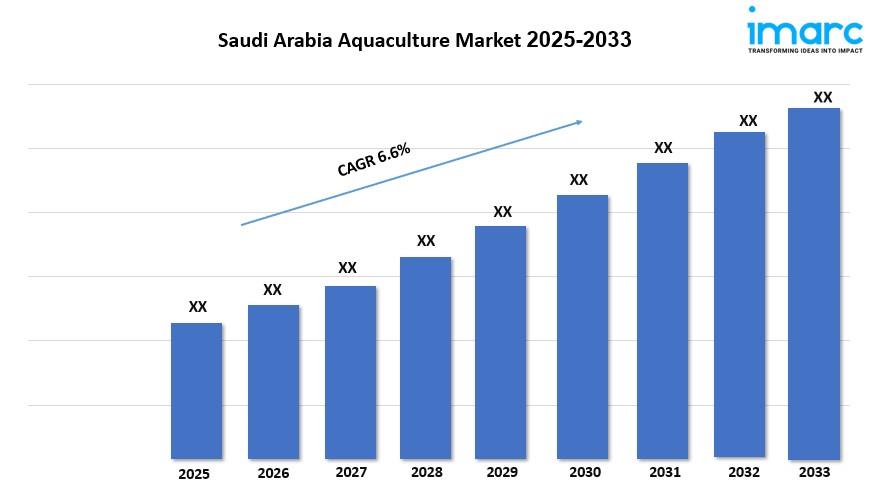

Saudi Arabia Aquaculture Market To Reach 817,000 Tons By 2033, Growing At 6.6% CAGR

Market Size in 2024 : 459,000 Tons

Market Size in 2033: 817,000 Tons

Market Growth Rate 2025-2033: 6.6%

According to IMARC Group's latest research publication,“ Saudi Arabia Aquaculture Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2023“ , The Saudi Arabia aquaculture market size reached a production volume of 459,000 Tons in 2024. Looking forward, IMARC Group expects the market to reach 817,000 Tons by 2033, exhibiting a growth rate (CAGR) of 6.6% during 2025-2033.

Growth Factors in the Saudi Arabia Aquaculture Industry-

Vision 2030 and Government Support

Saudi Arabia's Vision 2030 is a game-changer for the aquaculture industry, pushing for food security and economic diversification. The National Fisheries Development Program has pumped over $4 billion into the sector, funding projects like hatcheries and fish feed mills. For example, the Ministry of Environment, Water, and Agriculture supports 3,000 Saudis with aquaculture training, boosting local expertise. This government backing has led to a 55.56% production jump, reaching over 140,000 tonnes recently, with companies like NAQUA expanding shrimp farming to meet domestic and export demands, making aquaculture a key player in the Kingdom's economy.

-

Rising Seafood Demand

More Saudis are eating seafood due to growing health awareness and changing diets. Seafood, packed with protein and omega-3s, is becoming a go-to for health-conscious consumers, with per capita consumption at 11.7 kg, and the government aiming for 20 kg. Urban centers like Jeddah see high demand, with supermarkets stocking farmed shrimp and tilapia. The National Aquaculture Group (NAQUA) reports serving over 40 countries, showing strong global appetite. This demand drives local production, with aquaculture contributing 65% of total seafood output, reducing reliance on imports and fueling industry growth.

-

Strategic Coastal Advantages

Saudi Arabia's 2,600 km coastline along the Red Sea and Arabian Gulf is a natural asset for aquaculture. Warm temperatures and pristine waters are perfect for species like shrimp and barramundi. The Red Sea's conditions, for instance, support NAQUA's massive shrimp farms near Al Leith, producing 100,000 tonnes annually. The Kingdom's location, bridging Europe, Asia, and Africa, simplifies seafood exports, with shrimp exports alone valued at $263 million. Investments in cold-chain logistics, like those by Tabuk Fisheries, ensure fresh products reach markets, boosting the industry's global competitiveness.

Key Trends in the Saudi Arabia Aquaculture Market-

Sustainable Aquaculture Practices

Sustainability is shaping the aquaculture market, with a focus on eco-friendly practices. NEOM's Topian initiative promotes regenerative aquaculture, using integrated multi-trophic systems to farm shrimp and fish together, cutting waste. The SAMAQ certification ensures products meet strict environmental standards, boosting consumer trust. For example, 298,491 tons of fish feed were used recently, with companies like NAQUA producing their own sustainable feed. This trend aligns with global demand for green seafood, helping Saudi farms attract ethically conscious buyers and investors while supporting Vision 2030's environmental goals.

-

Technological Advancements

Tech is transforming aquaculture, with tools like Recirculating Aquaculture Systems (RAS) and biofloc technology boosting efficiency. KAUST's partnership with the Ministry of Environment, Water, and Agriculture has introduced smart monitoring systems, cutting water use by 30% in some farms. NAQUA's state-of-the-art facilities near Jeddah use automated feeding to improve yields. These innovations help overcome water scarcity, a big challenge in Saudi Arabia, and ensure consistent production. The focus on tech also attracts investments, with $80 million spent on research for species selection and disease prevention, strengthening the industry.

-

Growth in Shrimp Production

Shrimp is the star of Saudi aquaculture, making up a huge chunk of output, with 66,400 tons produced recently. The government's pilot project in Tabuk for inland shrimp farming shows innovation in using desert land. Companies like Arabian Shrimp Company are scaling up, with new facilities boosting output by millions of dollars. The global demand for whiteleg shrimp, where Saudi Arabia is a top exporter to over 40 countries, drives this trend. Investments in hatcheries and cold-chain logistics ensure high-quality shrimp reaches markets, fueling both local and export growth.

Claim Your Free“Saudi Arabia Aquaculture Market” Analysis Sample Report Here

Saudi Arabia Aquaculture Industry Segmentation:

The report has segmented the market into the following categories:

Breakup by Fish Type

-

On the Basis of Production

-

Freshwater Fishes

Diadromous Fishes

Marine Fishes

Crustaceans

Others

-

Pelagic Fish

Freshwater and Diadromous Fish

Crustaceans

Demersal Fish

Others

Breakup by Environment:

-

Marine Water

Fresh Water

Brackish Water

Breakup by Distribution Channel:

-

Traditional Retail

Supermarkets and Hypermarkets

Convenience Stores

Online Channel

Others

Competitive Landscape:

The report has provided a comprehensive analysis of the competitive landscape in the Saudi Arabia aquaculture market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

-

National Aquaculture Group (NAQUA)

Saudi Fisheries Company (SFC)

Arabian Shrimp Company

Asmak Holdings

Jazan Energy, and Development Company (Jazadco)

Tabuk Fisheries Company

Future Outlook

The Saudi Arabia aquaculture market is poised for significant growth, driven by continued government support, technological innovation, and rising consumer demand for sustainable seafood. Initiatives under Vision 2030, such as the National Fisheries Development Program, will likely attract further investments, enabling the Kingdom to achieve ambitious production targets and reduce import dependency. The integration of advanced technologies like AI-driven monitoring and biotechnology for disease-resistant fish strains will enhance efficiency and resilience. However, challenges like water scarcity and environmental regulations must be addressed through sustainable practices. With strategic partnerships, such as those with international firms, and a focus on high-value species like shrimp and salmon, the market is set to become a global leader in sustainable aquaculture, contributing to food security and economic diversification.

Research Methodology:

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email:

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment