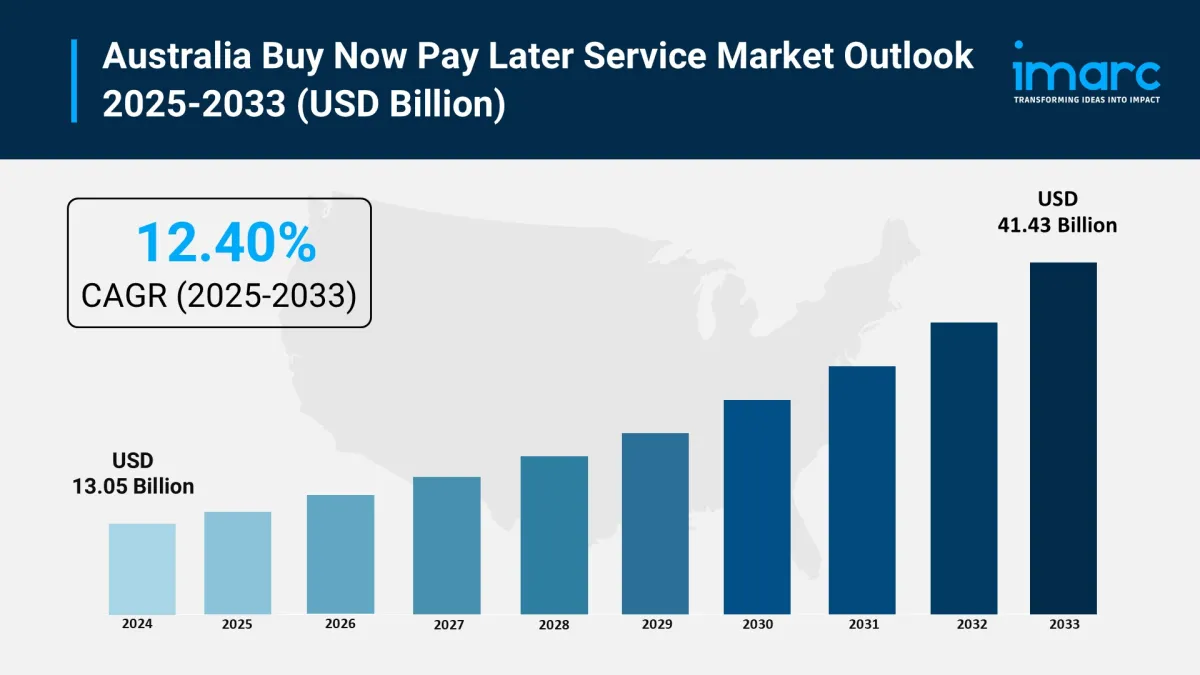

Australia Buy Now Pay Later Services Market Projected To Reach USD 41.43 Billion During 2025-2033

| Report Attribute | Key Statistics |

| Base Year | 2024 |

| Forecast Years | 2025-2033 |

| Historical Years | 2019-2024 |

| Market Size in 2024 | USD 13.05 Billion |

| Market Forecast in 2033 | USD 41.43 Billion |

| Market Growth Rate (2025-2033) | 12.40% |

Australia Buy Now Pay Later Services Market Overview:

The BNPL service market of Australia has grown rapidly because consumers are increasingly applying unsuitable payment options and interest rates. Fintech companies provide mobile applications and creative digital platforms to reshape the way users manage purchases and credit. Retailers combine BNPL options for cashiers to stimulate sales, while financial management agencies introduce executives to ensure transparency and protect consumers. The market benefits from the strong digital payment infrastructure, the increase in the penetration of e -commerce and the behavior of consumers who are beneficial for budget financial options.

Request For Sample Report: https://www.imarcgroup.com/australia-buy-now-pay-later-services-market/requestsample

Australia Buy Now Pay Later Services Market Trends and Drivers:

The market is developing while Fintech suppliers expand off incentives to include health care, tourism and education. The partnership between BNPL companies and traditional banks is increasing, providing customers with access to larger financial ecosystems. Organizations stipulating the development of policy directives to improve risk management and data transparency. The verification of digital identity and credit risk analysis is being integrated to assess the reliability of the borrower, while the loyal customers improve the maintenance and commitment of customers.

The increasing demand for credit solutions for consumers instead of stimulating the BNPL service market in Australia. Millennials and consumers of the Z generation, the application of fuel because of priority to sponsor digital sponsorship without interest. The growth of e -commerce, combined with the convenience of practical credit approval, promotes many traders to apply BNPL at the sales point. Fintech's support regulations, an increase in the use of smartphones and the low penetration of credit cards grow better.

Challenges and Opportunities:

The Australian BNPL sector confronts growing regulatory pressures. Since June 10, 2025, BNPL providers must hold Australian Credit Licences and perform affordability and credit checks under the Credit Act, adding complexity and compliance costs. Rising default rates-such as Zip Co's bad debts quadrupling and significant credit losses at Afterpay-highlight elevated consumer risk amid cost-of-living pressures. Consumer over-reliance is also a concern, with many using BNPL for essentials like food, petrol, and childcare, often leading to financial distress and long-term financial instability.

The BNPL market in Australia is set for robust growth. Valued at over USD 13 billion in 2024, it's projected to reach USD 41 billion by 2033, driven by ecommerce momentum, tech adoption, and flexible payment demand. Corporates are expanding into new retail sectors: Afterpay now facilitates payments for furniture, while Humm services automotive maintenance needs. Strategic collaborations-such as Zip's integrated invoicing solution with Xero and Stripe-offer BNPL access to small businesses, expanding use cases beyond consumer purchases. Continued innovation in service integration and expansion into underpenetrated industries present further growth opportunities.

Australia Buy Now Pay Later Services Key Growth Drivers:

-

Rising e-commerce penetration and mobile-first consumer behavior

Increasing partnerships between BNPL platforms and online/offline retailers

Favorable fintech regulation and digital payment infrastructure

Consumer demand for transparent, interest-free financing

Adoption across new sectors like travel, healthcare, and education

Browse Full Report with TOC & List of Figures: https://www.imarcgroup.com/australia-buy-now-pay-later-services-market

Australia Buy Now Pay Later Services Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Australia buy now pay later services market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on channel, enterprise size, and end use.

Analysis by Channel:

-

Online

Point of Sale (POS)

Analysis by Enterprise Size:

-

Large Enterprises

Small and Medium Enterprises

Analysis by End Use:

-

Consumer Electronics

Fashion and Garment

Healthcare

Leisure and Entertainment

Retail

Others

Regional Analysis:

-

Australia Capital Territory & New South Wales

Victoria & Tasmania

Queensland

Northern Territory & Southern Australia

Western Australia

Competitive Landscape:

-

Afterpay Australia Pty Ltd

Zip Co Limited

humm BNPL Pty Ltd

Klarna Australia Pty Ltd

Sezzle

Commonwealth Bank of Australia (via StepPay)

National Australia Bank Limited (likely via its BNPL offerings)

Quest Payment Systems Pty Ltd

Australia Buy Now Pay Later Services Market News:

-

August, 2025: Zip partnered with Xero and Stripe, allowing businesses to offer BNPL on invoices to improve cash flow and reduce late payments.

June, 2025: Afterpay revealed that over 10% of users were advised to close accounts for mortgage eligibility, later being offered credit cards instead.

June, 2025: New regulations now mandate BNPL providers to report credit defaults and applications to credit bureaus, meaning widespread BNPL use may negatively affect consumer credit scores.

Note: If you require specific information not currently within the scope of the report, we can provide it as part of the customization.

Ask an analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=24081&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email:

Tel. No.: (D) +91 120 433 0800

Americas: +1-201-971-6302

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Bitcoin Adoption On Sui Accelerates As Threshold Network And Sui Launch Phase 2 Of Tbtc Integration

- Falcon Finance Announced $FF And Community Sale On Buidlpad

- United States Fin Fish Market Size Forecast With Demand Outlook 20252033

- Bitmex And Tradingview Announce Trading Campaign, Offering 100,000 USDT In Rewards And More

- Virtual Pay Group Secures Visa Principal Acquirer License

- United States Kosher Food Market Long-Term Growth & Forecast Outlook 20252033

Comments

No comment