibillion-dollar demand for its IPO (August 2024), underscoring investor confidence in kids and baby retail. This supports store and tech investments aligned with Digital India and formalization of retail.

Global–India sourcing push: Shein × Reliance Retail accelerating India supplier base expansion (June 2025) to export“Made-in-India” apparel internationally-supportive of Make in India and export competitiveness.

Retail network expansion: Large fashion retailers (Reliance Retail, Arvind Fashions, ABFRL, V-Mart, etc.) have re-started aggressive, profitability-focused expansion-benefitting kidswear shop-in-shops and private labels, and aligning with organized retail growth agendas.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- TOKEN2049 Singapore Breaks Records: 25,000 Attendees At The World's Largest Web3 Event

- Permissionless Data Hub Baselight Taps Walrus To Activate Data Value Onchain

- Newcastle United Announce Multi-Year Partnership With Bydfi

- Ethereum Meme Coin Little Pepe Crosses $25M, Announces 15 ETH Giveaway

- Canada Real Estate Market Size, Share, Trends & Growth Opportunities 2033

- Everstake Expands Institutional Solana Services With Shredstream, Swqos, And Validator-As-A-Service

Comments

No comment