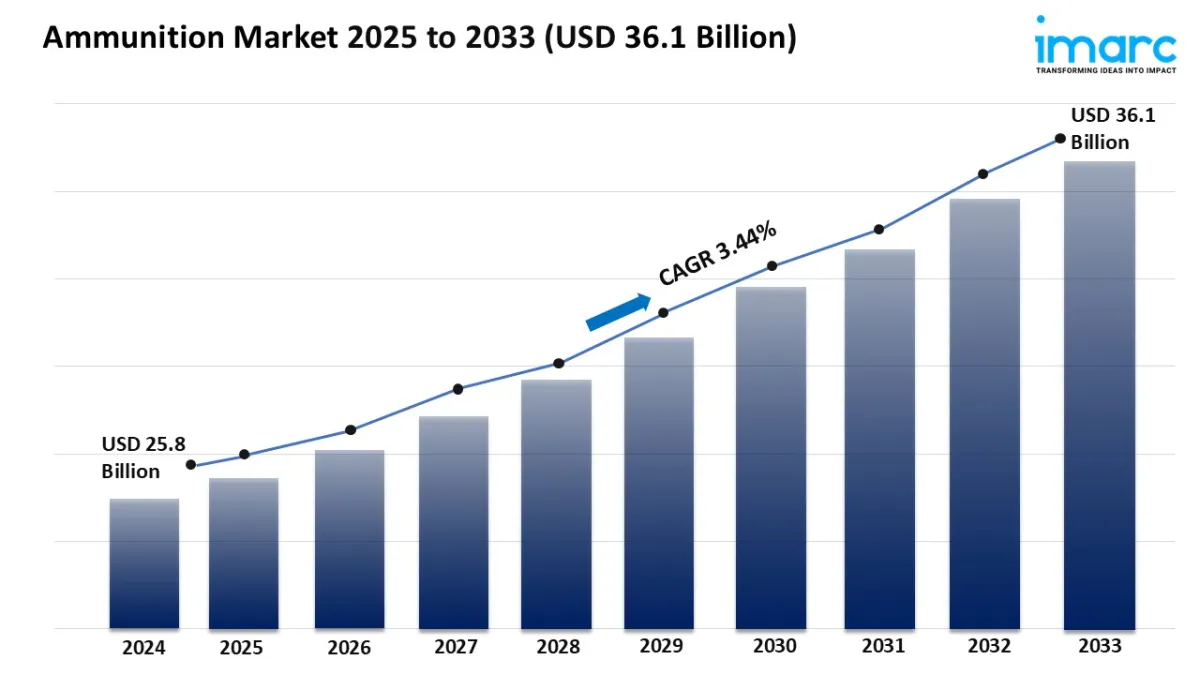

Ammunition Market Size To Hit USD 36.1 Billion By 2033 With A 3.44% CAGR

The ammunition market is experiencing rapid growth, driven by geopolitical tensions and defense modernization, government policy and incentives for local production, and expanding civilian market and product diversification. According to IMARC Group's latest research publication, “Ammunition Market Size, Share, Trends, and Forecast by Product, Caliber, Guidance, Lethality, Application, and Region, 2025-2033”, the global ammunition market size was valued at USD 25.8 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 36.1 Billion by 2033, exhibiting a CAGR of 3.44% from 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Get Your Free“Ammunition Market” Sample PDF Report Now!

Our report includes:

-

Market Dynamics

Market Trends and Market Outlook

Competitive Analysis

Industry Segmentation

Strategic Recommendations

Growth Factors in the Ammunition Market

-

Geopolitical Tensions and Defense Modernization

The global ammunition industry is seeing a surge in demand due to escalating geopolitical tensions and military modernization programs. Governments worldwide are increasing defense budgets to bolster national security in response to evolving threats. For example, major economies like China and India have significantly grown their military expenditures to modernize weapon systems and expand ammunition stockpiles. In Europe, Germany alone allocated over $107 billion for defense initiatives, reflecting a broader trend of military readiness and expansion. These investments are directly fueling higher procurement and research into advanced munitions, keeping the market dynamic and competitive.

-

Government Policy and Incentives for Local Production

Strategic government initiatives are driving growth by boosting local production and reducing import dependency. India's“Atmanirbhar Bharat” and“Make in India” programs have prioritized domestic ammunition manufacturing, resulting in hundreds of new industrial licenses and foreign direct investment surpassing $600 million in the defense sector. The European Union has contributed more than $500 million to ramp up ammunition manufacturing across member states. Such policies not only strengthen supply chains against global shocks but also create new jobs, stimulate R&D, and attract multinational companies to set up state-of-the-art facilities, as seen with CBC's $300 million investment in the US.

-

Expanding Civilian Market and Product Diversification

Rising personal safety concerns and recreational demand are diversifying the market beyond military applications. In North America, over 41% of the market share is driven by civilian sales for hunting, sport shooting, and personal defense. The expansion of shooting ranges and growing interest among licensed hunters, with countries like Germany reporting over 430,000 licensed hunters, further propels demand. Manufacturers are innovating with a wider array of calibers and specialized ammo to serve both civilian and law enforcement needs, helping to cushion the market from purely defense-related cycles and broadening the industry's customer base.

Key Trends in the Ammunition Market

-

Rise of Smart and Precision-Guided Munitions

There's a strong wave of innovation in smart and precision-guided ammunition. Advanced munitions equipped with GPS, sensors, and automation allow for mid-flight trajectory correction and increased targeting accuracy, revolutionizing battlefield outcomes. Initiatives like the development of 155 mm smart ammunition in partnership with premier Indian research institutions have resulted in shells boasting 50% greater accuracy. This technological leap is not just limited to the military-law enforcement agencies globally are also adopting more specialized, digitalized ammo solutions for efficient inventory management and operational effectiveness.

-

Increased Regional Manufacturing and Supply Chain Localization

Faced with supply chain disruptions and international uncertainties, many countries are pushing for local production of ammunition. The Middle East, Asia-Pacific, and Eastern Europe are investing heavily in indigenous manufacturing facilities to lower import dependency and secure rapid access to critical munitions. The $300 million CBC plant in Oklahoma exemplifies a trend where global players invest in regional facilities, creating hundreds of new jobs and ensuring vertical integration for more resilient supply chains. Similar regionalization moves are underway in India, Brazil, and across the EU, each contributing to a more diversified and stable ammunition industry.

-

Growing Emphasis on Sustainability and Innovation

The industry is increasingly focused on developing environmentally friendly and advanced materials. Lightweight, polymer-cased, and lead-free ammunition are gaining traction due to rising environmental regulations, with manufacturers in the EU working under strict safety and sustainability criteria. Companies are also developing non-lethal options and more efficient logistics systems, such as digital inventory modules adopted by Indian police districts. Together, these innovations point to a future where ammunition is not only more effective but also safer for users and the environment, showing a clear response to both regulatory pressures and shifting consumer expectations.

Leading Companies Operating in the Ammunition Industry:

-

Ammo Inc.

Arsenal 2000 AD

BAE Systems PLC

CBC Ammo LLC

Denel SOC Ltd

Hanwha Corporation

Herstal Group

Hornady Manufacturing Company

Nammo AS

Nexter Group KNDS

Northrop Grumman Corporation

Nosler Inc.

Remington Outdoor Company Inc

Rheinmetall AG

Sierra Bullets (Clarus Corporation)

Ammunition Market Report Segmentation:

By Product:

-

Bullets

Aerial Bombs

Grenades

Mortars

Artillery Shells

Others

Bullets dominate due to widespread military, law enforcement, and civilian use, with key players like Winchester and Federal Premium driving innovation in rifle and handgun ammunition segments.

By Caliber:

-

Small

Medium

Large

Small caliber leads owing to its versatility across military, law enforcement, and recreational shooting applications, with popular cartridges like .223 Remington and 9mm driving demand.

By Guidance:

-

Guided

Non-Guided

Non-guided ammunition maintains dominance as traditional bullets and shells remain standard-issue for militaries worldwide, though guided munitions are gaining traction for precision applications.

By Lethality:

-

Less-Lethal

Lethal

Lethal ammunition holds the largest share, with defense forces prioritizing high-performance rounds, while less-lethal options grow for law enforcement crowd control scenarios.

By Application:

-

Defense

-

Military

Homeland Security

-

Sporting

Hunting

Self-Defense

Others

Defense applications lead overwhelmingly due to global military modernization programs and homeland security needs, dwarfing commercial uses like hunting and sport shooting.

Regional Insights:

-

North America (United States, Canada)

Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

Latin America (Brazil, Mexico, Others)

Middle East and Africa

North America dominates, fueled by massive U.S. defense spending, civilian gun culture, and presence of major manufacturers responding to both military and commercial demand.

Research Methodology:

The report employs a comprehensive research methodology , combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability .

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email:

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment